This post was originally published on this site

Getty Images

He goes by the Reddit handle BawceHog and claims he’s enjoyed a huge run in the market. Now the 32-year-old investor, with 14 years in the market under his belt, would like our advice.

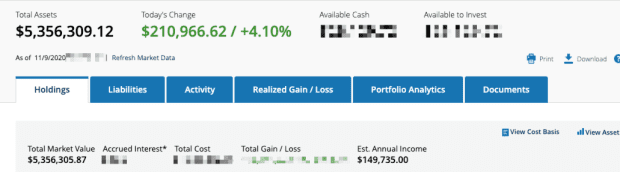

Of course, like most unverified and perhaps unverifiable claims posted on the internet, this deserves a healthy dose of skepticism, but, after sifting through the BawceHog history on Reddit and taking into account this screenshot, the WallStreetBets gang agreed to play along:

Not a bad day — or year, for most people. Some of the biggest BawceHog winners are Tesla TSLA, -2.29% at $154, Apple AAPL, +0.79% at $498, Facebook FB, -2.61% at $61, Salesforce CRM, -4.72% at $62 and Netflix NFLX, +2.51% at $309.

As you can see, those stocks have done pretty well in recent years:

So now what? “I have a $5.4M portfolio generating ~$155k/yr in dividends,” BawceHog wrote in his post. “Someone recently told me about this sub and I’m interested to know what plays you [offensive term redacted] think I should make.”

Several of the responses were of the “what are you doing here?” and “LEAVE NOW!” variety, including this one from ChiefLegalOfficer: “If you’re not lying, close this tab, and never come back here. You have it made. Why would you piss that away?”

Probably solid advice. BawceHog, however, responded by saying he just wants to play with a small piece of his overall portfolio, so ChiefLegalOfficer joined those chiming in with tips: “If you want madness, fine. … Take your next dividend payout and put a call on GE GE, +3.89% 10 weekly (if it’s already 10, just keep bumping it up by $1).”

From there, WallStreetBets served up a batch of favorites. Here’s just a quick roundup:

“Take 155k (one year of dividends profit) and put it all on NIO NIO, -4.04% $60 2022. Turn that to another mil or more.”

“Tech has been going like mad because everyone is locked at home. You need something that will rally when shit gets back to normal. Something still below February prices. Banks, gas, entertainment, hotels etc. This got me thinking and as a Canadian im going to buy suncor SU, +0.06% jan 2022 15c. Going to buy 10 and see what happens.”

“I think one of the major payment processors will be a trillion dollar company before 2030. I have plays in V V, -0.00% (Diagonals), JPM JPM, -0.75% (Diagonals), SQ SQ, -4.87% (Shares), and PYPL PYPL, -0.40% (Diagonals). If you want to be risky SQ could be the biggest winner of the group.”

“PFE PFE, -0.85% and BNTX BNTX, +5.10% for obvious reasons — vaccine news is hype very very soon.”

“JETS ETF JETS, -1.37% buy and hold. TAN TAN, -3.12% buy and hold. PLTR PLTR, -3.61% and NIO long calls.”

“If you’re into EVs there’s no reason not to buy into PLUG PLUG, +0.36%, I think they blow past $45 next year, been in since $5.50 and sitting on $7 1/21 calls.”

There you have it. The internet has spoken.

Of course, assuming BawceHog didn’t break through the $5 million level by listening to randoms on Reddit, who knows whether he’ll nibble at any of those plays. But, with “fun money” to spend, he seems open to the idea. “I have a portion of my portfolio dedicated to yolo’ing,” he said, echoing the community’s “You Only Live Once” rally cry.

After enjoying one of his most profitable days in the market yet to start the week, BawceHog is probably getting another bump, considering the Dow Jones Industrial Average DJIA, +0.75% was up again by triple digits on Tuesday. The S&P 500 SPX, -0.00% was also higher, while the tech-heavy Nasdaq Composite COMP, -0.94% was lagging.

As for the WallStreetBets fave NIO, well, not so good. The stock was down 5% at last check. Of course, that hardly makes a dent in the near-1,000% rally it’s racked up so far this year.

Any tips for BawceHog? Share them in the comments.