This post was originally published on this site

Agence France-Presse/Getty Images

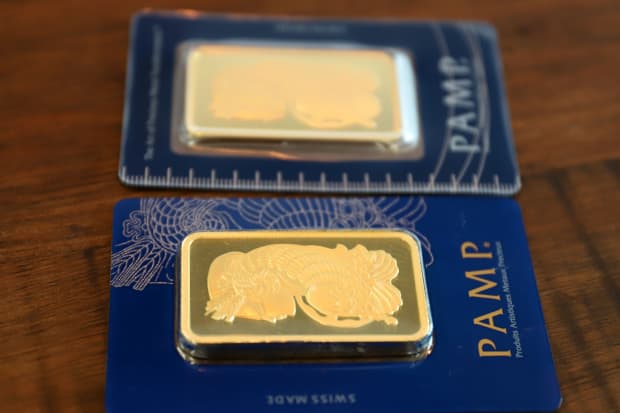

Gold rose Thursday, buoyed by optimism over the prospects for some sort of U.S fiscal stimulus eventually.

Prices held onto their gains after data on Thursday showed a larger-than-expected reading on U.S. first-time jobless claims.

Gold sank when President Donald Trump pulled the plug on fiscal stimulus negotiations with Congress, reducing the prospect of more reflationary deficit spending, but the precious metal has found support as House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin “talk about airline rescues and Trump says he wants more $1,200 [stimulus] checks, Adrian Ash, director of research at BullionVault, told MarketWatch.

Gold for December delivery GCZ20, +0.12% on Comex edged up by $2.30, or 0.1%, to $1,893.10 an ounce, while December silver SIZ20, +0.56% was up 12 cents, or 0.5%, at $24.015 an ounce.

Gold held gains after data showed first-time jobless claims fell to 840,000 last week from an upwardly revised 849,000 a week earlier, highlighting the need for more government spending to support the economic recovery from the coronavirus pandemic. Economists surveyed by MarketWatch had forecast a fall to 820,000.

Gold’s downtrend since August “remains very much intact, despite the recovery since late September. A break through this week’s highs may make things more interesting though and could represent a momentum shift,” said Craig Erlam, senior market analyst at Oanda, in a note.

“While I still think the decline since August is a corrective action, with more upside to come in the medium term, I remain unconvinced that the correction has run its course,” he said. “There’s clear support below around $1,850, if this goes then $1,800 could quickly come under pressure.”

Other metals on Comex traded higher. December copper HGZ20, +0.31% tacked on 0.1% to $3.037 a pound. January platinum PLF21, +0.40% rose 0.5% to $870.90 an ounce and December palladium PAZ20, +0.26% added 0.4% to $2,391.50 an ounce.