This post was originally published on this site

Analysts expect shares of Citigroup to rise 32% over the next 12 months.

Getty Images

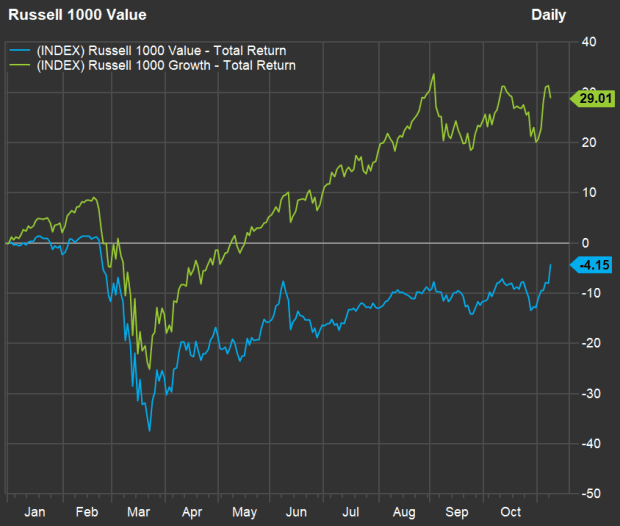

This has been quite a year for the performance of growth stocks, and their valuations have become quite stretched, while many value stocks struggle to get back to their Jan. 1 levels.

This divergence is one reason some investors expect value stocks to soon have their day in the sun.

The spending argument

Back on Oct. 9, Michael Brush wrote that value stocks were “poised to crush growth stocks” after the November election. That was based on data showing that for the following six months after every presidential election from 1980 through 2016, value stocks had outperformed growth stocks every time — more than doubling the return of the growth group, on average.

One reason is that government spending tends to increase, Brush explained.

When Joe Biden takes office as the 46th president on Jan. 20, the House of Representatives will still controlled by the Democratic Party. However, control of the Senate is still up in the air, pending the outcome of two runoff races in Georgia on Jan. 5.

But even if the Republicans retain control of the Senate, it seems likely that there will be another stimulus bill, based on comments by Senate Majority Leader Mitch McConnell, a Republican, even if the spending is much less than what Speaker of the House Nancy Pelosi (a Democrat) and Biden would like. Then again, Pelosi has said she favors a large federal infrastructure bill, and given that Biden has a history of negotiating successfully with McConnell, there are many possibilities.

The valuation argument

Regardless of what spending we see out of Washington, a quick look at growth stocks points to valuations so stretched that many investors are concerned.

The Russell 1000 Growth Index RLG, -1.92% and the Russell 1000 Value Index RLV, are partially overlapping subsets of the Russell 1000 index RUI, +7.50%. Broadly, the growth group has higher valuations to book value and higher expected growth rates. It’s the opposite for the value group.

Here’s how the indexes have performed this year through Nov. 9:

FactSet

A quick look at the five largest holdings of the iShares Russell 1000 Growth ETF IWF, -0.87%, which is designed to mirror the performance of the Russell 1000 Growth Index, shows how much forward price-to-earnings valuations have been expanded this year (The Russell Indexes and the iShares ETFs that follow them, are weighted by market capitalization):

Six stocks are listed because the ETF includes Alphabet’s Class A and Class C common shares. The five largest companies in the iShares Russell 1000 Growth ETF make up 37% of the portfolio.

The five biggest holdings of the iShares Russell 1000 Value ETF IWD, +0.91% make up only 9.8% of the portfolio. Here’s how their forward P/E valuations have changed this year, according to FactSet.

| Forward P/E – Nov. 9, 2020 | Forward P/E – Dec. 31, 2019 | |

| Berkshire Hathaway Class B BRK.B, +1.97% | 21.2 | 21.0 |

| Johnson & Johnson JNJ, +1.09% | 16.6 | 16.0 |

| JPMorgan Chase & Co. JPM, -0.83% | 13.3 | 13.1 |

| Verizon Communications Inc. VZ, +2.04% | 12.2 | 12.4 |

| Walt Disney Co. DIS, -1.86% | 50.2 | 25.8 |

| Data source: FactSet | ||

Disney is the exception among the value stocks listed above in that its valuation has more than doubled.

The company will report its fiscal fourth-quarter results on Nov. 12, after the market close. Analysts expect the company to lose $1.18 a share for fiscal 2020 after earning $6.64 a share in 2019, with revenue declining to 7% to $64.77 billion. But the stock has performed well this year, down only 2% because of investors’ enthusiasm for the success of the Disney + streaming service.

Read: Investors need to brace for a ‘violent rotation into’ cyclicals, value stocks, says Lee

Analysts’ favorite value stocks

Looking at the Russell 1000 Value Index, here are the 20 stocks rated “buy” or the equivalent by at least 80% of analysts (with coverage by at least five analysts polled by FactSet) with the most 12-month upside potential implied by consensus price targets:

Scroll the table to see all the data.

Three of the companies went public this year, so the 2020 total return column for those stocks was left blank. Here’s how they have fared:

- Vroom Inc.’s VRM, +3.66% first public offering was completed on June 9, with an initial price of $22. The shares were up 74% through the close on Nov. 9.

- GoHealth Inc.’s GOCO, -0.07% IPO on July 15 was priced at $21. The stock had fallen 39% through Nov. 9.

- Reynolds Consumer Products Inc. REYN, +2.22% went public on Jan. 31 at a price of $26. The shares were up 11% through Nov. 9.

Any stock screen is simply a starting point. If you are interested in any individual stock, it is important to do your own research to form your own opinion about how likely it is to remain competitive over the next decade.