This post was originally published on this site

https://d1-invdn-com.akamaized.net/content/pic50f69c02bf3e64efa0a07f6d54bad0b6.png

Exxon is confronting one of its biggest crises since Saudi Arabia began nationalizing its oilfields in the 1970s. The company lost $680 million, or 15 cents a share, during the third quarter, compared with the 25-cent per-share loss forecast in a Bloomberg survey of analysts. The company’s crude-refining business was hit particularly hard by weak fuel demand and prices.

Blindsided by the economic fallout from the Covid-19 pandemic, Exxon Chief Executive Officer Darren Woods abruptly ditched an ambitious rebuilding effort and imposed widespread job cuts that are unprecedented in Exxon’s modern history.

The firings and layoffs, announced less than 24 hours after Exxon declared a $3.7 billion payout to shareholders, will affect 1,900 U.S. workers and thousands more around the world. Pandemic-induced lockdowns have crushed demand for oil, natural gas and chemicals, sending Exxon’s finances into a tailspin. Prior to 2020, the company hadn’t posted a quarterly loss in at least three decades.

Although third-quarter results outperformed expectations, the company is still struggling to generate enough cash to fund dividend payments and capital projects.

Exxon’s cash flow has all but evaporated, Woods’s aggressive rebuilding plan has ground to a halt, and criticism is growing over the company’s climate strategy. The most immediate question for investors is how long the $15 billion-a-year in dividends survive.

Exxon follows rivals Chevron Corp. (NYSE:CVX), BP (NYSE:BP) Plc and Royal Dutch Shell (LON:RDSa) Plc is disclosing just how trying the third quarter proved. Chevron disclosed a surprise profit after slashing capital spending almost in half. Meanwhile, BP narrowly avoided a loss but warned that any recovery will be a long, slow slog.

Shell, for its part, exceeded all analysts’ forecasts by posting almost $1 billion in adjusted profit. The Anglo-Dutch giant also dangled the promise of fattening the dividend that’s dwindled to less than half of its year-ago value. Total SE also surpassed estimates.

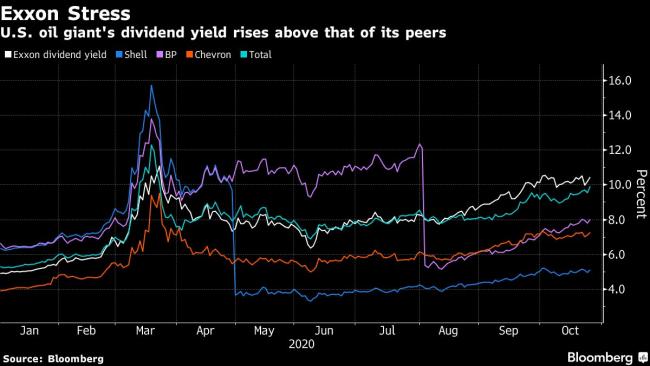

Exxon has plunged about 50% this year, lagging U.S. rival Chevron Corp. but ahead of Shell and BP. The drop has sent Exxon’s dividend yield soaring to more than 10%, a level that indicates investors expect the payout to be cut.

To defend the dividend and appease investors, Woods is implementing an extensive internal cost-cutting drive. Exxon cut $10 billion in capital spending in April and delayed some marquee projects. That slowdown is translating into job cuts, Woods said in a recent email to staff, adding to layoffs in Europe and Australia.

As if its financial performance wasn’t enough to worry about, Exxon is under pressure from critics to reset its climate strategy. Its European rivals have all committed to some form of carbon neutrality by mid-century but earlier this month Woods underscored his faith in fossil fuels. Oil and gas will still make up about half the global energy mix in 2040 and provide the most cost-effective pathway to development in poor countries, Woods told employees in the email.

Exxon is scheduled to host a conference call with analysts and investors at 9:30 a.m. New York time. Andrew Swiger and Jack Williams (NYSE:WMB), both senior vice presidents and members of Woods’s inner circle, will speak during the call.

©2020 Bloomberg L.P.