This post was originally published on this site

Mark Wilson/Getty Images

Foreign-exchange traders pushed the U.S. dollar to a new round of lows Tuesday before letting up, and currency watchers expect the greenback to remain under pressure on expectations the Federal Reserve will succeed in its attempt to drive inflation higher.

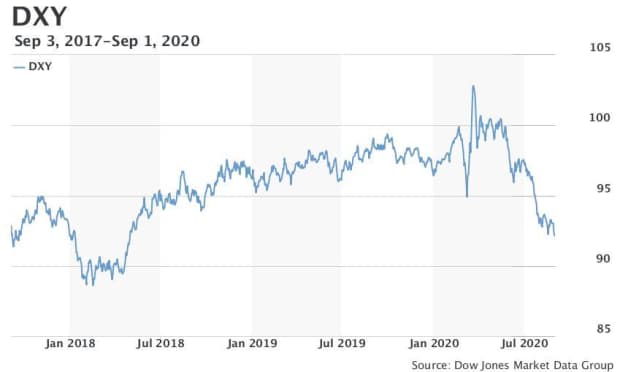

The U.S. dollar continued its broad-based slide, pushing the closely watched ICE U.S. Dollar Index DXY, +0.19% — a gauge of its value against six major rivals — to a session low of 91.75, dropping below 92.00 for the first time since May 2018. After trimming its decline, it was near unchanged at 92.19.

Among those major rivals, the euro EURUSD, -0.18% popped above $1.20 for the first time since May 2018 before pulling back to change hands in recent action at $1.1943, up fractionally on the day. The British pound GBPUSD, +0.11% remained up 0.2% at $1.3397 after trading at a 2020 high of $1.3480.

There were no obvious catalysts for the initial Tuesday decline, but the dollar’s continued weakness comes after Federal Reserve Chairman Jerome Powell last week made clear that policy makers would tolerate above-target inflation as part of a new policy-making framework that abandons the central bank’s previous bias toward pre-emptively hiking interest rates when the labor market gets tight and signs of potential inflationary pressures build.

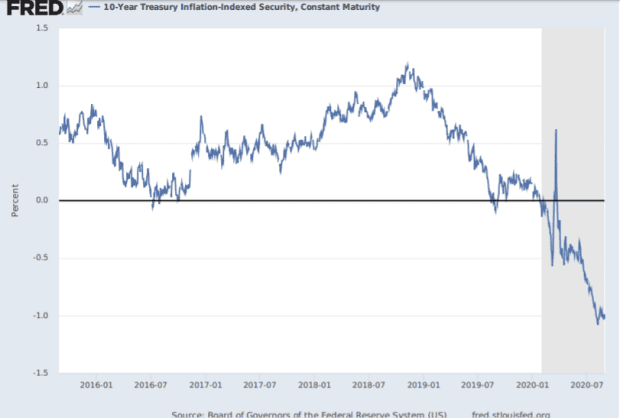

“With Chair Powell cementing the negative real yield narrative for the dollar, there is little to suggest the current U.S. dollar bear trend is to stop, wrote analysts Francesco Pesole and Petr Krpata of ING, in a note.

Read: Here are the major changes to Fed’s strategy to foster jobs

A resulting pickup in inflation expectations has dropped real yields — the yield on U.S. Treasurys minus expected inflation — to all-time lows. The real yield on the 10-year Treasury note on Tuesday stood near -1.08% after hitting an all-time low of -1.11% on Monday. The negative expected return makes the dollar less attractive to investors.

The adoption of average inflation targeting and a tolerance for an inflation overshoot suggests interest-rate hikes “are a very distant proposition” and that U.S. real interest rates will remain low and may go even lower if the Fed succeeds in generating domestic inflationary pressure, they said.

“None of these should strategically bode well for the dollar,” the analysts wrote, noting that high nominal and real rates were the key ingredients behind a stronger dollar in recent years.

The dollar’s slide has been under way since spring, with the currency dropping back sharply after running to a more than three-year high in March as the pandemic-induced global economic collapse and accompanying financial market turmoil sparked a global scramble for dollars.

As financial markets stabilized and central banks, particularly the Fed, stepped in to provide aggressive monetary stimulus alongside fiscal efforts by governments, the dollar has retreated. The Fed also moved to quench the global thirst for dollars by enhancing existing currency swap lines with major central banks and opening new ones.

The dollar’s decline began to pick up steam in the summer, with the DXY falling 4% in July for its biggest one-month drop in nearly a decade. The dollar’s drop from its pandemic peak was already being attributed to falling U.S. real yields and expectations the global economy was poised to outperform the U.S. as the pandemic eventually runs its course.

“The dollar cycle has turned because real yields have collapsed, in absolute and relative terms, and because the U.S. growth advantage relative to other major economies has been diminished,” said Kit Juckes, global macro strategist at Société Générale, in a Tuesday note.

The dollar’s fall has been viewed as a positive for the stock market, though some analysts have argued that foreign markets could outperform the U.S. The S&P 500 index SPX, +0.43% has erased the nearly 34% bear market plunged that took it from an all-time high in February to its March 23 low, pushing back into record territory last month.

Related: Dollar could become a ‘crash risk’ if U.S. loses credibility, analyst warns

Commodities are also seen benefiting from a weaker dollar, as it makes assets denominated in the unit cheaper to users of other currencies.

Opinion: Nouriel Roubini says reports of the dollar’s demise are greatly exaggerated

Juckes argued, however, that last week’s Fed move was relatively “modest” after the policy makers in March proved their willingness to go far beyond what previous officials had done. Market participants, however, have embraced the policy changes without asking important questions, he said.

Ahead of last week’s announcement, the Fed had already pledged to keep interest rates lower for far longer than previously anticipated, he noted. And, Juckes added, while the Fed’s willingness to allow inflation to move above its target for a time is a significant step, there’s little attention paid to the fact that the Fed has so far been unable to push inflation up to its 2% target any more than the Bank of Japan or the European Central Bank.

“The currency has moved further than the shift in growth expectations so far would seem to justify,” he said, while bets on a falling dollar have pushed speculative positioning to an extreme, though “when that triggers a correction isn’t easily forecastable. ”