This post was originally published on this site

Vials of potential COVID-19 vaccine CoronaVac are seen on the production line at Sinovac Biotech production facility in Beijing, China.

Kevin Frayer/Getty Images

U.S. stocks are once again set to move cautiously higher at the start of the week despite a lack of progress over a new stimulus package.

U.S. stock futures ES00, +0.55% NQ00, +1.63% pointed higher, despite a new $1.8 trillion White House coronavirus financial aid bill offer being met with opposition from both Senate Republicans and House Democrats on Saturday.

Coronavirus cases continue to rise in the U.S., with Sunday being the fourth consecutive day with more than 50,000 daily infections, according to Johns Hopkins University. Efforts to develop treatments and a vaccine are building pace behind the scenes, but have gone under the radar in recent weeks with the U.S. election on the horizon.

In our call of the day, UBS strategists led by Bhanu Baweja said the vaccine trade wasn’t over yet and had room to run.

Vaccine hopes accounted for just 4% of the S&P 500’s SPX, +0.87% 20% rise over the past five months, the bank’s global strategy team said in a note late last week, with liquidity and increased mobility accounting for the rest. They inferred that vaccine hope was only 55-60% priced in, based on how much of a drag current limited levels of mobility in society was still having on the market.

“Given that an approved vaccine should (eventually) help lift mobility to normal, the cumulative drag from mobility from February of 4% could be used as a proxy for further gains that can accrue from a vaccine,” they said.

In an earlier note at the end of September, UBS strategists said it was time to position for a vaccine approval.

“While mobility and economic data will improve slowly even after a vaccine is approved, market returns will very likely be front loaded. This will be a tactical, one-off rise in the market, we believe, and the time to position for this is now.”

They recommended positioning tactically in the cyclical sectors and called for a one-to-three-month spell of rotation away from the U.S., particularly to emerging market equities. When it comes to sectors the bank said there was additional scope for rotating into cyclicals, including leisure, automobiles, beverages, housing and airlines.

The team, reiterating their stance last week, said: “Vaccine hopes and a U.S. administration potentially less focused on tariffs can revive flows to EM [emerging markets] assets more broadly.”

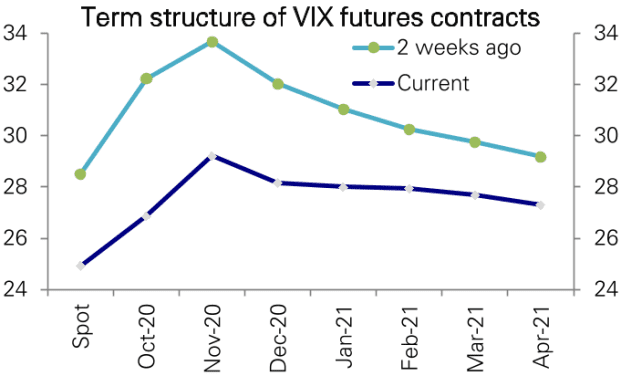

The chart

Deutsche Bank

This chart from Deutsche Bank DB, -0.85% shows that the Volatility Index futures curve has shifted down in the past two weeks. The bank’s strategist Parag Thatte said widening polls, with Democratic challenger Joe Biden increasing his lead, has led to the pricing out of some of the election-related volatility. But the analyst added that potential uncertainty around next month’s election “remains significant,” with polls tight in key battleground states.

The markets

U.S. stock futures pointed higher early on Monday on increased hopes of a second stimulus package. After a 3.8% gain for the S&P 500 SPX, +0.87% last week, S&P 500 futures ES00, +0.55% and Nasdaq COMP, +1.39% futures both rose, while Dow futures YM00, +0.07% were flat, implying a 2-point loss for the Dow Jones Industrial Average DJIA, +0.56%. European stocks also climbed, despite the worsening COVID-19 situation in the continent — the pan-European Stoxx 600 index SXXP, +0.80% rose 0.5%.

The buzz

President Donald Trump declared on Sunday he was ready to return to the campaign trail despite questions about his health. Trump will hold a rally in Florida later on Monday, his first rally since testing positive for COVID-19 earlier this month.

Regeneron REGN, +0.36% Chief Executive Leonard Schleifer warned against jumping to conclusions, after the company’s antibody cocktail apparently helped Trump fend off the SARS-CoV-2 coronavirus that causes COVID-19. Schleifer said it was a “case of one” and more testing was needed.

British Airways chief executive Álex Cruz will step down with immediate effect, the airline’s owner IAG IAG, +0.62% said on Monday, as it navigates the “worst crisis” facing the industry.

Saudi Arabia’s National Commercial Bank said on Sunday it will buy rival lender Samba Financial Group in a deal valued at $14.8 billion, creating what would become the kingdom’s largest bank.

Americans Paul R. Milgrom and Robert B. Wilson have won the Nobel Prize in economics for “improvements to auction theory and inventions of new auction formats.”

The Los Angeles Lakers beat the Miami Heat on Sunday night to win the franchise’s 17th National Basketball Association championship.

Soccer clubs Liverpool and Manchester United have angered the English Premier League and the U.K. government because of plans to reshape English soccer with a power grab that would also cut the size of the league from 20 teams to 18.

Random read

Hollywood actor Chris Pratt solves Rubik’s Cube in less than 60 seconds

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.