This post was originally published on this site

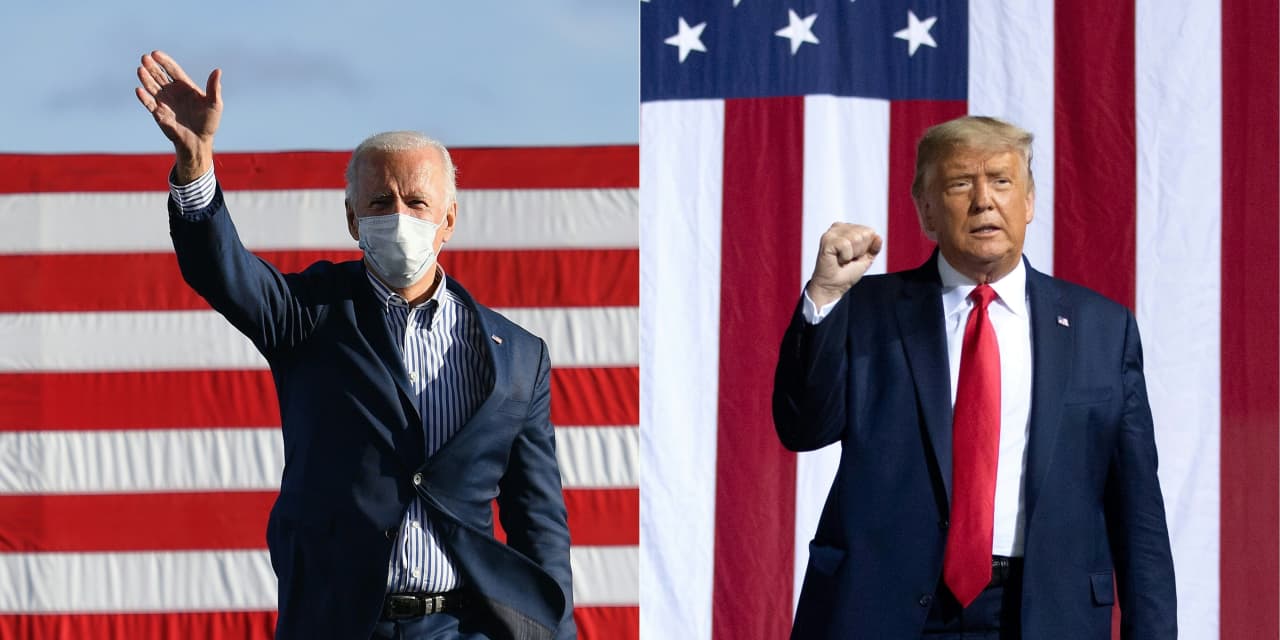

U.S. stocks were surging on Wednesday despite uncertainty hanging around the outcome of the 2020 presidential election race.

And although investors hate uncertainty, they appeared to be responding surprisingly positively to the apparent lack of a so-called “blue wave” which would have meant winning the White House and Congress.

For weeks, market participants had been wagering that a Biden presidential victory, coupled with Democrats achieving a majority in the Senate, would provide the best scenario for additional financial relief measures to help sustain the economy’s recovery from the COVID-19 pandemic that has stricken businesses and workers.

However, the Democrats have thus far only gained one seat in the Senate and seem unlikely to pick up the additional four seats necessary to get to a 51-seat majority. At last check, Democrats had 45 seats, while the GOP held 47, according to the Associated Press.

Investors are starting to believe that a Biden win, should he prevail in the White House race, combined with a divided Congress will result in the type of gridlock that could stymie the former vice president’s plans for stricter regulations on technology companies and a rollback of Trump’s 2017 tax cuts.

“This is basically going to be frozen government, for now,” said Art Cashin, director for floor operations at UBS during a Wednesday interview on CNBC .

Peter Tchir, head of market strategy at Academy Securities, said that the lack of a “blue wave” is “worth mentioning, because it should in theory affect Biden if he becomes president, because there was no wild support across the country for their ideas, so they might have to govern more from the center than previously thought – if he is declared the winner,” he wrote in a Wednesday research note.

Tchir said that many, including himself, may have been underestimating “how much the fear of potentially higher capital gains taxes was impacting the Nasdaq 100, for example.”

Indeed, the Nasdaq-100 futures soared overnight on Election Day, while the Nasdaq Composite COMP, +4.19% was trading 3.9% higher Wednesday, the S&P 500 index SPX, +3.14% was up 2.9% and the Dow Jones Industrial Average DJIA, +2.59% gained 2.3%, at last check.

“With the Republican Senate able to stop large changes to the tax code (corporate and individual) that risk to the market is reduced and is being priced in (haves vs have nots winning),” Tchir wrote.

On top of that, analysts are still expecting that another fiscal relief measure will be passed by Congress eventually, but it may not be as expansive.

“The only firm conclusion is that the ‘Blue Wave’ has receded before reaching shore, and that the prospects for a stimulus package remain undiminished,” wrote Barings’ Christopher Smart in an emailed note.

Smart wrote that a protracted presidential vote count, similar to what happened in 2000 with Al Gore versus George W. Bush, could have “longer term damage to confidence in U.S. institutions,” which “may prove lasting.”

“In the near term, however, the chances for a large fiscal package remain high as both candidates have pledged to push for more money,” Smart wrote.

“In many ways, the Senate outcome was the most important for the equity markets rather than the Presidential election”, concluded a note from Jeffries, headed by chief equity strategist Sean Darby.

With a split Congress, even if Biden wins, “he will be unable to spend as he wishes”, wrote Etsy Dwek, head of global market strategy at Natixis Investment Managers.

“That said, if we remain closer to a status quo, we could get stimulus sooner, though the figure would be smaller (closer to the USD1.5 trillion, or less),” the strategist wrote.

Ultimately, the presidential race may still take days or weeks before all votes are tallied but indicators on Wednesday suggested that Biden might prevail over Trump in the tight contest.

Still, the failure to achieve a “blue wave” raises questions about projections and polls leading up to the election that pointed to a more decisive victory for Democrats.

“Voting has not matched polled intentions,” the Jefferies team wrote.