This post was originally published on this site

U.S. stock-index futures traded higher on Wednesday, even as the presidential race between President Donald Trump and former Vice President Joe Biden looked too close to call in a number of states.

The vote tallies were slowly rolling in with the Federal Reserve due to kick off its two-day policy meeting later Wednesday, while investors also pondered data showing a smaller rise in U.S. private sector employment in October than the previous month.

How are stock benchmarks performing?

Futures for the Dow Jones Industrial Average YMZ20, +0.51% YM00, +0.51% were trading higher by 146 points, or 0.5%, at 27,522; those for the S&P 500 ESZ20, +1.78% ES00, +1.78% were up 54 points, or 1.6%, at 3,416; and Nasdaq-100 futures NQZ20, +3.72% NQ00, +3.72% were surging 399 points to reach 11,665, a gain of 3.5%.

On Tuesday, the stock market closed sharply higher, with the Dow Jones Industrial Average DJIA rallying 554.98 points, or 2.1%, to 27480.03, its biggest one-day point and percentage gain since July 14. The S&P 500 SPX rose 58.92 points, or 1.8%, to 3,369.16. The Nasdaq Composite COMP rose 202.96 points, or 1.9%, to 11,160.57.

What’s driving the market?

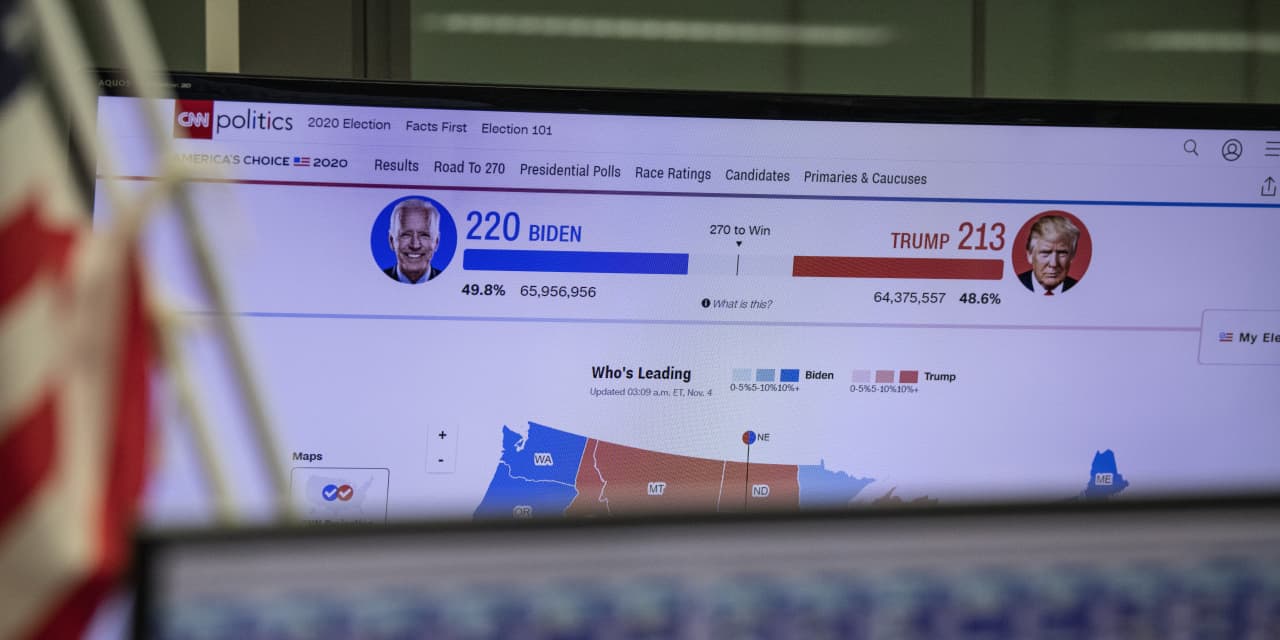

A few key states now will determine a 2020 U.S. presidential race that has turned out to be far closer than pollsters and market participants had expected, with a number of states still counting votes Wednesday morning.

Vote counting in Pennsylvania, Michigan and Wisconsin was expected to stretch into Wednesday, with both candidates having a path to secure the necessary 270 electoral college votes.

See: Biden leads Trump as control of presidency and U.S. Senate are still in doubt

Overnight stock futures swung violently as voting returns rolled but futures took a turn lower after Trump in a speech threatened to take the election to the Supreme Court, indicating the he would contest the election results if they didn’t favor him.

A contested election could have long-term bearish implications for equities, harking back to substantial drops in the S&P 500 index during the contest between former Vice President Al Gore and George W. Bush back in 2000.

Meanwhile, investors have been bidding up technology shares in thinly traded premarket action as Wall Street appeared to revert to the investments that had helped to lead the market out of the depths of the coronavirus pandemic.

The election results so far also have diminished the likelihood of a so-called Blue Wave, where a Democrat takes the White House and the party takes control of both chambers of Congress. Market watchers had viewed that outcome as key to another round of fiscal aid for workers and American businesses.

“While we haven’t yet learned who the winner will be, we were reminded again that with all the 21st century technological advancements, the polling business and methodologies need to be revamped,“ wrote Peter Boockvar, chief investment officer at Bleakley Advisory Group, in a Wednesday research note, referring to early polling that pointed to a decisive win for Biden and the possibility of a Democratic sweep in the Senate.

“As for the eventual outcome of this election, I’m keeping this conversation solely focused on policy, not personality. Regardless of the presidential winner, it does look like the Republicans will keep control of the Senate,“ Boockvar said.

Researchers at Wolfe Research, led by chief investment strategist Chris Senyek, said that the market may be trying to price in the possibility of a Biden win but a Republican Congress and a weakened prospect for more substantial relief to combat the coronavirus pandemic.

“A Biden/GOP Senate scenario appears to be getting priced in this morning,“ wrote Wolfe Research. “As we write, the U.S. 10-year yield has fallen by -11bps and NASDAQ-100 futures are up roughly +2%,” the team noted. “Our sense is that this reflects expectations for a disappointing fiscal stimulus bill (GOP Senators want $500 billion-$1 trillion), while the Fed ramps up [quantitative easing] as an offset,“ they wrote.

Americans went to the polls Tuesday under the shadow of a resurgence in the coronavirus pandemic, with an alarming increase in cases nationwide and the number of people hospitalized with COVID-19 reaching record highs in a growing number of states.

See: Coronavirus infections rise in 47 states

Meanwhile, the Fed is set to deliver a policy update at 2 p.m. Eastern on Thursday, a day later than usual due to the election.

On the U.S. economic front, a monthly report on private employment from Automatic Data Processing, a precursor to the closely watched October jobs report on Friday, was weaker than expected, showing 365,000 jobs were created in October, versus expectations for a gain of 675,000.

Separately, a report on the international trade deficit for September is due at 8:30 a.m., while a reading on the services sector from IHS Markit will be released at 9:45 a.m. A more closely followed report from the Institute of Supply Management, the ISM services index, follows about 15 minutes later.

Which stocks are in focus?

- Ride-share companies saw their stocks surge in premarket trading Wednesday after winning a legislative fight in California that allows them to classify drivers as independent contractors, not employees. Shares of Uber Technologies UBER, +2.75% and Lyft LYFT, +7.06% were both up double digits.

- Wendy’s Co. WEN, +4.51% shares were down after missing Wall Street expectations for Q3 revenues.

- Hilton Worldwide Holdings Inc. HLT, +3.01% swung to a profit in the most recent quarter, the company said before the bell. Shares were fractionally higher.

What are other markets doing?

The yield on the 10-year Treasury note TMUBMUSD10Y, 0.783% slid about 10 basis points to 0.801%, as investors rethought the “reflation trade.” Yields and debt prices move in opposite directions.

The Stoxx 600 Europe Index SXXP, +1.43% jumped 1.1%, while London’s FTSE 100 UKX, +1.34% was up 0.8%.

Oil futures surged, with the U.S. benchmark CL.1, +2.31% up 2.7% or $1.02 to $38.68 per barrel, while gold futures GC00, -0.10% were virtually unchanged at $1,911.00.

The ICE U.S. Dollar Index DXY, -0.05%, a gauge of the currency against a basket of six major rivals, was down 0.2%.

MarketWatch has launched ETF Wrap, a weekly newsletter that brings you everything you need to know about the exchange-traded sector: new fund debuts, how to use ETFs to express an investing idea, regulations and industry changes, inflows and performance, and more. Sign up at this link to receive it right in your inbox every Thursday.