This post was originally published on this site

The personal computer, given up for dead by many consumers when smartphones became the device of choice, has experienced a huge revival during the COVID-19 pandemic, as workers, students and other consumers realized they needed new PCs to handle tasks such as videoconferencing.

Declining PC sales in recent years have led many prognosticators to declare that the PC is dead or dying, being replaced by smartphones and tablets. However, sales have seemingly exploded during the pandemic, thanks to bulk purchases by companies and schools who must now connect to workers and students remotely, as well as consumers who had avoided an upgrade for years.

The biggest reason, according to experts: Older devices were ill-equipped for videoconferencing such as Zoom Video Communications Inc.’s ZM, -2.99% offering, which has exploded in use for videoconferencing, key for team meetings and remote classes.

“The old PCs are not doing so well, they didn’t have the next graphics card and other things,” said Maribel Lopez, principal analyst at Lopez Research. “If you have a four year old PC and you are doing videos, it’s really not working. This is one reason the PC market is going gangbusters. Today’s entry-level PC would be better than what you bought four years ago.”

IDC analyst Jitesh Urbani agreed that video was a big driver of some of the increase in PC demand.

For more: How the boom boosted Zoom earnings and how you may use it for free but companies are paying for it

“At the start of the pandemic, we heard of many instances where folks were scrambling to buy new PCs, and when they couldn’t find one, they would resort to using their old PCs, which often lacked a decent webcam, microphone, or other hardware features,” Urbani said in an email. “However, as video calls have essentially become mandatory, those people ultimately sought to upgrade their old PCs.”

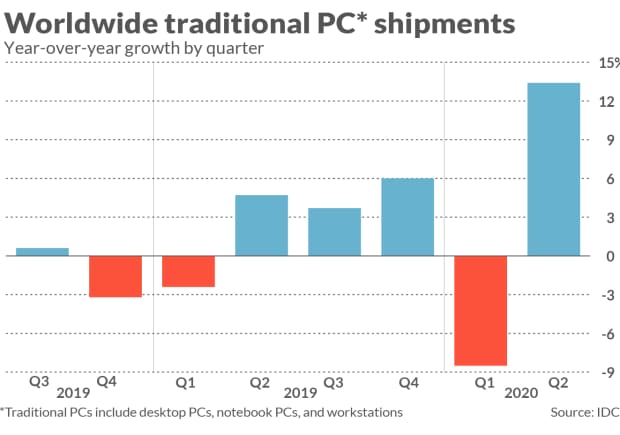

The upswing in shipments began in the second quarter of the year, IDC reported, after retail channels were wiped out from early buying during the COVID-19 pandemic, which began affecting the U.S. in early- to mid-March. The first quarter, when China began shutting down its factories, also saw some issues in the global supply chain that were a factor in a nearly 10% drop in worldwide PC unit shipments, according to IDC. But demand picked up as supply became more available, and consumers realized the extent of working from home. Worldwide PC unit shipments surged 11.2% in the second quarter, according to IDC.

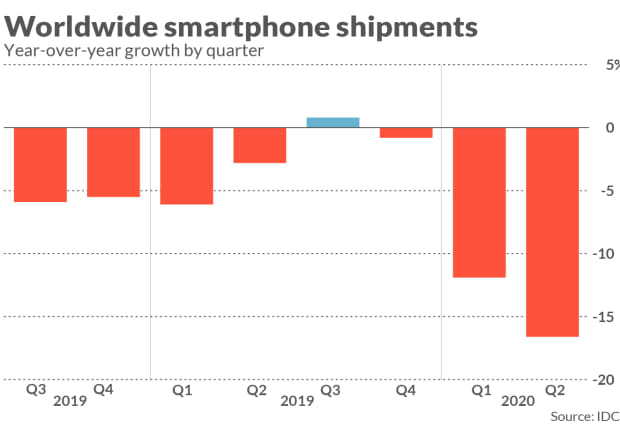

On the other hand, smartphones went in the opposite direction. In the second quarter, IDC said global smartphone unit shipments plunged 17%. Apple Inc.’s AAPL, +0.06% third quarter results showed these trends, with only a very slight uptick of 1.6% in iPhone revenue, while the iPad tablet experienced a major resurgence, with revenue jumping 31% and sales of the Mac climbed nearly 22%, in the quarter that ended July 30.

Laptops are clearly the biggest benefactor of the pandemic’s tech trend, especially in many households where the work situation is fluid, with dad in the home office, mom working at a makeshift desk in the kitchen or dining room, while also trying to help one child with homework on yet another separate computer or tablet, and then moving to another room later in the day.

“Many people don’t have a dedicated office,” Alex Cho, president of the PC business at HP Inc. HPQ, told MarketWatch. “People are working around the house a lot, they are mobile in the house…They are also sharing resources, including the couch, the number of people working in a bedroom and network bandwidth.”

IDC also noted strong growth for Chromebooks, which are popular in education but also elsewhere. Lopez noted that the devices that run an Alphabet Inc. operating system are also being used by call center employees who cannot store any consumer data on devices in their homes. They are now often working with Chromebooks or some other type of virtual desktop interface, so that all their work goes to the cloud, sometimes via a legacy app in a mainframe that is designed as cloud first.

Cho said that HP has been getting a lot of feedback from customers, partners and employees about their working from home situation and how it could be improved. Trying to avoid the neck pain from slouching over a laptop, many have been using thick books to raise their devices.

“We are getting pictures of people’s home environments,” he said. “I did not realize how much work is happening in the bedroom, in the garage.”

More from Therese: The CEO who made one of Silicon Valley’s worst acquisitions wants a $400 million blank check

HP and other PC manufacturers recently detailed the big resurgence in PC sales in quarterly earnings. In its fiscal third quarter, where overall revenue slipped 2.1%, pulled down by corporate printing, HP saw net revenue of the consumer segment of its personal systems business jump 42%, while commercial revenue fell 11%.

Lenovo Group Ltd. 992, -0.19%, the world’s largest PC maker, reported its third quarter earnings in August, and said that its consumer PC segment saw revenue growth of 45%. Gianfranco Lanci, president and chief operating officer, told analysts on the company’s conference call that consumers are finding that the PC they occasionally used at home for maybe one hour or two a day “is not good enough.” “So it’s not only people buying a new PC, but it’s also people replacing a PC,” he said.

At Dell Technologies Inc. DELL, -1.35%, an otherwise lackluster quarter, where overall revenue fell 3%, saw its biggest revenue gains in the consumer segment. Revenue in consumer was $3.2 billion, up 18% driven by the strong double-digit growth across consumer notebooks and gaming systems. Dell’s higher end consumer PCs, the XPS and its Alienware gaming systems saw combined growth of 25%.

The company, though, did forecast that it expected its fiscal fourth quarter would be down more than normal on a sequential basis. Jeff Clarke, Dell Chief Operating Officer and Vice Chairman, told analysts that the gains in consumer sales have been largely education driven. “That is largely education-driven, that is largely lower end ASPs [average selling prices] that are associated with it,” he said on the company’s conference call.

See also: A tale of two $2 billion Chinese IPOs headed in very different directions

The renewed love affair with the PC won’t last forever. Both IDC and Gartner Inc. predict that the growth will be short-lived, but have different predictions on when that may happen.

“It is likely that the surging laptop and tablet demands will be short-term, and not sustainable in the long-term,” said Mikako Kitagawa, a Gartner analyst. “Once the devices are distributed to these who need [them], then the demands will slow down significantly. This will most likely happen in 2021.”

Lopez believes demand will remain stable for the rest of this year, but “fall off the cliff” in the first quarter of 2021. IDC said in a forecast last week that the overall market for desktops, notebooks and workstations book market will grow 3.3% in 2020, and decline 7.5% in 2021.

At HP, the company is trying to take advantage of all the demand while it can, but Cho also noted that the company was already seeing a resurgence in interest in PCs, even before the pandemic forced everyone to work from home, particularly among Gen Z.

Now, “the PC is essential,” Cho said.