This post was originally published on this site

‘Vote Here’ sign in Las Vegas.

Mario Tama/Getty Images

Wall Street is betting on a win for risky corporate bonds no matter who occupies the White House.

Investors piled into the riskiest “junk” rated part of the roughly $10.5 trillion U.S. corporate bond market on Election Day, with a view that the sector will benefit from a quick resolution to the presidential race.

“I think there is a lot of misplaced fear in the marketplace,” said John McClain, a high-yield portfolio manager at Diamond Hill Capital Management. “This isn’t about pushing all your chips in or going 100% maximum long, but we do think we’ll see a resolution relatively quickly,” he said of the presidential contest.

“Irrespective of who wins, the market is going to be happy with an outcome,” he told MarketWatch.

The bullish tone was evident in soaring shares of the sector’s largest exchange-traded funds (ETFs) on Tuesday.

Shares of the mega $39.7 billion iShares iBoxx $ High Yield Corporate Bond ETF HYG, +0.86% rose 0.9% on Tuesday, booking its biggest daily advance since June 30, according to FactSet data. The $12.3 billion SPDR Bloomberg Barclays High Yield Bond ETF JNK, +0.95% rose 1%, its biggest daily gain since July 14.

Live blog: Trump predicts ‘great night’ even as polls point to Biden win

U.S. stocks also surged on Tuesday, with the Dow Jones Industrial Average DJIA advancing 554 points, or 2.1%, after a rough patch for riskier assets at the end of October, which saw investors pull billions from speculative-grade corporate debt funds as bond spreads widened.

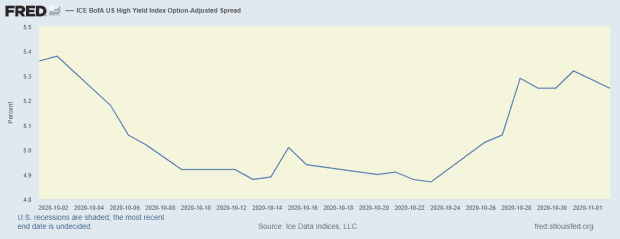

U.S. junk-bond spreads, or the level of compensation that bonds pay investors above a risk-free benchmark, were last spotted at about 525 basis points over Treasurys TMUBMUSD10Y, 0.887%, after a choppy month of October.

Spreads dip and climb

St. Louis Federal Reserve

About two weeks ago, junk-bond spreads rallied to a pandemic low of 487 basis points over Treasurys, but shot back up to 532 basis points last week, according to Federal Reserve data.

“Directionally, its positive,” said Ken Monaghan, co-director of high-yield at Amundi Pioneer. “Once levels got inside 500 basis points, which has been the low end of this year post-COVID crisis, we started to see money exit and flows out of ETFs, as people were de-risking.”

Monaghan said the fresh rally points to market participants who have begun to expect an election resolution within a relatively concise period, rather than a contested stretch of weeks or longer.

“That would cause concern for risk markets across the board, not just high yield,” he said.

See: What the election means for the markets as investors pine for a ‘clear victory’

What else might spark volatility?

Investors pointed to a possible return to March-style business shutdowns in the U.S. as a negative for speculative-grade corporate debt, particularly after Massachusetts Gov. Charlie Baker on Monday announced a new stay-at-home advisory and curfew for most businesses in a bid to curb rising Covid-19 cases and hospitalizations.

But debt-market participants still expect Congress to pass another pandemic spending package, regardless of whether Republican President Donald Trump prevails or his challenger and former Vice President Joe Biden wins the White House for Democrats, which likely would boost markets.

Although, if election uncertainty drags out for a while, or the pandemic’s grip on the U.S. worsens and threatens the economic recovery, the ace in the hole for junk bonds still would be the Federal Reserve.

The central bank been buying up corporate debt for the first time in history and keeping credit flowing since virus chaos erupted in March, but without a second extension of its timeline, the extension of credit through the Fed’s facilities is set to expire on Dec. 31.

“Having the credit facilities in place prevents real tightening in financial conditions,” said Steven Friedman, senior macroeconomist at MacKay Shields, in an interview.

“It makes sense to extend them just as an insurance policy and as an important backstop for credit markets.”