This post was originally published on this site

Wall Street’s got coronavirus relief on the brain, and the fervent attention on Congress signing off on additional fiscal aid has detracted from the busiest coming stretch of quarterly corporate earnings of the quarter.

In fact, more than one third of the S&P 500 index components, or 186 companies, are set to report third-quarter results in the final week of October, FactSet senior analyst John Butters said in email.

Thus far, earnings mostly have been a sideshow for investors who have been fixated on whether Congressional lawmakers and the White House can achieve an accord on another round of funding for U.S. businesses and workers, hit by the COVID-19 pandemic.

Investors shouldn’t be faulted for closely watching the drama on Capitol Hill because trillions of dollars more flowing into the economy could arguably do wonders in helping to sustain the current economic recovery, economists say.

But next week’s earnings reports bear watching because some of the biggest companies will be reporting results, with many expected on Thursday, including the majority of a contingent of stocks known as FAANGS.

Facebook FB, +2.39%, Apple AAPL, -0.61%, Amazon.com AMZN, +0.88%, and Google parent Alphabet Inc. GOOGL, +1.63% GOOG, +1.58% report on Thursday. Netflix NFLX, +0.62% reported results last week.

“As far as next week, there are so many big names reporting, including many on the same day—Apple, Alphabet, Facebook, and Amazon all report on Thursday,” Jim McAllister told MarketWatch via email.

“Given the fact they represent over 16 percent of the S&P 500 [by market value], their results could very well have a big impact on the market,” he noted.

So far, however, S&P 500 blended earnings, including actual results and forecasts, show a decline of 16.5% in the third-quarter, with 27% of companies reporting. If that level of deterioration in earnings eventuates, it would represent the second-steepest year-over-year earnings decline since the second-quarter of 2009 when it declined by 26 .9%.

At the sector level, nine of the 11 sectors in the S&P 500 index are reporting a year-over-year decline in earnings, led by energy (-123.6%), FactSet reports.

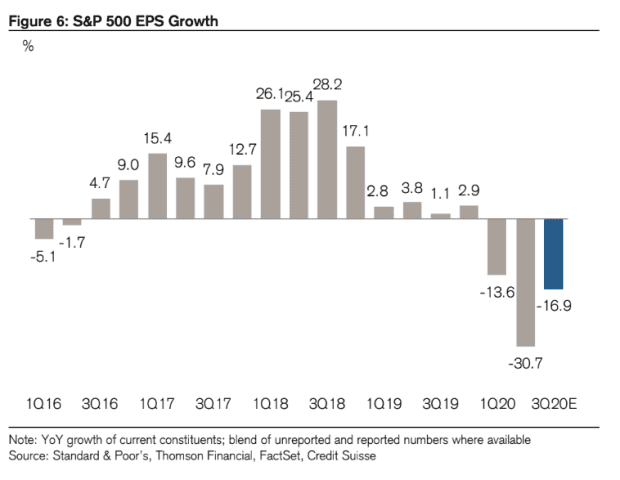

Credit Suisse’s research team led by Jonathan Golub, sees earnings decline at 16.9% (see attached):

Credit Suisse

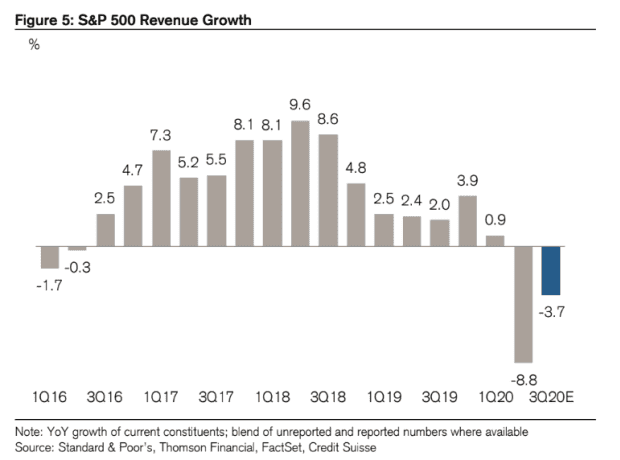

CS also sees year-over-year revenue growth retreating 3.7% but coming off a much more severe period in the early phases of the public health disaster (see attached):

Credit Suisse

Now for the good news—at least on a relative basis.

Earnings are surprising to the upside, but at a less substantial level than the prior quarter. About 84% of companies reporting have beaten estimates on earnings per share, which would mark the highest percentage of companies beating estimates since 2008, while 81% are reporting a surprise on revenue.

“We’re seeing net earnings revisions that are surprising to the upside and, with the exception of a few misses along the way, many companies are beating previous forecasts,” wrote Brian Price, head of investment management for Commonwealth Financial Network, in an emailed response to MarketWatch. “The quality of these earnings beats seems especially high in that it’s not just cost cutting but rather stronger revenues that companies are delivering,” he said.

Forward guidance—an even more important metric in the throes of an economically disruptive pandemic—is looking positive as well. With five companies issuing negative outlooks, while 19 companies are forecasting increased earnings per share, or EPS, so far.

All that said, earnings and the prospects for good results down the road won’t exactly ameliorate worries that coronavirus cases are rising in the U.S. and Europe in particular, while economic growth remains wobbly amid the pandemic.

In addition, there is the uncertainty around the 2020 U.S. presidential election between President Donald Trump and Democratic challenger Joe Biden which could influence policy for years to come and impact the stalled talks on fresh fiscal relief.

“Earnings reports are important, but the market seems laser focused on the election and any news related to stimulus talks,” Price said. “It seems unlikely that we’re going to get a large stimulus package before the election, and I am somewhat surprised that volatility isn’t higher in light of this ambiguity,” he said.

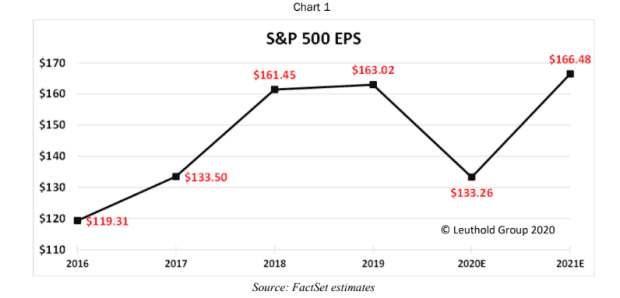

Once those various hurdles are cleared, however, many bulls are betting that an unprecedented snapback in earnings may take place for 2021.

A report released Friday but the Leuthold Group implies that reaching record EPS results in 2021 is achievable if technology and health care helps to drive the market higher, after a big rally in stocks in the information technology sector following the lows seen in March this year as the coronavirus pandemic hit.

“Technology and Health Care lead the way in 2021 when measured both by percentage growth and absolute dollars of earnings gains,” Scott Opsal, senior analyst at Leuthold writes.

Leuthold Group

GDP for the record books

Beyond earnings reports this week, investors also will follow the first reading of third-quarter GDP due Thursday, which is expected to show a rise in economic activity of 31.8% annualized, more than making up for the 31.4% plunge in the worst part of the pandemic.

The data will be published less than a week from Election Day on Nov. 3 and could be used by Trump to make his case that the recovery from the worst pandemic in a more than century has proceeded healthily.

However, critics warn that the GDP figures won’t reflect the fact that millions remain unemployed, and follows last quarter’s terrifying numbers. Many parts of the economy, notably in the travel, leisure, entertainment and hospitality sectors, remain in dire straits, but are improving from the abysmal levels created by social-distancing restrictions to help limit the spread of the virus.

How did other assets finish the week?

The Dow Jones Industrial Average DJIA, -0.09% finished Friday’s trade with a weekly decline of 1%, the S&P 500 index SPX, +0.34% closed the week 0.5% lower, while the Nasdaq Composite Index COMP, +0.36% ended the weekly period off 1.1%.

However, the small-capitalization Russell 2000 index RUT, +0.62% closed the week 0.4% higher. The financial focused Financial Select Sector SPDR Fund XLF, +0.31% rose 1%, while the Invesco KBW Bank ETF KBWB, +0.72% rose 3.6% for the week, as 10-year Treasury yields TMUBMUSD10Y, 0.842% saw their sharpest weekly gain to 0.84% since Aug. 14, reflecting a steeping of the so-called yield curve.

Read: MarketWatch’s wrap of weekly moves and the outlook for exchange-traded funds: ETF Wrap. Sign up for the weekly newsletter here.