This post was originally published on this site

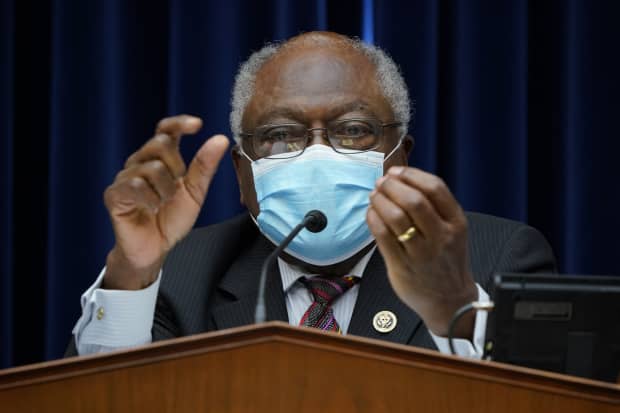

Rep. James Clyburn (D-SC)

Getty Images

The U.S. House Select Subcommittee on the Coronavirus sent letters to four air cargo firms Monday, requesting that they return funds disbursed to them under the CARES Act bailout fund for the airline industry, or prove that those funds were needed to maintain employment.

Rep. James Clyburn, a South Carolina Democrat and chairman of the coronavirus subcommittee, sent requests to Atlas Air Worldwide Holdings Inc. AAWW, +0.66%, Kalitta Air LLC, Western Global Airlines LLC and Amerijet International, Inc. None of the four companies immediately responded to requests for comment.

Clyburn wrote that all four companies appear “to have had financial success during the crisis,” as the Covid-19 epidemic has boosted demand for products sold over the internet and shipped to customers in many cases through the air.

The CARES Act, passed into law in March, provided more than $2 trillion in coronavirus relief aid, including up to $4 billion for cargo air carriers under the Payroll Support Program. “If your company didn’t need PSP funds to keep workers on the payroll, failing to return the funds to the Treasury would be inconsistent with Congress’ clear intent,” Clyburn wrote.

In the case of Atlas, Clyburn cited the company’s claim that adjusted second-quarter net income rose to $123.2 million from $4.5 million in the second quarter of 2019 as evidence that it may not need aid from taxpayers to maintain jobs.

“It is troubling that Atlas Air is set to receive over $406 million in taxpayers funds…to pay the wages and benefits of its workers while simultaneously reporting record earnings,” Clyburn wrote. Atlas shares have risen 134% year-to-date, relative to a 6.7% increase for the Russell 3000 RUA, +2.90%, according to FactSet.

In the case of Western Global, Clyburn cited an August note from Moody’s Investors Service that the company has “benefited from increased demand for its global air cargo services…amid a surge in online shopping.”

Bloomberg reported in August that Western has also benefited by the Federal Reserves support of the junk bond market, which allowed the firm to seek $410 million from debt markets to finance the sale of stock to an employee ownership plan.

Clyburn cited industry reports and comments from executives to question whether the privately held Kalitta Air and Amerijet International were really in need of money to support its pre-pandemic employment levels.

To each company, Clyburn wrote, “given Congress’s goal of preserving jobs, I urge you to return the funds or, if the money was in fact needed for this purpose, demonstrate why this was the case despite the company’s recent success.”