This post was originally published on this site

The bubble isn’t burst yet.

Justin Edmonds/Getty Images

Traders at the moment seem to have as much patience with tech stocks as Kansas City Chiefs fans do for a moment of unity.

Thursday was the fourth ugly finish in five sessions, with the Nasdaq Composite COMP, -1.99% skidding 2%, and the other major indexes backtracking as well.

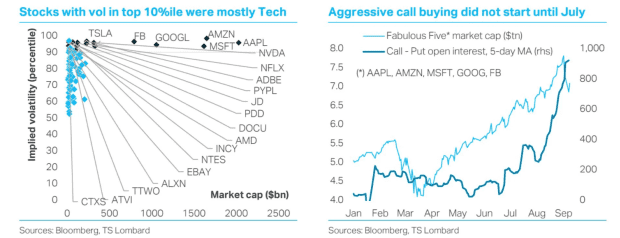

Andrea Cicione, head of strategy at independent investment research firm TS Lombard, said excessive leverage in the market really began in earnest in July. Cicione added that was occurring in U.S. stocks wasn’t happening anywhere else in the world.

And while he’s seeing signs of a bubble, he thinks if the selling doesn’t intensify, the bubble may reflate soon.

“The leverage accumulation so far may not be enough to burst the bubble just yet,” he writes. “If the recent selloff does not intensify further, the whole episode may end up simply emboldening the bulls to buy the dip and take even more risk.”

Between 1997 and 1998, the Nasdaq experienced three sell-offs of at least 17%, only to emerge stronger and rise four-fold to the 2000 peak. “Leverage is a key characteristic of all bubbles, and almost invariably it is the mechanism that leads to their collapse. But there may not have been enough leverage for the dot-com 2.0 bubble to burst just yet,” he says.

The reason leverage is important in bursting bubbles is because it uniquely can lead to forced unwinding. “When faced with margin calls they cannot meet, investors may have to liquidate positions against their will. The resulting fall in prices can instil doubts in the mind of others, persuading them to sell,” he said.

The buzz

Consumer price data for August is due at 8:30 a.m. Eastern.

The quarterly services survey and August budget deficit are also due for release. The Congressional Budget Office, which typically gets the budget picture pretty close to the mark, estimated the August deficit was $198 billion, and said the September-ending fiscal year gap will be the highest relative to the economy since 1945.

Database software giant Oracle ORCL, +0.66% topped earnings and revenue expectations, helped by revenue from key client Zoom Video Communications ZM, -1.32%. Oracle also declined to discuss whether it will buy the U.S. operations of social-media company TikTok, as U.S. President Donald Trump said Thursday there will be no extension of the Sept. 15 deadline for it to be sold to a U.S. company or shut.

Peloton Interactive PTON, -3.75%, the exercise bicycle company, reported stronger-than-forecast fiscal fourth-quarter earnings and revenue, with its current year outlook also well ahead of estimates.

Jean-Sébastien Jacques, the chief executive of mining giant Rio Tinto RIO, -1.67%, announced he will resign in March following the controversy over the firm blowing up ancient caves while excavating for iron ore.

Thursday marked the first day since spring when new coronavirus cases in the European Union and the U.K. exceeded the United States.

The market

U.S. stock futures ES00, +0.74% NQ00, +0.95% were stronger.

Gold futures GCZ20, -0.59% fell while oil futures CL.1, -0.05% edged higher.

The British pound GBPUSD, +0.15% continues to reel from its more combative stance taken against the European Union in trade negotiations.

The chart

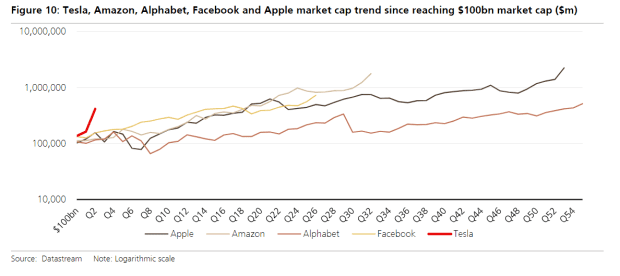

This incredible UBS illustration of Tesla TSLA, +1.38% shows how shares have performed compared to other tech giants since joining the $100 billion market cap club. It took Apple AAPL, -3.26%, Alphabet GOOGL, -1.36% and Facebook FB, -2.05% between 4 to 11 years to achieve what Tesla did in three quarters. UBS increased its Tesla price target to $325 from $160 ahead of the company’s battery day presentation.

Random reads

Here’s the 2010 memo from a venture capital firm on an investment which valued retail software maker Shopify at $25 million. Shopify SHOP, -1.59% is now worth $114 billion.

China said its U.K. ambassador’s Twitter account was hacked — after a steamy post was liked.

An experimental treatment kept mice strong in space, one that could have uses back on Earth.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.