This post was originally published on this site

Is Target, with its fun clothing and shiny new electronics, a consumer discretionary play, or a bet on consumer staples, because of its toothpaste and paper towels?

paul j. richards/Agence France-Presse/Getty Images

If you’ve been struggling to make sense of markets in recent weeks, you’re not alone.

Investors seem to want to embrace a value tilt – stocks that will do well as an economic recovery gathers steam – but then fall back on the tried-and-true growth stocks that have done well so far, through more uncertain times.

But what if those old “value” and “growth” frameworks are the wrong way to measure market moves?

“The recent market volatility is more about Quarantine vs. Recovery and Cyclicals vs. Defensives than Value vs. Growth,” argues Evercore’s Dennis DeBusschere in a Thursday note.

Read: Don’t assume this stock-market value rotation will stick, J.P.Morgan says

Value stocks have traditionally belonged to sectors like retail, financials XLF, +0.69%, energy XLE, +0.09% and industrials XLI, +1.35%. And in past cycles, companies in areas like technology and consumer discretionary have typically been classified as growth plays.

Those broad categories don’t quite capture the current moment, though. In the past, for example, households and businesses may have opted to spend more on technology when the economy was picking up, and to tighten their wallets when things were getting slow. But now, the migration to work-from-home for so many people has changed that calculus.

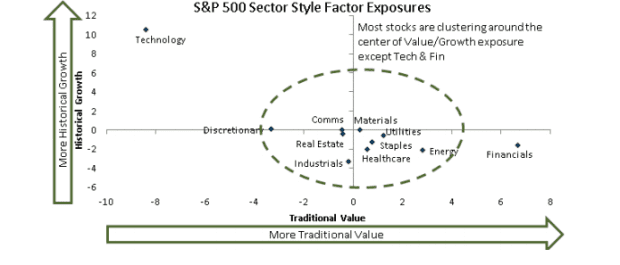

In fact, other than in technology – which is likely to keep outperforming – and financials, which are likely to stay depressed for some time, most stocks have attributes of both value and growth, DeBusschere points out, as seen in his chart, below.

*** ONE-TIME USE ***

“Broad economic reopening, positive COVID trends, and supportive monetary and fiscal policy will benefit a rotation into more economically sensitive stocks, but not necessarily out of the mega cap, cash-returning stocks that have led the S&P higher this year,” he wrote.

Of course, for some investors, the best stocks may be the ones that straddle both worlds.

Related: Wall Street’s road warriors have spent the past three months grounded. How’s that working out?