This post was originally published on this site

Grit your teeth and hang on.

angela weiss/Agence France-Presse/Getty Images

It may be a good thing that the week will be short for U.S. investors, as post-Labor Day trade points to a rough ride for technology stocks, with some worried last week’s mini-meltdown is the start of something bigger.

Not helping is news from late last week that Tesla TSLA, +2.78% won’t be added to the S&P 500 SPX, -0.81% next month. The electric-car maker’s shares are down 12% in premarket.

Rallying the troops is our call of the day from Goldman Sachs’ chief global equity strategist Peter Oppenheimer, who has 10 reasons why the bull market has further to go, but a caveat as well.

- We are in the classic “hope” phase of a new investment cycle that has come on the heels of a deep recession. That first phase is usually the strongest and that explains this year’s gains.

- “The economic recovery looks more durable as vaccines become more likely.”

- Goldman’s own economists have recently revised up economic forecasts and the rest of Wall Street should follow.

- The bank’s Bear Market Indicator, which was elevated in 2019, points to low risks of a market rout even if valuations are high.|

- Central banks and governments will keep providing support to markets and economies, reducing risk for investors.

- Equity risk premium — the expected return on stocks over bonds — has room to fall. Since the financial crisis, a fall in dividend yields hasn’t kept up with a “relentless” drop in bond yields.

- Negative real interest rates are supportive for stocks. Resumption of zero nominal interest rate policy, alongside extended forward guidance from banks creates “an environment of greater negative real interest rates.” And that should support riskier assets such as stocks during a recovery.

- While inflation isn’t expected to rise by any big amount in the near to medium term, “equity markets can offer much more effective hedge against unexpected price increases.”

- Compared to corporate debt, equity looks cheap, especially when it comes to companies with strong balance sheets.

- The digital revolution and how it will transform the economy and stock markets has further to go. Oppenheimer says yes, the whole market, including tech stocks, could correct if the economy slows down. “But, given that many of these companies generate a great deal of cash and have strong balance sheets, they are also seen as relatively defensive and might continue to outperform even in a market correction,” says the strategist.

Alas, there are risks to this bullish thesis. Oppenheimer says stocks could fall if the rapid rebound economy markets have priced in, starts to falter. “In this case, we see room for a correction of perhaps up to 10% as investors re-access the path of growth over the next several months.”

The markets

Nasdaq-100 futures NQ00, -2.79% are getting hammered, with S&P 500 ES00, -1.16% and Dow YM00, -0.60% tumbling too European stocks SXXP, -1.48% have been dragged south too, with oil CL.1, -6.51% falling sharply and the dollar DXY, +0.62% climbing.

The buzz

GM GM, +1.76% shares are climbing after the auto maker says it will be the exclusive supplier of fuel cells to zero-emission truckmaker Nikola NKLA, -1.60% for Class 7/8 models. Nikola shares are soaring.

While Tesla has gotten the S&P 500 snub, pharmaceutical group Catalent CTLT, -2.83%, online marketplace Etsy ETSY, -3.58%, and automatic test equipment group Teradyne TER, -4.06% are in.

Boeing BA, +1.35% shares are down after a report that production problems have triggered a review of Dreamliner aircraft quality-control lapses by air-safety regulators.

Tech giant Alphabet’s Google GOOGL unit has ditched plans to rent office space for 2,000 workers in Dublin, Ireland.

Results from sports leisure wear maker Lululemon LULU, -4.35% and messaging platform Slack WORK, -6.16% are coming after the close.

Downloads of media giant Disney’s DIS, -0.93% streaming app jumped 68% over the weekend, likely driven by the release of “Mulan.”

The U.S. may ban the use of cotton from China’s Xinjiang region, over allegations of forced labor, while President Donald Trump threatened to “decouple” America’s economy from China’s.

PG&E plans power outages for California as wildfires continued to rage over the Labor Day weekend.

The final IHS Markit manufacturing purchasing manager index for August is ahead, alongside the Institute for Supply Management’s index for the same month, construction spending and automobile sales.

The chart

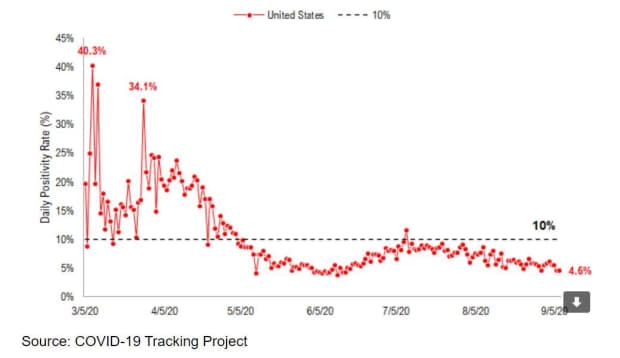

While Spain and other European countries are seeing a second wave of COVID-19 cases, the U.S. reported under 30,000 cases for the first time in months. Thomas Lee, founder of Fundstrat Global Advisors, says the U.S. positivity rate fell to 4.6% over the weekend, a three-month low.

FundStrat Global Advisors

“Getting this figure below 5%, along with expanded testing, is seen as a level where the COVID-19 infection is fairly contained,” he told clients in a note.

Random reads

Australian journalists leave China after diplomatic rift.

Belarus opposition members allegedly snatched off the street in Minsk

Eight sentenced to prison in Saudi Arabia over the murder of journalist and dissident Jamal Khashoggi.