This post was originally published on this site

The previously beaten down U.S. dollar continued to bounce back strong this week, reasserting its role as a haven when risky assets like stocks sell off. Chart watchers at BofA Securities argued Friday that there’s probably a little more space to the upside.

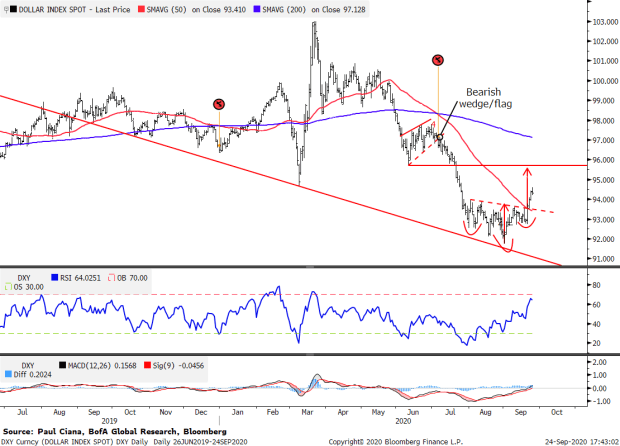

“We estimate there is some room left for the USD to move higher in the coming weeks as we look for certain retests, measured moves or Fibonacci levels to be reached,” the analysts said in a Friday note. Fibonacci levels are retracements of market movements that adhere to a sequence named after an Italian mathematician.

BofA Securities

The ICE U.S. Dollar Index DXY, +0.34%, a measure of the currency against a basket of six major rivals rose 0.4% Friday, contributing to a 1.9% weekly rise and a gain of around 2.8% so far in September. The index earlier this month hit a more-than-two year low, marking a volatile stretch after it soared to a near three-year high in March as market turmoil sparked by the COVID-19 pandemic resulted in a global scramble for dollars. The index has trimmed its year-to-date fall to around 1.8%.

The September rebound has accompanied a rough patch for stocks, with major benchmarks on track Friday for their fourth straight weekly loss and headed for their first monthly loss since March. The S&P 500 SPX, +0.79% is on track for a 1.7% weekly fall and a 6.8% monthly decline after hitting an all-time high on Sept. 2. The Dow Jones Industrial Average DJIA, +0.52% was headed for a 2.8% weekly decline and on track for a monthly fall of more than 5%.

Read: A rebounding U.S. dollar is crushing gold — how far can it go?

The dollar’s bounce has been blamed in part for a weaker tone for commodities, with gold GOLD, -0.19% off around 5% this week and oil futures CL.1, -0.14% down more than 2%. A stronger greenback can be a negative for commodities priced in the dollar as it makes them more expensive in other currencies.

From the fundamental side, analysts said the dollar’s bounce might reflect in part concerns over a rise in COVID-19 cases that have forced some European countries to reimpose restrictions on activity, undercutting the idea that they were handling the pandemic better than the U.S.

They’ve also argued, however, that the dollar downtrend is likely to remain intact after a short-term rebound tied in part to short covering by bearish speculators that had loaded up on bets for the U.S. currency to fall.

“The rally in the USD this month is viewed as the start of a stretched short position washout and resolution of oversold momentum conditions,” the BofA analysts wrote. “From a technical target perspective we think the [Bloomberg dollar index] can rise to 1200/1210, the DXY into the mid 95s and euro EURUSD, -0.42% should get close to $1.15. New and tactical USD longs considered should BBDXY dip to 1175,” they said.