This post was originally published on this site

https://i-invdn-com.akamaized.net/trkd-images/LYNXMPEG8G1DB_L.jpg

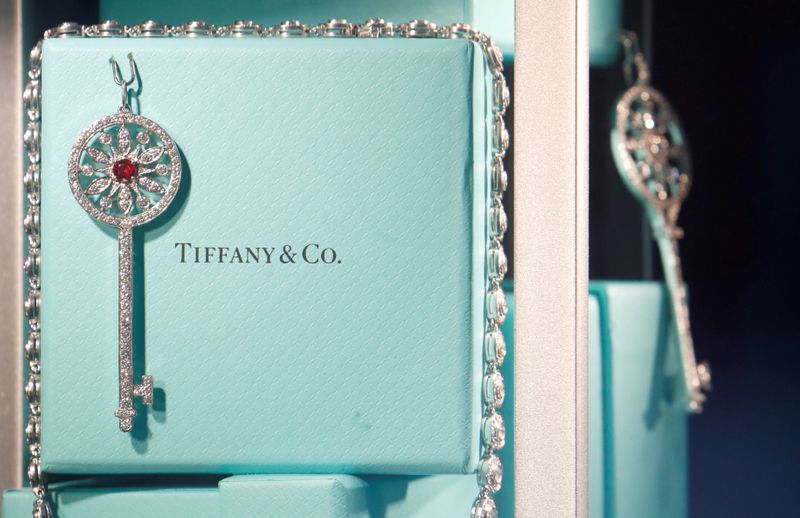

LVMH’s $16 billion purchase of Tiffany hit the rocks last week after the Louis Vuitton owner said it could no longer complete the purchase, citing an intervention by the French government and the jeweller’s weakening performance.

Tiffany sued LVMH and asked a court in Delaware, where the case has been filed, to expedite proceedings, as it seeks to have a ruling before a Nov. 24 deadline for closing the acquisition.

LVMH, run by France’s richest man Bernard Arnault, said in a statement it saw no reason to fast-track the case and argued that having a trial in six to seven months’ time would allow the parties to prepare properly.

“Tiffany offers no reason why this court should move mountains,” LVMH said in its filing, accusing Tiffany of trying to rush a decision to avoid scrutiny of its management of the coronavirus pandemic.

The acquisition – which would be the biggest ever in the luxury industry and was meant to expand LVMH’s footprint in jewellery, which it is less exposed to – was agreed before the coronavirus crisis, which has hit the sector hard.

The French group, which has said it would countersue, rejected Tiffany’s accusations that it had deliberately stalled anti-trust filings, including with the European Union, to delay the purchase.

LVMH has in turn lambasted some decisions by Tiffany’s management since the purchase was agreed last November, including to pay dividends even after the pandemic hit and retailers were forced to close stores.