This post was originally published on this site

Travelers are coming back… slowly.

Delta

More than 1 million passengers were screened by the Transportation Security Administration on Sunday, marking a new pandemic high for an airline industry in dire need of some good news.

The announcement lit a buying fire early in the session under long-suffering stocks such as United Airlines Holdings UAL, +3.71%, Delta Air Lines DAL, -0.31%, JetBlue JBLU, -0.36% and Southwest Airlines LUV, -0.18%, but is the news really that bullish?

Not according to Wolf Richter of the popular Wolf Street blog, who said the “TSA hype” doesn’t quite capture what’s happening in the industry. “There was zero numerical context, such as the comparison with the same period last year,” Richter said. “This context that the TSA failed to discuss, and that the media then failed to mention, is still unchanged-horrible.”

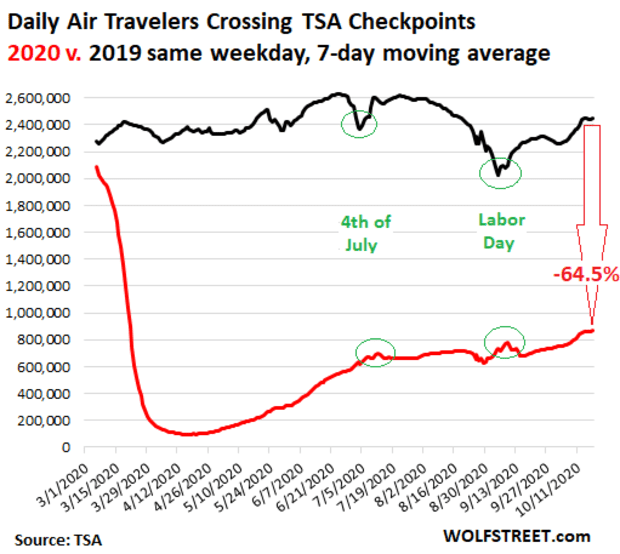

He posted this chart for some perspective:

As you can see, traffic is still down 64.5% from last year, and, also of note, it’s not even the “least-worst” week of the pandemic. That milestone was reached around Labor Day, Richter said.

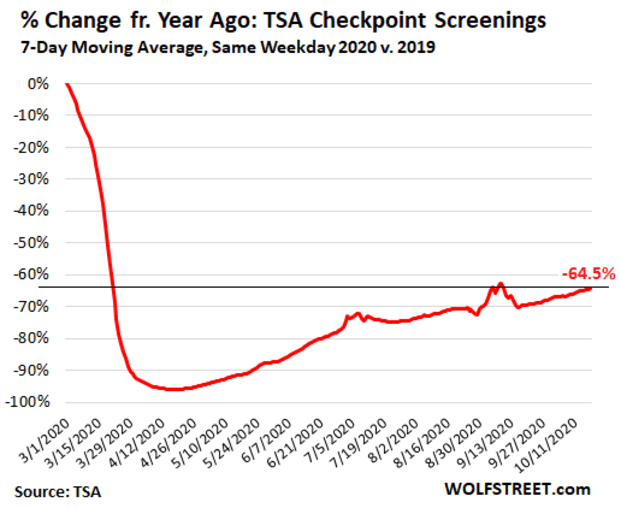

Here’s another way to look at it:

“What this boils down to is this: Airline passenger traffic, compared to the same period last year, has recovered a little bit from the catastrophic near-zero April lows but remains down about 64% from a year ago, in a phenomenon I have called the ‘worst recovery ever,’” he said.

Nevertheless, the news was clearly bullish enough for investors to buy up airline stocks in the face of a weak market on Monday. At last check, the Dow Jones Industrial Average DJIA, -1.53%, S&P 500 SPX, -1.68% and tech-heavy Nasdaq Composite COMP, -1.64% were all firmly lower.