This post was originally published on this site

GM’s EV hot-rod.

COVER Images/Zuma Press

Another record-busting day for stocks is looking dicey for Thursday, with the Nasdaq Composite COMP, +0.97% poised to lead the way south.

No doubt some may be feeling angst-ridden about the post-pandemic run we’ve seen for stocks. A Bank of America Merrill Lynch “Don’t Panic” list observes that every hour since the March COVID-19 lockdown, central banks have purchased $1.4 billion in assets and the Nasdaq-100’s market cap has gained $1.6 billion. (More below.)

If the above doesn’t help, then our idea-packed call of the day might. It comes from Levin Easterly Capital’s chief investment officer and lead portfolio manager Jack Murphy, who seeks out cheap and unloved value stocks, which have been mostly underdogs since the 2008-09 financial crisis.

“We like good companies that are down in price that have attractive valuation characteristics or we can identify some change going forward. We love companies that are breaking off or splitting up,” Murphy told MarketWatch.

He sees a lot of “good companies” out there with 30% to 50% upside. And “the economy doesn’t have to get better, you don’t need interest rates to be lower, you don’t need more stimulus money into the economy for these stock ideas to work,” said Murphy.

His first pick is General Motors GM, +3.92% — down 15% year-to-date. The automobile maker generates big cash flow with cars and crossover sport-utility vehicles and trucks, though loses money on its electric-vehicle (EV) and driverless car units.

“We think they’re going through a strategic review right now, on whether they should do a partial initial public offering of their automated electric vehicle business,” he said, adding that depending on how that plan goes, GM could be at least 50% undervalued.

“The fact that General Motors, which generates billions in free cash flow has a market cap of $42 billion and Tesla TSLA, -5.82%, which generates not even a billion in freecashflow has a market cap of $455 billion — we think there’s a massive disconnect there,” said Murphy.

He also likes European cable and broadband operator Vodafone VOD, +0.75% —down 24% year-to-date. Among its features are a 7.3% dividend yield, but more important, he expects Vodafone will likely spin off or do an IPO of its cellphone tower business, a lucrative industry. That alone could mean 35% to 50% upside for shares, he says.

The next stock is conglomerate DuPont DD, +5.06% — off 6% — which is merging its nutrition business International Flavors and Fragrances IFF, +0.97%, with a spinoff expected in early 2021. Shares are down 6% year-to-date.

“That’s an incredibly shareholder friendly transaction because IFF trades at a big premium valuation to what DuPont’s worth,” said Murphy. He thinks DuPont will break up further in the future, with IFF a key business. Other pluses — DuPont will likely to settle on some legal issues and a better China outlook may also be a boost to shares. “DuPont is trading at $55 but is worth closer to $85,” he said.

As for those highflying growth stocks, he says investors are “discounting a very strong environment for a very long time for a very high valuation and we think that’s dangerous.” With Tesla down 7% in premarket, the jitters may have arrived.

The markets

Nasdaq-100 futures NQ00, -1.10% are leading the way, south with S&P 500 ES00, -0.40% dipping, but Dow futures DJIA, +1.58% flat. European stocks SXXP, +0.78% are rallying again, as the euro EURUSD, -0.38% slips again amid dollar DXY, +0.19% strength.

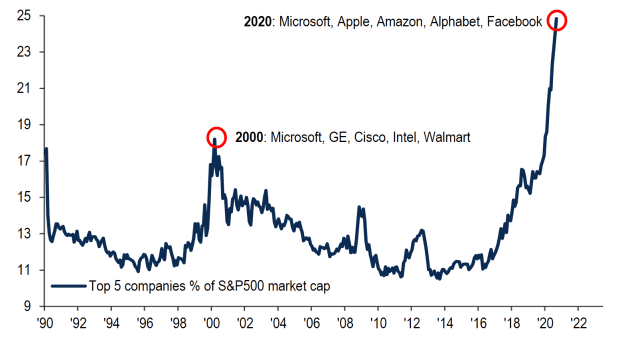

The chart

How polarized is this stock market? Michael Hartnett, chief investment strategist for Bank of America, in his list of top market statistics unveils this one:

Read more here.

The buzz

Ahead of Friday’s payrolls data, we’ll get initial and continuing weekly jobless claims, along with trade deficit numbers and an Institute for Supply Management services index.

U.S. states are being told to be ready to distribute a COVID-19 vaccine by Nov. 1, which has some health experts concerned. Meanwhile, new research says coronavirus may linger 30 days in the body, raising questions about contagion lengths. Sanofi SNY, +1.06% has started a Phase 1-2 trial of its vaccine after promising early data.

Walmart’s WMT, +0.06% top Christmas toy list is here, and the retailer has set up a virtual Wonder Lab for children to give things a test run.

Popular trading platform Robinhood is facing a Securities and Exchange Commission probe over a failure to disclose to clients that it sold their orders to high-speed trading firms.

Random reads

Prince Harry and Meghan, Duchess of Sussex, are headed to Netflix, sort of.

“Star Wars” actor John Boyega calls out Disney DIS, +1.37% over sidelining Black characters.

COVID-19 finds Dwayne “The Rock” Johnson.