This post was originally published on this site

The yield on Italian 10-year TMBMKIT-10Y, 0.663% and 30-year TMBMKIT-30Y, 1.496% debt fell to record lows on Monday.

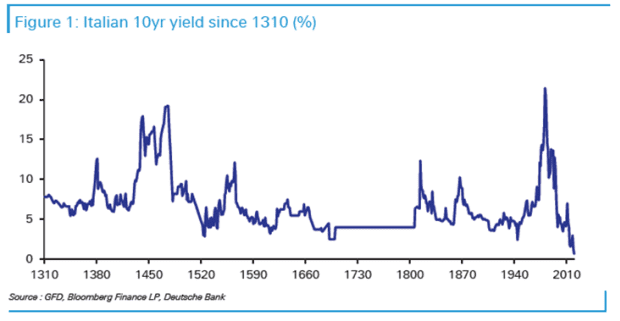

As this chart from Deutsche Bank shows, the yield on the Italian 10-year is lower than it was even before Italy became a country. Deutsche Bank strategist Jim Reid attached proxies for Italian debt, such as from Naples, to chart pre-1861 data. (There is also a gap in the data series for the 1700s.)

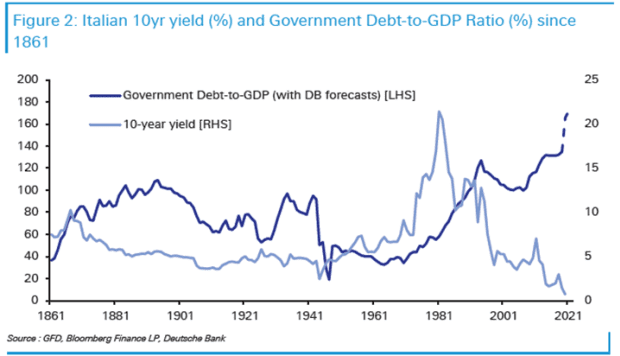

He also charted debt-to-gross-domestic-product, which shows the Italian economy with an all-time low capability to service that debt.

The move on Monday came after the European Central Bank’s chief economist gave an interview suggesting the central bank may take further action. Among the ECB’s actions stimulus so far is the purchase of government debt from countries including Italy, through what’s called the pandemic emergency purchase program.

“Has the ECB permanently suppressed yields and spreads or are there many more twists and turns to this story over the years ahead? I would lean towards the latter but for now Italian politics and their control of the second wave are acting as strengths and not weaknesses,” Reid said.

David Stockman, the former Reagan-era budget director and acerbic critic, looked at the same chart and issued this brief but withering analysis: “when central banks crush rates, politicians bury their governments in debts.”

The current explosion in debt-to-GDP has been because the latter dropped, precipitously. The Italian economy shrank by 18% year-over-year in the second quarter.

Italy also has been issuing more debt. According to Italian bank Intesa Sanpaolo, Italy is forecast to issue a net €177 billion in new debt in 2020, compared with €54 billion in 2019.