This post was originally published on this site

An uphill year ahead? Get ready.

AFP via Getty Images

Stocks are setting up for a struggle on Thursday, with no good news on the COVID-19 front and vaccine optimism all but used up, for now.

And that budding value trade — buying hard-hit companies that would benefit from better economic times — is also showing signs of investor wobble as techs come creeping back. Granted, the value trade was tough for a decade versus those powerful growth stocks.

It may be different this time, Tobias Levkovich, Citibank’s chief U.S. equity strategist, told clients in a note. For example, he noted lopsided weightings in the S&P 500 SPX, -0.41% (35% belongs to the technology sector right now) have never endured in the past. And investors may need an income boost from dividend-paying stocks, which “tend to reside in the value camp,” he said.

Tapping into the latter point is our call of the day from Ben Kirby, co-head of investments and portfolio manager for the Thornburg Investment Income Builder Fund TIBIX, who said investors will need dividend-paying stocks headed into a year when tech returns may be less stellar.

Kirby noted penetration rates for tech companies are already high due to the pandemic. “So a lot of the tech spending has accelerated in the COVID period, and we think it’s pulling forward a lot of that demand that would have taken two or three years to play out,” Kirby told MarketWatch in a recent interview. Hence, a less rosy 2021 for that sector.

So what is he betting on for 2021? For starters, he’s keen on international stocks, which he said often offer up better dividends, such as European telecoms Orange ORAN, +2.71% and Vodafone VOD, -0.47% that offer high single-digit dividends.

U.S. offerings in the portfolio include JPMorgan JPM, -1.97%, down around 17% year-to-date, but still offering a dividend, and Home Depot HD, -0.11%, which is a play on a “tremendously strong” housing story that will run a long time, he said. And he does have a few tech stocks, but only where dividends are possible — Taiwan Semiconductor TSM, +0.17%, Broadcom AVGO, +0.12%, and Qualcomm QCOM, -1.40%.

Read: What a COVID-19 vaccine would mean for mortgage rates and the housing market

Kirby said it also wouldn’t hurt investors to pick up some energy stocks. “Fifteen years ago it was the biggest and now it’s 2 or 3% of the market, so it’s a small sector that’s become pretty well hated. In terms of a contrarian play the world is going to be using oil for a very long time,” he said. And those companies — his fund owns Total TOT, -0.31% — pay dividends, of course.

The markets

Stocks SPX, -0.41% DJIA, -0.49% are weaker, outside of techs COMP, +0.02%, which are showing some teeth. European equities SXXP, -0.87% are mostly lower. And Asian markets fell, apart from the Nikkei 225 NIK, +0.67%. Oil is steady, while the International Energy Agency cut its 2020 demand outlook by more than expected.

The buzz

Weekly jobless claims fell to a pandemic low, but fresh restrictions and virus outbreaks may push those numbers higher again. Continuing jobless claims were also down. Consumer prices rose 1.2%.

The first batch of data from late-stage testing of its COVID-19 vaccine is ready for analysis, said biotech Moderna MRNA, +4.17%. New York has joined a handful of states rolling out fresh restrictions to stem record infection and hospitalization rates in the U.S.’ second wave.

Profit for Chinese tech giant Tencent TME, +3.63% jumped 89% in the third quarter.

Entertainment giant Disney DIS, -0.59% will report after the market close (see preview), as well as Cisco CSCO, -0.54%, and analysts are not optimistic about the computer-networking equipment group’s results. Software and data group Palantir PLTR, -4.57% ‘s first set of earnings since going public are also ahead.

Two days after technology giant Microsoft MSFT, +0.27% released its latest Xbox, Sony’s SNE, -0.19% PlayStation 5 game console hits the shelves on Thursday.

Federal Reserve Chair Jerome Powell will appear on a panel at the European Central Bank’s forum on central banking at 11:45 a.m. Eastern, alongside top bankers such as Christine Lagarde, the president of the eurozone central bank.

The chart

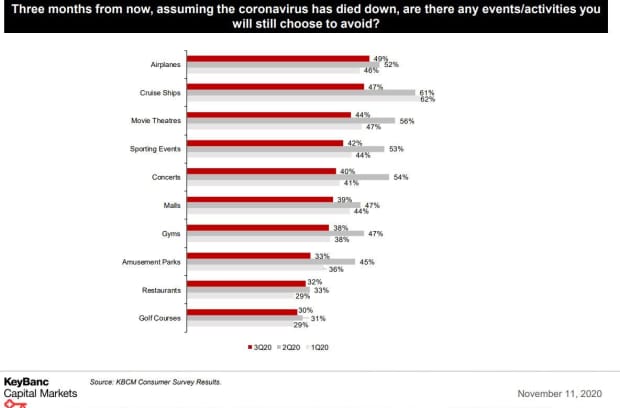

How are consumer feeling these days? Analysts at KeyBanc Capital Markets surveyed 1,000 Americans between October 14 and 26. Here’s the answer to one question they asked:

Random reads

President Nancy Pelosi? Here’s how one lawyer says that could happen for the current Speaker of the House.

Here’s another botched-art restoration travesty in Spain:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.