This post was originally published on this site

Advanced Micro Devices Inc. announced a $35 billion deal to purchase Xilinx Inc, as well as third-quarter earnings, on Tuesday morning.

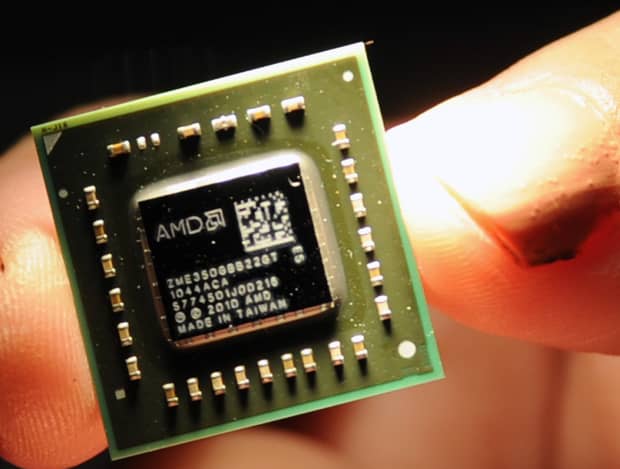

AFP/Getty Images

Advanced Micro Devices Inc. smells blood in the water from the troubles at rival Intel Corp., and it struck Tuesday with a hefty deal to buy fellow chip maker Xilinx Inc. for $35 billion in stock.

The mega-acquisition is getting a mixed reaction from Wall Street and analysts, as AMD AMD, -4.07% shares fell 5% and Xilinx stock XLNX, +8.55% climbed nearly 8% in Tuesday trading after the deal was announced in the morning. The deal is clearly using the appreciation in AMD’s stock — the biggest gainer in the S&P 500 SPX, -0.30% in both 2018 and 2019 — to compete further with Intel INTC, -2.31% in the data center, as well as entering new markets.

AMD’s move is similar to another Silicon Valley chip maker’s use of its high-flying stock to build a more well-rounded competitor to Intel: The proposed $40 billion deal by Nvidia Corp. NVDA, +1.94% to buy ARM Holdings PLC from SoftBank Group Corp. 9984, +1.33% and enter the microprocessor business. Both Intel rivals are expanding their potential markets just as longtime dominant semiconductor force Intel struggles with its manufacturing process.

For more: How did Intel lose its Silicon Valley crown?

Xilinx was the biggest rival of Altera, which was acquired by Intel several years ago for its technology and portfolio of FPGA (field programmable gate array) chips. In June 2015, Intel bought Altera for $16.7 billion, an approximate 56% premium at the time. Xilinx will bring AMD more expertise in markets such as 5G communications, data center, automotive, industrial aerospace and defense.

“Xilinx is the ideal match for AMD,” AMD Chief Executive Lisa Su said on a conference call.

“We will have a combined TAM [total available market] of $110 billion, building on AMD’s $80 billion TAM with an additional $30 billion, a very attractive Xilinx TAM,” Su told analysts. “As we look at growth drivers in the three-to-five-year time frame, we see significant revenue synergy opportunities that can build on AMD’s strong organic growth.”

The news was reported along with AMD’s earnings, which were better than expected, with a 31% jump in its computing and graphics business, results that were better than Intel’s, and confirmation that AMD is gaining share at the expense of its rival.

Read more about Intel’s third quarter earnings

Stacy Rasgon, a Bernstein Research analyst, wrote in a note ahead of AMD’s earnings that a deal with Xilinx could be a strong competitive move against Intel.

“We could see, for example, an opportunity for AMD to add in FPGA and programmable logic to their chiplet architecture, delivering further differentiation (after all, Intel is going down this path as well, and we might argue that AMD, with chiplets already in volume production and no process tech issues might be even better suited to pursue it),” Rasgon wrote. “It could give AMD a further leg into accelerated datacenter computing, complementing their CPU and GPU portfolio (3 full architectures), and strengthening their AI play.”

Some analysts were not as excited by the deal and are taking a wait-and-see attitude, but also noted that the positives AMD has managed so far under Su. Eric Ross, an analyst at Cascend Securities, said he believes Nvidia should have considered buying Xilinx instead of Arm, because he views Arm primarily as a licensing business. He added, though, that AMD’s Su is one of the best of the best CEOs in the semiconductor industry, with Nvidia’s CEO Jensen Huang on the same footing.

“Intel desperately needs this kind of leadership,” he wrote in an email to clients.

Clearly, AMD and Nvidia are making big moves while they see weakness at Intel, which has regularly looked down on its rival chip makers, while easily outpacing them. Intel will have to make some kind of startling comeback, but it may be much harder as AMD and Nvidia use the power of their stock — thanks to investors’ bets on them — to increase their odds.