This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEGA40BS_L.jpg

WASHINGTON (Reuters) – Allstate Corp (N:ALL) wants a potential Democratic administration to back a taxpayer-funded program that would pay for losses caused by the largest climate-change fueled natural disasters, the Illinois-based insurer’s chief executive said.

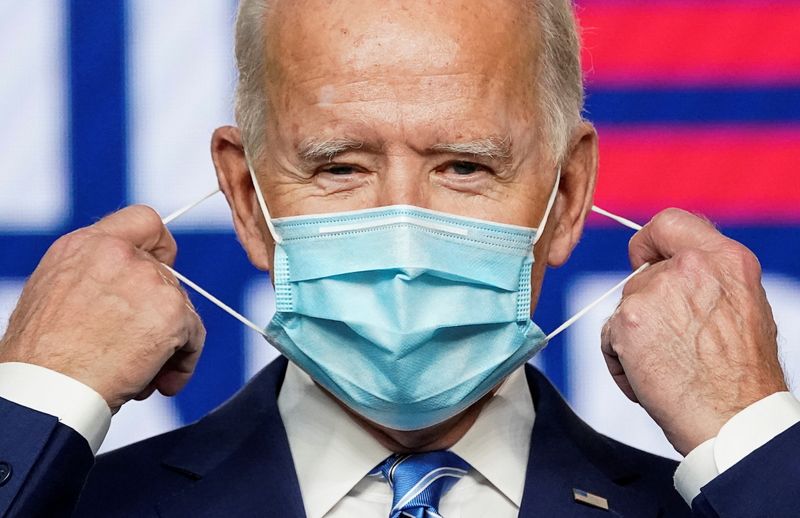

Democratic presidential challenger Joe Biden was leading Republican incumbent President Donald Trump in electoral college votes on Wednesday evening, as the ballot count looked poised to stretch into a third day.

Biden has outlined an ambitious plan to invest $2 trillion in clean energy to get the United States to reach net zero carbon emissions by 2050.

Tom Wilson, chief executive of Allstate, one of the largest U.S. property and casualty insurers, said a possible Biden climate package should include legislation to address property destruction caused by the costliest hurricanes and wildfires that exhaust all insurance coverage and state resources.

“You need really disaster protection because if the weather keeps getting worse, the private market for those really big events is going to be too expensive,” he told Reuters on Wednesday when the company reported third-quarter results.

Insurers are bracing for about $4.3 billion in insured losses from Hurricane Zeta in the United States, catastrophe modeling company Karen Clark & Co said on Monday, adding that this year has seen a record number of named storms making landfall.

That’s on top of what Moody’s (NYSE:MCO) estimates could be as much as$8 billion in losses resulting from dozens of wildfires on the West Coast this summer which scientists say were partly fueled by climate change.

Growing risks of wildfires have led insurers to drop thousands of homeowners in the most vulnerable areas, according to the California Department of Insurance.

Allstate would “love” to see Biden confront climate change, a problem policymakers have tried to address through long-term measures, said Wilson. “But people spend a lot of time arguing about the long term solution when a house is burning down.”

A government-backed program could be modeled on state-run insurers of last resort, such as the California Earthquake Authority, which cover natural disaster risks that are too steep for private property insurers to take on, said Wilson.

The government often pumps money into areas after they have been devastated, but a government-backed insurance program could create a structure more “equitable” for taxpayers, he said.

The United States already runs a taxpayer-funded flood insurance program and created government-supported commercial terrorism products following the Sept. 11 attacks, which require insurers to pay part of the claims.

Some property and casualty insurers are also pushing for a federal program to cover small business losses resulting from future pandemics.

While a Democratic bid to gain control of the Senate looked set on Wednesday to fail, reducing the prospects of aggressive legislation, Wilson said he believed there were lawmakers on both sides of the aisle who would support an insurance program.

“I think there are both Democrats and Republicans that are in the areas that are impacted by this, that would be in favor of a solution.”