This post was originally published on this site

POOL/AFP via Getty Images

Shares of Zoom Video Communications Inc. surged to a record Thursday, as the videoconferencing company’s annual Zoomtopia event led a stampede of analysts to raise their price targets.

The stock ZM, +3.50% rose 4.3% in afternoon trading, to trade well above Tuesday’s record close of $518.79. The stock had jumped as much as 6.0% to an intraday high of $536.85, which topped the previous all-time intraday high of $529.74 reached on Sept. 23, before paring some gains.

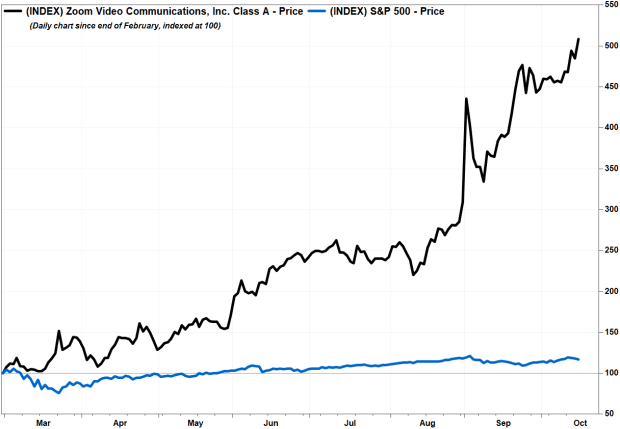

Zoom Video, which has flourished during the COVID-19 pandemic, has seen its stock more than double (up 107.2%) over the past three months and skyrocket nearly eightfold (up 680.2%) year to date. In comparison, the S&P 500 index SPX, -0.23% has edged up 7.5% this year.

No less than 9 of the 32 analysts surveyed by FactSet raised their price targets after Zoomtopia.

Don’t miss: Zoom Video adds online events, apps to service.

BofA Securities analyst Nikolay Beliov reiterated the buy rating while lifting the price target to $570 from $475, saying he walked away from Zoomtopia “incrementally even more positive on Zoom’s position as a key digital transformation enabler.”

Beliov said the company appears to be in the “very early innings” of monetizing the largest Global 2,000 companies, and is making “significant progress” on its Zoom Phone offering.

“We believe Zoom’s increasing relevance and continued good execution translate into both near-term and long-term upside ,” Beliov wrote in a note to clients. “Furthermore, new product releases and enhanced capabilities signal Zoom’s ambition to become a more holistic collaboration and workflow platform, vs a video and [unified communications as a service] solution,” Beliov added.

FactSet, MarketWatch

D.A. Davidson’s Rishi Jaluria kept the rating at buy while raising the price target to $600 from $460, saying the highlight of Zoomtopia was understanding the room the company had to grow in the Global 2,000.

“Our main takeaway was although [Zoom] has had strong traction in COVID-19, it is still underpenetrated and faces a massive market opportunity with runway for sustained growth post-COVID-19,” Jaluria wrote.

The average price target of analysts surveyed by FactSet increased to $489.06 from $434.98 at the end of September. The current target is 7.9% below current levels, with half the analysts surveyed rating the stock the equivalent of buy, 14 analysts are at neutral and 2 analysts recommend selling.

Analyst Tom Roderick at Stifel Nicolaus increased the stock’s target to $400, which is about 25% below current levels, from $350. He reiterated the hold rating he’s had on the stock since May 2019, which was about a month after Zoom Video went public, he was still upbeat on the company’s prospects.

“We are conscious of the stock’s egregiously high multiple but there’s no reason to suspect that momentum is slowing here,” Roderick wrote.