This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEB760N5_M.jpg

Investing.com – European stock markets are set to open mostly lower Friday, following Wall Street’s overnight lead, which saw its biggest slump in months, ahead of key U.S. employment data.

At 2:00 AM ET (0600 GMT), the DAX futures contract in Germany traded 0.1% higher, while CAC 40 futures in France dropped 0.4% and the FTSE 100 futures contract in the U.K. fell 0.5%.

In the U.S., the Dow Jones Industrial Average closed Thursday down 2.8%, the biggest fall since June, while the S&P 500 fell 3.5% and the Nasdaq Composite posted a 5% drop.

The biggest names in technology were also the biggest losers after a prolonged bull run. Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Facebook (NASDAQ:FB) and Alphabet (NASDAQ:GOOGL) all finished Thursday with big losses.

“It’s too soon to say whether this is a pause that refreshes or whether this is the beginning of a more meaningful downturn in big tech,” Nancy Prial, co-chief executive at Essex Investment Management told Bloomberg. “Most of these are great companies with really robust growth opportunities, but the stocks are very richly valued.”

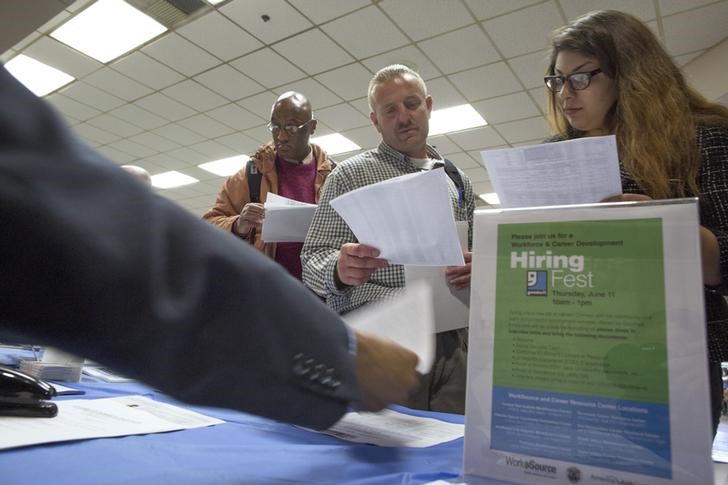

Investors are now looking ahead to the closely-watched U.S. jobs report later Friday, which is expected to show job growth slowed further in August.

Nonfarm payrolls are seen rising by 1.4 million jobs last month, helped by hiring for the 2020 Census. Employment increased 1.763 million in July and its growth peaked at 4.791 million in June.

Employment would still be about 11.5 million below its pre-pandemic level, and the slowing growth could add pressure on U.S. policymakers to restart stalled negotiations for another fiscal package.

Turning back to Europe, EssilorLuxottica (PA:ESLX) said on Friday it would appeal against a court verdict regarding planned takeover target GrandVision, after losing a Dutch court case that could jeopardise the deal.

Oil prices slumped Friday, amid worries over a slow pickup in demand amid ample fuel supplies.

Rising coronavirus cases worldwide and renewed lockdowns are dashing hopes of a drawdown in oil stocks for some time, while production in the Gulf of Mexico is moving closer to restarting following the halt caused by Hurricane Laura.

U.S. crude futures traded 0.9% lower at $41.02 a barrel, while the international benchmark Brent contract fell 0.7% to $43.74. Both contracts are heading for their biggest weekly drops since June.

Elsewhere, gold futures rose 0.4% to $1,944.90/oz, while EUR/USD traded flat at 1.1850.