This post was originally published on this site

In the long-run politics may not matter for the stock market, but that may not stop investors from making bets on presidential election races.

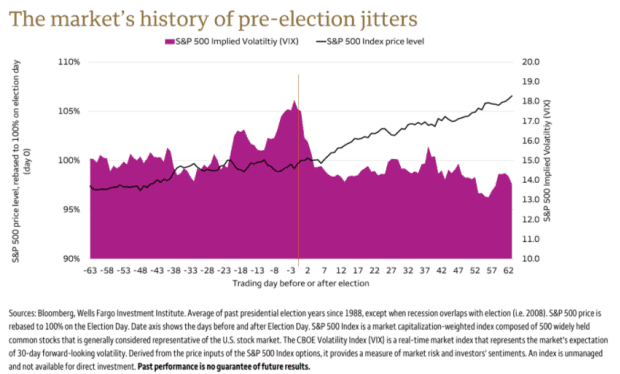

Wells Fargo Investment Institute’s Chao Ma, global portfolio and investment strategist, highlights a chart that shows the degree to which expectations for volatility can swing higher in the lead-up to Election Day on Nov.3 when voters will determine whether incumbent President Donald Trump or and Democratic challenger former Vice-President Joe Biden will occupy the White House.

Ma’s chart shows that the Cboe Volatility Index VIX, +1.73%, which measures the implied volatility for the S&P 500 index SPX, -0.08%, as measured by options bets on the S&P 500 index for the coming 30-day period, tends to climb in the month prior to the presidential election and can also surge above its historical average just about two weeks outside of voting day.

Wells Fargo Investment Institute

The attached chart shows the past presidential elections going back to 1988, with the VIX moves represented in purple and S&P 500 trading in black superimposed atop it.

Although a relatively small sample size, the WFC chart illustrates that the VIX, whose historical average is 19.44, can surge 20% as the election approaches. The VIX tends to rise as stocks fall and vice versa and is widely viewed as a hedge against expected volatility in the market.

The VIX currently stands at 29.18 and has climbed more than 10% so far in October, even as the S&P 500 has climbed 2.8% in the month to date, the Dow Jones Industrial Average DJIA, -0.19% has gained 2.3% and the Nasdaq Composite Index COMP, -0.20% has rallied by 3.5%.

Read: Here’s what stock returns from now until Election Day tell us about Biden and Trump

The Trump-Biden race for the White House is seen as a particularly pivotal one for markets and the U.S. economy, with the world in the throes of a recession caused by the worst pandemic in more than a century.

Investors also have been hanging hopes that a win by Biden, who currently leads in a closely followed average of national polls, could result in a sweeping fiscal coronavirus relief package that could breathe new life into beleaguered businesses and the stock market hard hit by the viral pandemic.

See: Biden will win, polls say. But the stock market is sending a different signal

Regardless, of the election outcome, Wells Fargo says that investors need to be focused on the longer term.

“Politics can bring out strong emotions, but an election has not significantly changed the direction of market movements, historically,” Ma writes. “We believe it is important to focus on long-term goals and not to try to time market movements around elections,” the strategist writes.

As a key reminder, the Wells Fargo analyst says that historically, the S&P 500 has generated a 9% average return in the 12 months before an election and a 13% average returns in the 12 months after, which is viewed as “well above the 8% average return since the 1980s.”