This post was originally published on this site

A political face-off for the ages?

Debates ordinarily don’t alter the course of history. They haven’t been a major market mover either. But could this hotly anticipated tête-à-tête between President Donald Trump and Democratic challenger Joe Biden prove different?

That’s the question some investors may be pondering as they brace for Tuesday’s first scheduled presidential debate between the two political opponents. Certainly, the U.S. equity market has moved in sometimes violent fits and starts—mostly lower in September—as the race for the White House has heated up, amid a global viral outbreak that has rocked economies world-wide.

I think it is incredibly “important,” Bryn Talkington, of Requisite Capital Management said of the first debate, during an interview Monday on CNBC’s “Halftime Report.”

“Expectations for Joe Biden to hold his own as a debater are low,” she told the business network, noting that the debate outcome could set the tone for the “narrative going forward” in the presidential race.

Currently, Biden leads Trump by 6.9 percentage points, 49.8 to 42.9, according to a national average of polls by Real Clear Politics.

On Monday, stocks were aiming to claw back from a poor showing last week, amid concerns about rising cases of coronavirus and about potential Election Day volatility. Still, stocks were on track to halt a monthly win streak that began in April. The Dow Jones Industrial Average DJIA, +1.78% was looking at a 3.4% monthly decline in September, the S&P 500 index SPX, +1.77% was on pace for a 4.4% monthly slide, while the Nasdaq Composite Index COMP, +1.73% has declined 5.3% so far for the month, FactSet data show.

Could things pivot demonstrably postdebate? History suggests otherwise.

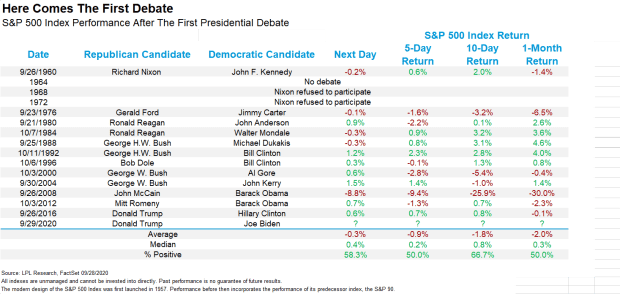

On average, going back to 1960, when televised debates started to become more of a fixture in American politics, the S&P 500 index has fallen in the next day and posted lower returns in the 5-day, 10-day and one-month period, according to Ryan Detrick, chief strategist at LPL Financial. Those are declines of 0.3%, 0.9%, 1.8% and 2%, respectively, according to the data commissioned by MarketWatch from LPL (see attached table).

Dow Jones Market Data notes that the data are skewed lower due to the 2008 financial crisis, when markets began the first stages of a precipitous and violent plunge, due in part to the souring of arcane mortgage securities that spread across the globe.

Data from Dow Jones on the stock market’s performance after the first presidential debates between the final front-runners show that a 0.14% decline on average on the day after the debate, a 1.51% decline from the first debate to the next, a 2.51% decline between the first debate and the final presidential face-off and a 0.35% slump from the first debate to Election Day.

The median results skew higher, with the median average reflecting a 0.9% gain from the first debate to Election Day, the Dow Jones data show.

Read: What stock-market investors will be watching for in first Trump-Biden debate

Also of note, is the fact that there weren’t any presidential debates from 1964 to 1972, as President Lyndon B. Johnson refused to debate Republican presidential candidate Barry Goldwater in 1964, perhaps, helping to usher in a lengthy stretch of no debates.

Read: This stock-market metric has correctly predicted presidential election results since 1984

Paul Nolte, portfolio manager at Kingsview Investment Management, told MarketWatch that market participants already have been signaling who they think will win the 2020 election—and they don’t foresee major surprises.

“Generally speaking, the way we look at it is from Labor Day to about Election Day to determine whether the incumbent party wins. So, right now the market is not doing all that well, so it is leaning more toward Biden,” Nolte said.

“The truth is most people probably know who they are going to vote for at this point. Still, a strong or weak showing by either candidate could potentially sway a few of the last on the fence voters,” LPL’s Detrick told MarketWatch.

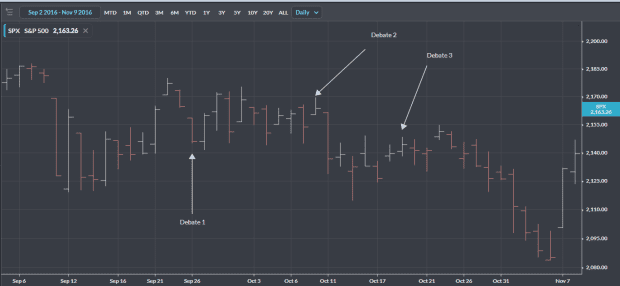

Michael Antonelli, market strategist at Robert W. Baird & Co., said that he doesn’t put a lot of significance in the debates as influential for markets and points to 2016 as an example of lackluster moves.

via Michael Antonelli

“In general, I don’t believe debates have a meaningful impact on stock markets or volatility. I looked back at the 3 debates in 2016 and couldn’t really find much to write about,” he said.

That said, investors have largely viewed Trump as favorable to Wall Street, while many expect that Biden will increase corporate taxes and tighten regulations, which some argue will weigh on stocks, at least in the short run.

A solid showing for either presidential candidate in the debate could cause some reformulation of betting odds and polls, which in turn could alter the outlook for certain policies.

“Markets care more about policies than politics,” Antonelli said.

Kingsview’s Nolte added: “Bring a big bowl of popcorn and a large adult beverage because this is going to be a show,” referencing the possibility of the first debate to be entertaining, if not market-moving.

—Ken Jimenez contributed to this article