This post was originally published on this site

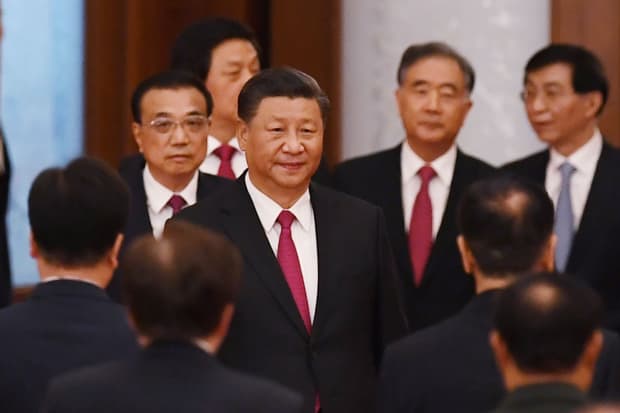

Chinese President Xi Jinping arrives for a reception in Beijing on Sept. 30.

AFP/Getty Images

Asian markets were little changed in early trading Wednesday as traders digested a speech by Chinese President Xi Jinping.

Japan’s Nikkei 225 NIK, +0.13% rose 0.1%, while Hong Kong’s Hang Seng index HSI, -0.09% retreated 0.2%. The Shanghai Composite SHCOMP, -0.56% fell 0.5% and the smaller-cap Shenzhen Composite 399106, -0.54% slipped about the same. South Korea’s Kospi 180721, -1.14% declined 0.4%, while benchmark indexes in Taiwan Y9999, -0.21% and Singapore STI, -0.58% fell. Stocks gained in Indonesia JAKIDX, +0.30% while Australia’s S&P/ASX 200 XJO, -0.26% was about flat.

Xi spoke Wednesday in Shenzhen, where he “reiterated China’s plan to open the economy to focus on both capital market reform and technology,” Stephen Innes, chief global markets strategist at Axi, wrote in a note. “He noted that through the [Chinese Communist Party] leadership, technology had taken Shenzhen to a higher level. This is the frontrunner to the Party Plenary, where market reforms will be laid out thick and heavy. And should be very positive for risk, so much so a grandeur CCP display could steal a bit of the U.S. election thunder, that’s if the current election polls prove reliable.”

Elsewhere, the Bank of Korea left interest rates unchanged at 0.5%, as expected, and Singapore reported its economy shrank at a slower pace in the third quarter, down 7% compared to a 13.3% contraction in the second quarter due to coronavirus-related shutdowns.

U.S. stocks snapped a four-day winning streak Tuesday, with the Dow Jones Industrial Average DJIA, -0.54% falling 157.71 points, or 0.55%, to 28679.81, while the S&P 500 SPX, -0.63% fell 22.29 points, or 0.63%, to 3,511.93 and the Nasdaq Composite COMP, -0.10% edged 12.36 points lower, or 0.1%, to close at 11,863.90.

The International Monetary Fund

The IMF said Tuesday it expects the global economy to shrink 4.4% in 2020. That would be the worst annual plunge since the Great Depression of the 1930s. The world economy contracted by a far smaller 0.1% after the devastating 2008 financial crisis.

Benchmark U.S. crude oil CLX20, -0.49% lost 17 cents to $40.03 per barrel in electronic trading on the New York Mercantile Exchange. It gained 77 cents to $40.20 per barrel on Tuesday. Brent crude BRNZ20, -0.42%, the international standard, also gave up 17 cents, to $42.29.

The U.S. dollar USDJPY, -0.00% weakened to 105.39 Japanese yen from 105.47 yen. The euro slipped to $1.1743 from $1.1748.

The Associated Press contributed to this report.