This post was originally published on this site

How much of the stock market’s gain since the financial crisis is due to the Federal Reserve’s extraordinary monetary policy actions, particularly quantitative easing, or QE? A pretty huge chunk, according to analysts at Société Générale.

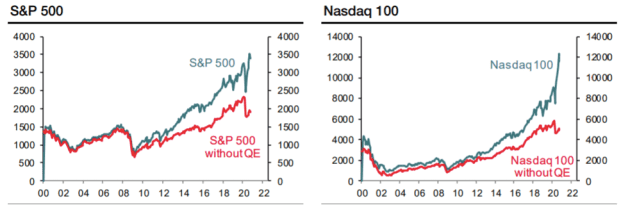

“ In fact, without QE, the Nasdaq-100 NDX, -0.24% should be closer to 5,000 than 11,000, while the S&P 500 SPX, -0.25% should be closer to 1,800 rather than 3,300” through the end of October, wrote equity strategists Sophie Huynh and Charles De Boissezon, in a Friday note (see charts below).

Société Générale

Stocks have rallied in the first week of November, with the S&P 500 on track for a weekly gain of around 7.3% near 3,512. The Dow Jones Industrial Average DJIA, -0.40% is up around 7% near 28,360.

In quantitative easing, a central bank creates credit out of thin air, which it uses to buy securities from banks and other institutions. Purchases of long-dated bonds are intended to drive down yields, which is seen enhancing appetite for stocks and other securities as investors look elsewhere for returns.

But skeptics question how much direct impact QE has on bond prices, which move in the opposite direction of yields, arguing that it functions instead as more of a signal that policy makers intend to keep official rates low. In turn, the argument goes, investors are comfortable buying bonds, pushing down yields, on the expectation the central bank will keep official rates down.

Related: Why the Fed owes a debt to Tom Sawyer

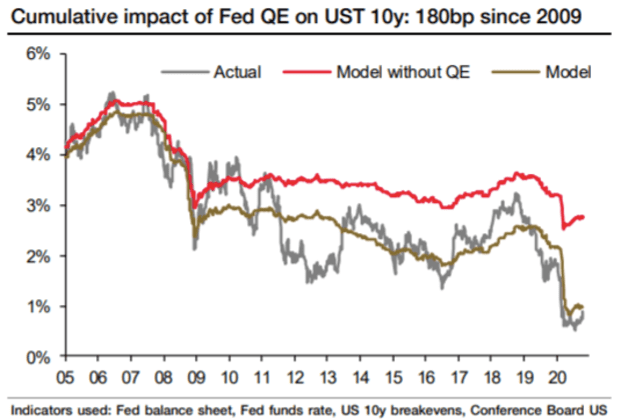

For their part, the SocGen analysts, using a mix of weekly macroeconomic indicators running back to 2005, took a stab at estimating the effect of the Fed’s bond-buying effort on the benchmark 10-year Treasury note yield TMUBMUSD10Y, 0.816%. They concluded that QE likely knocked around 180 basis points, or 1.8 percentage points, off the 10-year yield (see chart below).

Société Générale

The analysts used their work on QE and the 10-year yield in conjunction with their equity risk-premium framework. Equity-risk premium refers to the extra yield that investors require to hold equities over risk-free Treasurys.

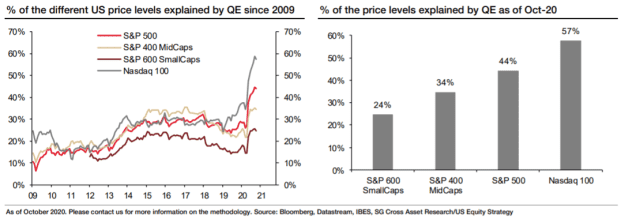

They found a lot of variation among the different stock indexes, with the tech-concentrated Nasdaq-100 feeling the most impact from QE, particularly in 2020, while S&P 600 Small Caps were the least affected (see charts below).

Société Générale

That underlines the tech sector’s sensitivity to interest rates, with highfliers often tumbling when Treasury yields begin ticking higher.

“The sensitivity to bond yield can also be explained by the low payout and higher price-to-book ratios of Nasdaq-100 companies versus peers,” the analysts wrote.

“Growth companies are overall less focused on dividends, but rather more on share buybacks as a way of neutralizing the impact of restricted share units,” they said. “Small and mid caps, on a relative basis, given their higher payout and lower price-to-book value ratios, are less sensitive to swings in bond yields.”

The analysts also noted a shift in “causality” between equity- and bond-market moves.

Before QE, they said, U.S. stocks were more often the driver of the bond market. Investors added either more or fewer bonds to their portfolios as they took signals on risk appetite from moves in the stock market.

Since QE, the relationship has flipped, with movements in equities increasingly driven by changes in bond yields, they said.

In fact, recent moves have underlined the phenomenon, they said, with the Nasdaq-100 significantly underperforming as the 10-year yield broke out to the upside from its longstanding range of 0.5% to 0.8% in October.

“The rotation into the cyclical sectors, which have lagged the more defensive and growth sectors since the start of the bear market rally, combined with a preference for value versus growth, were a reflection of the bond selloff,” they said.

Those positions saw some unwinding as investors await for a final result from the U.S. presidential election (the Nasdaq-100 is up more than 9% this week). They argued, however, that “[a]ll in all, being long S&P 400 MidCaps versus the Nasdaq-100 could offer good leverage for the higher U.S. yield environment.”