This post was originally published on this site

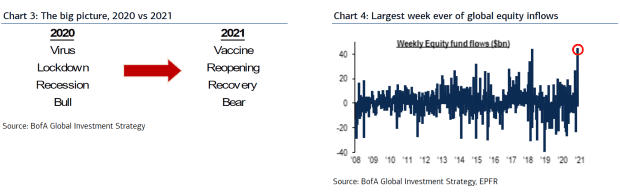

How seismic was the stock-market move that kicked off the week following news of effective coronavirus vaccine candidate? It was the best week ever for inflows, according to BofA Global Research, in a report dated Thursday but released broadly on Friday.

BofA Global Research

The investment management firm reported some $44.5 billion in flows into equity funds for the week, exceeding a flood of funds that poured into stocks back near the spring of 2018.

About $38.7 billion of investor funds were pumped into exchange-traded funds, while $5.7 billion flowed into mutual funds. Investors also reduced their cash holdings by $17.8 billion, according to the report led by Michael Hartnett, chief investment strategist.

Read: MarketWatch’s snapshot of the financial market

Meanwhile, the analysts noted that flows into government bonds yielding less than 0% surged to around $17 trillion, approaching the highest since late 2019, and coming as central banks and governments across the world attempt to combat the harmful economic effects of the COVID-19 pandemic.

This week’s rally was prompted by euphoria about the prospects for a vaccine for COVID-19 after Pfizer PFE, +2.85% and its German partner BioNTech BNTX, +4.30% reported that their experimental candidate was 90% effective.

That vaccine announcement on Monday sent stocks soaring, and particularly drove investors into the shares of companies that suffered from the economic fallout of the pandemic and out of those that fared better from the work-from-home trend.

Large-capitalization technology shares took it on the chin, with the Nasdaq Composite Index down 1.2% so far this week, while the small-cap focused Russell 2000 index RUT, +2.08% is eyeing a weekly gain of over 1%. The Dow Jones Industrial Average DJIA, +1.37% and the S&P 500 index SPX, +1.36% are also heading for weekly advances of 3.5% and 1.6%, respectively.

And stock investment themes like value, representing stocks that are undervalued by some metric, trounced growth stocks, or those expected to show above-average profit and revenue gains, by more than 5 percentage points, by at least one measure.

The iShares S&P 500 Value ETF IVE, +1.94% is on pace for a weekly gain of 5.2%, compared against its growth counterpart, the iShares S&P 500 Growth ETF IVW, +1.07%, which is headed for a 0.8% loss on the week.

Hartnett and Co. recommend that investors sell the news on potential COVID-19 vaccines and therapies in the coming months and buy on the reopening of global economies in the weeks and months that follow.

”We are sellers-into-strength into vaccine in coming months…peak positioning, peak policy, peak profits likely coming months; best analog is 2018 when US tax cuts caused peak positioning, policy, and profits early that year; 2021 (vaccine) sees early peak in asset prices on higher interest rates,” the strategists wrote.

The BofA report comes as the U.S. for the first time reported more than 150,000 new coronavirus cases in a single day on Thursday, driven by record infection counts in more than a dozen states, and hospitalizations that are also at or near records in a number of areas.

That news, however, didn’t prevent this week’s equity inflows from surpassing the then-record of $43.3 billion that was put into equities in March of 2018 as investors shrugged off risks around the international trade war with China started by President Donald Trump.