This post was originally published on this site

Electric energy generating wind turbines near Palm Springs, Calif.

David Mcnew/Agence France-Presse/Getty Images

President Donald Trump vowed four years ago to bring back the U.S. coal industry.

That never happened, as the New York Times and the public radio program The Allegheny Front each pointed out recently through in-depth looks at coal country since Trump’s 2016 election.

Now as the Nov. 3 presidential election draws nearer, Wall Street has been examining what a potential shift in power in Washington might mean for the U.S. energy sector.

Despite the Trump administration’s oil-and-gas friendly policies, including its push to open up public lands for exploration and slashing of environmental protections, the shift away from fossil fuels is already well underway.

BlackRock BLK, +1.90%, the world’s largest asset manager, on Monday underscored how a potential White House win by former Vice President Joe Biden and Democrats taking control of the Senate could accelerate the move by the U.S. toward cleaner power sources.

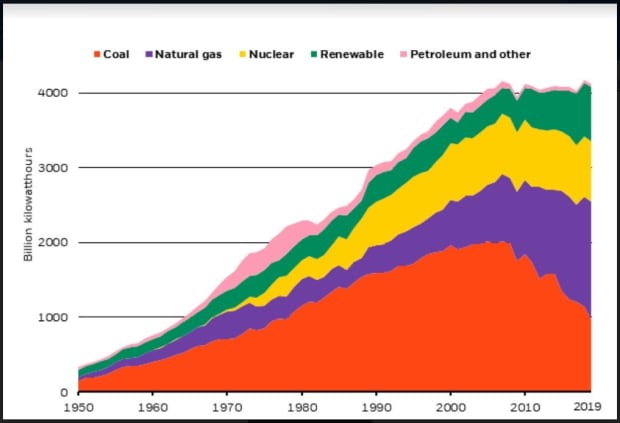

But first, here’s their chart showing how coal already has been declined since early 2000, in terms of powering the U.S. electricity grid.

Coal’s diminished role since 2000

BlackRock Investment Institute, U.S. Energy Information Administration

It also shows that the share of electricity generated by renewable sources rose to 17% in 2019 from 10% in 2010.

“A Democratic sweep could accelerate the decarbonization of the power sector, by extending and expanding tax credits for renewable power sources and other zero-carbon industrial sources such as carbon sequestration,” wrote a BlackRock Investment Institute team led by Mike Pyle, global chief investment strategist.

Read: Here’s where Trump and Biden stand on climate change

Specifically, they noted Biden’s near $2 trillion Green New Deal proposal aims to significantly slash emissions in the transport sector and to retrofit commercial and municipal buildings to increase their energy efficiency by 2050.

Even without a united “blue” government in power, Pyle’s team still sees plenty that could happen under a Biden win on the regulatory front, including crack downs on drilling and pipeline permits that could hamper U.S. shale supply and increase oil prices, particularly once demand returns as the U.S. overcomes the COVID-19 pandemic.

“Yet any spike in oil prices may not be sustained given the prospect of an accelerating shift to clean energy in the transport sector,” the BlackRock team wrote.

Oil futures rose Monday, with the U.S. benchmark West Texas Intermediate crude for November delivery CLX20, +0.33% adding $2.17, or 5.9%, to settle at $39.22 a barrel on the New York Mercantile Exchange, following losses in the past two sessions.

But with oil prices trading below $40 a barrel, it remains unclear how many U.S. shale companies can survive over the long haul, even with pandemic-era support.

Embattled U.S. oil-and-gas companies have borrowed a record $100 billion in the corporate bond market since the Federal Reserve announced its plans to buy corporate debt for the first time in history to offset pandemic shocks, according to a report from BailoutWatch and two other nonprofits.

“Some companies might not have survived had the Fed failed to restore market liquidity,” according to the report.

As the presidential race enters its final weeks, it also is worth noting that investors have grown increasing comfortable betting on companies promising to be part of a more climate-friendly future.

Electric car maker Tesla Inc. TSLA, +2.55% shares closed up 408.8% on the year to date Monday.

Mark Haefele, chief investment officer at UBS Global Wealth Management, pointed out that Florida-based solar and wind power generator NextEra Energy NEE, +2.39% nearly surpassed ExxonMobil‘s XOM, +2.30% stock market value on Friday to become the largest U.S. energy company.

NextEra shares settled 18.9% higher on the year to date Monday, giving it a $141 billion market capitalization, according to FactSet data. Exxon shares were 51.7% lower for the same period, putting it at a slightly higher $142.7 billion market cap.

“This does, in our view, underline the multiyear shift from traditional toward renewable energy, one that will continue in the decades

ahead,” Haefele wrote in a note Monday.