This post was originally published on this site

If a financial bubble is indeed brewing, it may continue for longer than many expect, TS Lombard strategists said.

AFP via Getty Images

The outperformance of technology — and therefore Growth — stocks is set to continue “for a while longer” yet, despite the market looking like the “dot-com bubble on steroids.”

That’s the view of TS Lombard’s chief U.S. economist Steven Blitz and head of strategy Andrea Cicione.

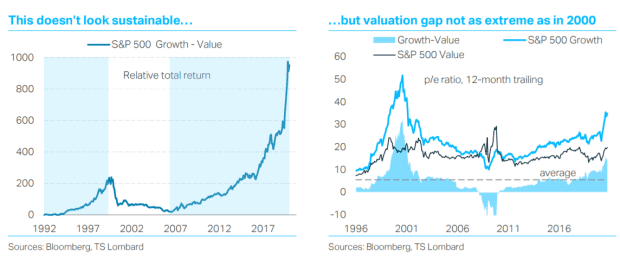

They said they were “not alone in being nervous” about Tech stocks valuations. “Growth has had an unprecedented surge for more than 13 years and the recent acceleration appears completely unsustainable,” they said, noting that the recent swell was more extreme than the Growth outperformance during the dot-com bubble — as seen in the chart below (left). They described it as the ‘dot com bubble on steroids,’ in a note.

However, on closer inspection they said the argument for rotating into Value was “less convincing,” as the first two years of stronger Value returns post-2000 were during a bear market. “If the same were to happen this time around, rotating into Value would be at best a defensive strategy.”

But Blitz and Cicione said if a bubble was indeed inflating in tech, there was no guarantee Growth’s outperformance would stop now. “Through its aggressive policy choices, the Fed has engineered a rebound in equity prices since March that is giving investors the perception of lack of risk. So why stop betting on a winning horse now, especially if there is no downside,” they said.

The chart below (right) shows that while the valuation gap between S&P 500 SPX, -1.63% Growth and Value is above average, it is not as extreme as it was in 2000. But Growth’s run may be more advanced that the valuation gap suggests, they added, particularly as many tech companies are now both large and very profitable — in contrast to the late 1990s — making it harder to justify the multiples seen at the height of dot-com mania.

T S Lombard U.S. Watch

“Investors looking to rotate from Growth to Value would be better off doing so in small-caps, where the odds of a sustained period of Value outperformance are more favorable.

“However, they should bear in mind that if a financial bubble is indeed brewing, it may continue to do so for longer than many expect — under such a scenario, Growth will probably keep doing better until the bubble pops,” they said.