This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEGA809R_L.jpg

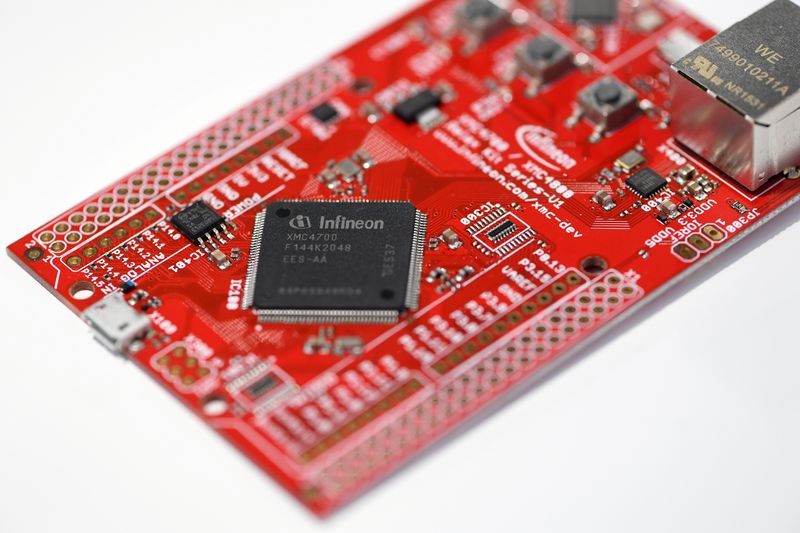

BERLIN (Reuters) – German chipmaker Infineon (OTC:IFNNY) forecast that revenue would grow by nearly 23% in the year ahead as it reported fiscal fourth quarter results on Monday that were in line with analyst estimates.

The Munich-based chipmaker ditched its guidance in March as the coronavirus hit – just before its $10 billion acquisition of U.S. Cypress Technologies closed – but has since staged a recovery led by China and the autos sector.

CEO Reinhard Ploss said that Infineon had successfully completed “an exceptional and difficult fiscal year with a very respectable fourth quarter”.

“We have proven that our company has a robust business model and continues to develop steadily, even in uncertain times,” Ploss said in a statement.

Taking into account the impact of the pandemic and ongoing risks as countries battle a second wave of coronavirus infections, management proposed a 5-cent cut to its annual dividend to 22 euro cents.

Investors shrugged off the cut, focusing instead on the sales outlook, sending Infineon shares up 4% in premarket trading, slightly outpacing a wider German market lifted by Joe Biden’s victory in the U.S. presidential election.

Infineon forecast sales in the fiscal year to Sept 30, 2021 of 10.5 billion euros ($12.5 billion), representing growth of 22.6% from the year just ended.

The segment result margin – management’s preferred measure of the operating profitability of its business units – was forecast to recover to 16.5% from 13.7%.

That outlook was more or less in line with a poll of analysts by Vara Research, while results for the year just ended were also close to street estimates and the company’s own reinstated guidance.

Fiscal fourth-quarter revenue came in at 2.49 billion euros, a quarter-on-quarter gain of 15%, as the auto industry bounced back over the northern summer and a trend towards electric mobility gathered pace in Europe.

The specialist in semiconductors used in automotive electric drivetrains, wind turbines and security systems reported a fourth-quarter segment margin of 15.2%, up from 10.1% in the third quarter.

($1 = 0.8415 euros)