This post was originally published on this site

Madrid’s Puerta del Sol Plaza, with a boarded-up Apple store in the background, pictured Oct. 21, 2020.

MarketWatch/Kollmeyer

Well-received results from banks and auto makers were helping to drive gains for European stocks on Friday, while flash purchasing managers index data revealed continued pandemic-fueled struggles for the region. U.S. stock futures were modestly higher.

The Stoxx Europe 600 index SXXP, +0.86% rose 0.8%, sidestepping a potential fifth-straight loss, which would be the worst losing run for the index since early March, according to FactSet. The German DAX DAX, +0.90% gained 0.8%, the French CAC PX1, +1.26% gained 1.1% and the FTSE 100 UKX, +1.11% rose 1%.

U.S. stock futures YM00, +0.14% ES00, +0.13% NQ00, +0.15% logged gains of around 0.1% across the board after the second and final presidential debate late Thursday. President Donald Trump and former Vice President Joe Biden exchanged barbs over the pandemic as the clock ticks down to the November election.

Front and center for markets, though, is the progress of stimulus talks in the U.S., which is “arguably the only hope for an immediate lift to U.S. stocks before 3 November,” said Han Tan, market analyst at FXTM, in a note to clients.

“Investors are likely to stay neutral in the markets, gripped by the looming political risks with the U.S. elections less than two weeks away,” the analyst said. House Speaker Nancy Pelosi said noted progress talks with the White House, but cautioned that a bill may still take longer to write and get passed by Congress.

One positive for markets may be late Thursday news that Gilead Science’s GILD, +0.76% GILD treatment for COVID-19, Veklury, was formally approved by the Food and Drug Administration. Known as remdesivir up until now, Veklury is the first COVID-19 therapy to receive full FDA approval during the pandemic.

Meanwhile, economic data showed a continued struggle in Europe. In Europe, flash October PMI data showed France’s Composite Output index slipped to 47.3 from 48.5, a five month low. Germany’s PMI Composite fell to 54.5 from 54.7, a two-month low.

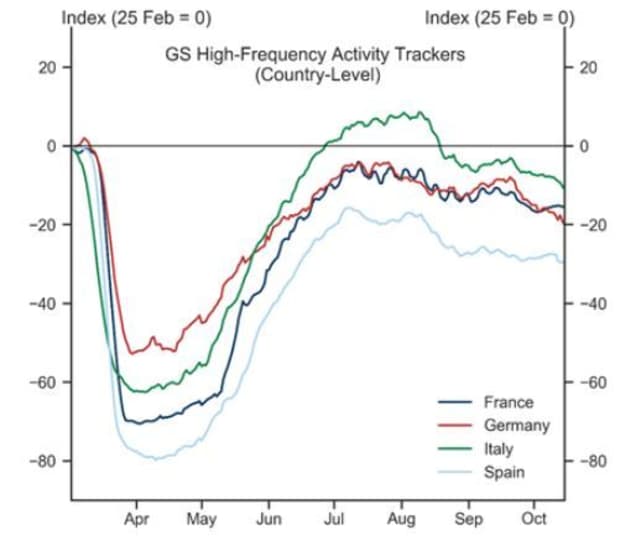

Economists at Goldman Sachs expected PMI data would disappoint for three reasons: COVID-19 infections have risen sharply in October, sparking more restrictions; the bank’s high-frequency activity tracker shows a further momentum slowdown; and recent survey and hard data show services PMIs having a tougher time than manufacturing PMIs.

Goldman Sachs Global Investment Research, Markit, Haver Analytics

Several European countries have imposed restrictions and curfews on populations to curb the virus spread. French officials on Thursday expanded a 9 p.m. to 6 p.m. local curfew across 38 regions.

U.K. data was slightly more positive, with retail sales rising in September and beating expectations.

Earnings news was driving share action as well. Shares of Barclays PLC BCS, +2.61% BARC, +4.60% rose nearly 4% after the U.K. bank reported higher third-quarter total income, net profit and pretax profit than the market expected, despite booking hefty provisions.

The banking sector was largely higher across the board, with shares of HSBC Holdings HSBC, +1.45% HSBA, +3.45% up over 2% and Banco Santander SAN, +1.50% SAN, +2.85% up 1.5%.

Auto makers were in focus with Renault shares up 1.8% and Daimler up 1.6% after each reported results. Renault RNO, +2.10% said revenue fell in the third quarter, but the French auto maker still beat analysts forecasts. German car maker Daimler DAI, +2.38% reported a rise in profit, but a fall in revenue.

On the downside, share of Kering KER, -1.96% fell over 2% after the luxury-goods group reported better-than-expected third-quarter group sales, but disappointment from the Gucci label, said analysts at Citigroup.

“With the shares having outperformed in the past three months (+13% vs. sector +7% and European market -6%) and the likely disappointment on Gucci, share price reaction might be mixed,” said a team of analysts led by Thomas Chauvet, in a note to clients.