This post was originally published on this site

Mark Wilson/Getty Images

Don’t believe a weaker U.S. dollar is good news for the stock market?

The inverse correlation between the currency and the S&P 500 index is running so strong it’s nearly become “automatic,” wrote analysts at Bespoke Investment Group, in a Tuesday note.

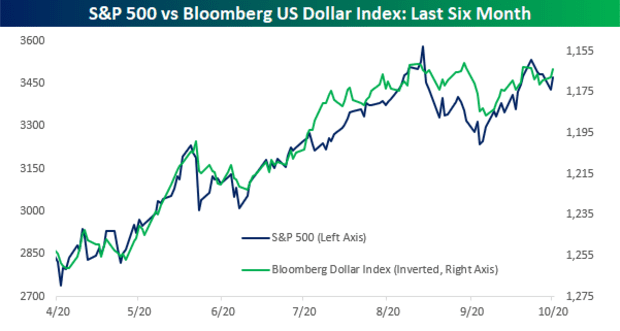

They pointed to the chart below, tracking the S&P 500 SPX, -0.04% versus an inverted reading of the Bloomberg U.S. Dollar Index.

Bespoke Investment Group

“In a pattern so reliable that it’s become nearly automatic, when the dollar rallies stocks decline and when the dollar declines stocks rally,” they said. “Given the relationship between the two, equity bulls should be happy to see that the dollar is lower and not far from 52-week lows.”

The dollar has been on a roller coaster in 2020. It surged in February and early March, with the ICE U.S. Dollar Index DXY, -0.52% hitting a three-year high as the COVID-19 pandemic closed down much of the global economy and prompted a world-wide scramble for greenbacks. The dollar retreated as the Federal Reserve and other central banks flooded the international financial system with liquidity, reducing risk. That included the Fed expanding existing dollar swap lines with other central banks and establishing new ones.

The dollar subsequently accelerated its decline over the summer with the DXY index, which measures the currency against a basket of six major rivals, falling to a more than two-year low in September before consolidating.

The currency index slumped 0.6% on Wednesday and is down more than 4% so far in 2020. Stocks were higher Wednesday, with the S&P 500 up 0.5% to trade near 3,460, while the Dow Jones Industrial Average DJIA, -0.15% rose around 100 points, or 0.4%.

A weaker dollar is usually seen as a positive for stocks, particularly shares of U.S.-based multinationals who earn a large chunk of revenue overseas. A weaker dollar can be little help, however, if the weakness is due to U.S. economic underperformance versus the rest of the world. Stocks have also at times done well during periods of dollar strength that reflected U.S. economic outperformance.

The relationship between the dollar and stocks isn’t always so straightforward. The long-term correlation between dollar moves and the S&P 500 is slightly negative — meaning weakness in one asset tends to somewhat be accompanied by strength in the other.

Investors and analysts previously told MarketWatch they expected dollar weakness to continue and to be particularly positive for stocks in 2020, a volatile year that’s seen the S&P 500 rally back to records after the pandemic-inspired bear market that took the S&P 500 down nearly 34% from a Feb. 19 record to its March 23 low.