This post was originally published on this site

A “high-water” mark for technology stocks?

AFP via Getty Images

The deadline for a pre-election stimulus package, badly needed by millions of Americans, is fast approaching.

The back and forth has been knocking markets around, but as cold as it sounds, we may wake up on Wednesday with no deal and no stock meltdown, or at least not a long-lasting one. That is because most economists are convinced a stimulus package will be unavoidable for the next U.S. president.

Read: Speaker of the House Pelosi reports progress in still-stalled stimulus talks

If it could be read as such, technology stocks seem the least worried about the state of politics and the economy. Beating all index comers and up 28% year-to-date, the Nasdaq Composite COMP, -1.65% has made up more than half the ground it lost in September.

Yet some out there keep telling us that the best gains have been made, even as tech stocks continue to defy gravity. And investors should rotate at least some of their money into unloved and cheaper value stocks, which have been in a long, long drought.

Our call of the day from JPMorgan strategists says earnings season may offer the first sign that tech stocks are about to drown in all that greatness.

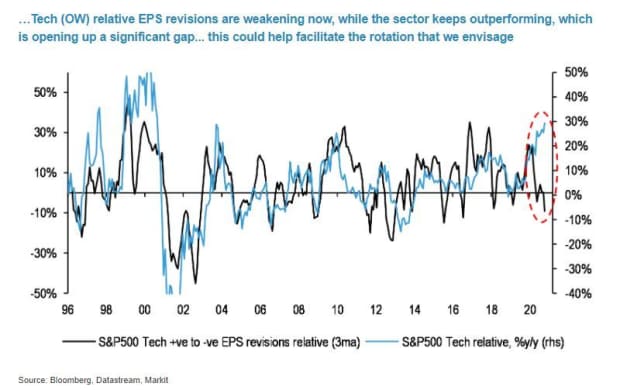

“We expect technology to deliver robust results, where strong earnings delivery was one of the reasons behind our consistent OW (overweight or bullish) stance on the sector, but there is a chance that this could mark a tactical high-water mark for tech earnings versus other sectors,” a team of strategists, led by Mislav Matejka, told clients in a recent note.

JPMorgan has been favoring tech/U.S./China over value/banks/energy/EuroStoxx 50/emerging markets ex-Asia during the current recovery.

“The potential peaking out in tech EPS [earnings per share] revisions versus other sectors might facilitate a rotation further down the line,” said Matejka. He pointed to the below chart that shows how upward revisions to tech earnings are starting to weaken, even as the sector keeps bounding ahead.

JPMorgan

Slowing positive revisions could be the trigger for a rotation, said Matejka and the team. In other words, the tech sector may be starting to run out of all the good news that has been driving investors into those stocks.

Earnings from Netflix and Texas Instruments later will get the ball rolling for earnings from tech highfliers. Get your flood pants while supplies last.

The markets

Stock futures ES00, +0.64% YM00, +0.62% NQ00, +0.60% are higher, following the worst day in four weeks for the Dow industrials DJIA, -1.43%. European equities SXXP, -0.13% are rising as well.

The buzz

Consumer goods corporation Procter & Gamble PG, -1.71% reported an earnings beat and shares are up. We’ll hear from streaming giant Netflix NFLX, -0.01%, Snap SNAP, +2.98%, the parent of social media app Snapchat, and chip maker Texas Instruments TXN, -1.54% after the close.

IBM IBM, -0.32% shares are down after the technology company reported another revenue fall and no outlook.

Read: Tesla and Netflix put big 2020 gains on the line this week

Intel INTC, +0.77% has reached a roughly $9 billion deal to sell its flash-memory manufacturing business to South Korea’s SK Hynix 000660, -1.73%.

Moderna’s MRNA, -4.03% chief executive said the U.S. government could grant the drugmaker emergency-use authorization for its COVID-19 vaccine candidate as soon as December. Shares are up.

Goldman Sachs GS, -0.25% has reportedly agreed to a more-than-$2 billion settlement with the U.S. Justice Department for its role in Malaysia’s 1MDB scandal.

Tuesday’s data: housing starts — the number of new homes on which construction has started — and building permits

California wine country is having a terrible, awful year.

No interruptions will be allowed at Thursday’s second presidential debate.

The chart

Frothy commodities?

Random reads

Oil major Exxon Mobil wants everyone to know that a hypothetical phone call with President Donald Trump never happened.

Heathrow offers not-cheap rapid COVID-19 tests

Health battle begins for a famed Hollywood actor:

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.