This post was originally published on this site

Shares of Kaixin Auto Holdings Inc. tumbled in premarket trading Tuesday, after skyrocketing 15-fold over the past four sessions, as the China-based auto-dealership company confirmed there was no news released to explain the volatility.

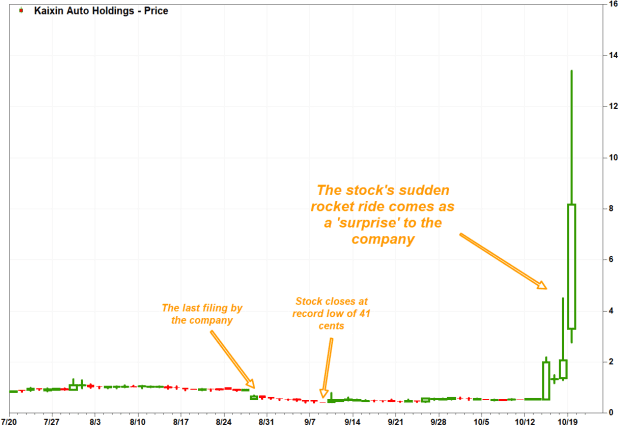

“The spike of stock price came as a surprise to people in Kaixin,” the company said in an emailed statement to MarketWatch.

The stock KXIN, +293.72% fell 23% ahead of the open, after it soared 293.7% on record volume of 235.3 million shares on Monday.

It ran up 55.6% on volume of 55.1 million shares on Friday, tumbled 32.8% on volume of 6.3 million shares on Thursday and soared 266.7% on volume of 60.6 million on Wednesday. In total, the stock has gained 1,409.3% over the past four days.

The company’s last 6-K filing with the Securities and Exchange Commission was on Aug. 26. At that time, Kaixin said it decided to halt its used-car dealership operations, meaning second-quarter revenue will be “significantly lower” than in prior periods, and that “it may not have meaningful revenue starting in the third quarter of 2020.”

The stock closed at a record low of 41 cents on Sept. 8.

FactSet, MarketWatch

“There is no change in the status of Kaixin’s business operations since the company filed the last 6-K on Aug. 23, 2020, and its dealership business is still in halt,” the company said.

With the recent rally, the stock has now climbed 335.8% year to date through Monday, while the iShares MSCI China exchange-traded fund MCHI, -0.60% has advanced 20.7% and the S&P 500 index SPX, -1.63% has gained 6.1%.