This post was originally published on this site

Getty Images

Shares of United Parcel Service Inc. took a dive Wednesday, after the package delivery giant’s profit and revenue beats weren’t quite good enough to extend their recent run up, given concerns over the margin outlook for its largest domestic business.

The stock UPS, -8.76% tumbled 8.5% in afternoon trading, putting it on track to close at the lowest price since Aug. 11, and to suffer the biggest one-day drop since Jan. 15

Up until Tuesday, UPS’s stock had soared 88.7% since the end of February, while the S&P 500 index SPX, -3.52% had gained 14.8%, as the COVID-19 pandemic sparked a surge in e-commerce activity, the UPS said it expects to continue.

Don’t miss: UPS stock rises after UBS analyst turns bullish a day before earnings.

“From a customer-first perspective there has been a step change in the composition of retail sale, as e-commerce sales are now projected to make up more than 20% of all U.S. retail sales this year,” Chief Executive Carol Tomé said in a post-earnings conference call, according to a FactSet transcript. “We don’t think the penetration of e-commerce retail sales will decline even after the pandemic.”

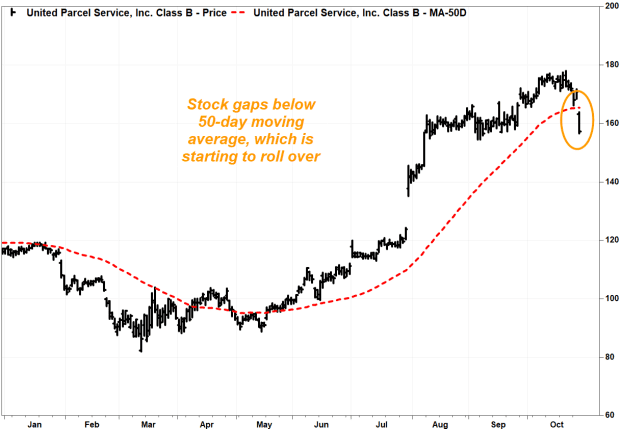

The stock was set to close below the closely watched 50-day simple moving average, which many Wall Street technicians use as a guide to the medium-term trend, for the first time since May 15.

While the 50-day moving average (50-DMA) is still rising, which remains a technical positive, the pace of gains has decelerated sharply and is set to rollover soon. The 50-day rose by about 5 cents on Wednesday to $165.54, after rising by an average of 61 cents a day over the previous 19 days this month, according to a MarketWatch analysis of FactSet data. Read more about the 50-DMA.

FactSet, MarketWatch

Before Wednesday’s open, UPS reported a third-quarter adjusted profit that rose to $2.28 a share from $2.07 a share in the same period a year ago, and was well above the FactSet consensus of $1.90.

Revenue rose 15.9% to $21.24 billion, which was about $1 billion above the FactSet consensus.

Here’s why investors appear to be disappointed:

Revenue for its U.S. domestic business segment, which made up about 62% of total revenue, grew 15.5% to $13.23 billion, to beat expectations of $13.05 billion. However, operating profit for that segment actually fell, by 9.7% to $1.10 billion.

That knocked operating margin for U.S. domestic to 8.3% from 10.6%.

CEO Tomé explained on the post-earnings call that margins were hurt, as the decision to speed up the completion of its “fastest-ground-ever” initiative eight months early came at a cost of $179 million for the quarter.

“It was the right thing to do,” as it helped UPS gain market share with small- and medium-size businesses, “but it certainly put some pressure on the expense line,” Tomé said, according to a FactSet transcript.

What also hurt the bottom line was that productivity was below expectations, which resulted from having 40,000 new employees and increased employee turnover.

“Turnover is a function of many things, including COVID candidly, but when you have a lot of new people in your operations, sadly, we just weren’t as productive as we should have been,” Tomé said.

If that’s not enough, Chief Financial Officer Brian Newman noted that 2019 legislation for alternative fuel tax credits, that lowered expenses by $150 million last year, “are not expected to repeat.”

Analyst Amit Mehrotra at Deutsche Bank, who rates UPS a buy, asked Tomé if the domestic business will return to positive operating leverage in the fourth quarter, and will expand in 2021.

“That is not what I’m saying,” Tomé answered, saying the turn to positive “won’t happen until 2021.”

Cowen analyst Helane Becker, who reiterated her market perform rating on UPS, was upbeat about the results and outlook, but acknowledged in a research note that UPS continued to have trouble “bending the cost curve” in the domestic business.