This post was originally published on this site

Democratic Presidential candidate and former Vice President Joe Biden gestures before delivering remarks at a drive-in event in Coconut Creek, Florida, on October 29, 2020.

jim watson/Agence France-Presse/Getty Images

Former Vice President Joe Biden is favored to win the U.S. election no matter if you look at betting markets or polling. But the hard money on the election isn’t nearly as tilted toward Biden as polling would indicate.

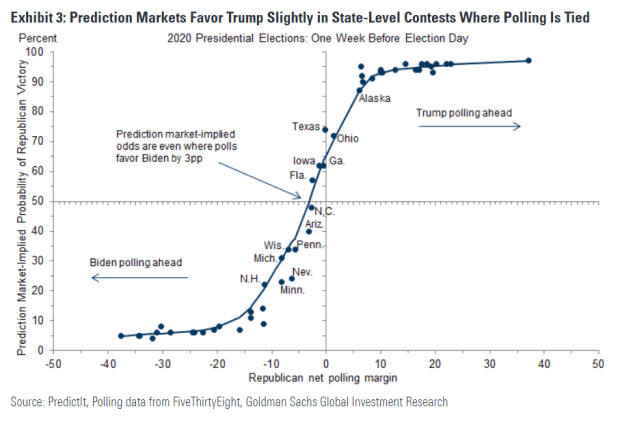

Goldman Sachs analysts Blake Taylor and Alec Phillips say prediction models maintained by data journalists and academics put the probability of a Biden win above 80%. But prediction markets suggest the election outcome is still highly uncertain, implying just over a 60% chance that Biden will win the Electoral College.

One reason, they say, is just how the Electoral College works, that it weights bigger states rather than total voting margins. In so-called tipping point states, Biden enjoys a 5- rather than 9-point lead. In 2016, while polls were off by 1 or 2 points nationally, they were wrong by an average of 4 points in Wisconsin, Michigan, Pennsylvania, and Florida.

The Goldman Sachs analysts say markets are expecting President Donald Trump to outperform the polls, by about 3 percentage points. One possible reason is the so-called “shy Trump voter,” who might not be willing to express support for the Republican candidate. Goldman Sachs ran its own experiment using the gap between live interviews and automated or online polls, and found a 1-2 point gap, though they caution it could be statistical noise. Another issue, the Goldman analysts say, is polling error based on incorrect turnout assumptions.

The large differential in voting method between the parties creates additional uncertainty, with Democratic voters more likely to be impacted by problems with, or legal challenges to, voting by mail, they say. By contrast, the recent COVID-19 resurgence could reduce Republican turnout.

Interestingly, this gap isn’t the same in the key Senate battles, where prediction markets follow polls more closely, the Goldman analysts find.

The S&P 500 SPX, +1.19% has dropped 4% over the last five sessions, though traders also have had to consider fresh European lockdowns and an impasse in U.S. fiscal stimulus talks.