This post was originally published on this site

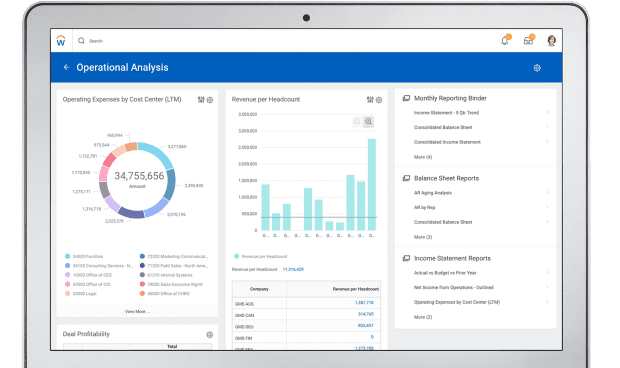

Workday’s Financial Management desktop product

Workday

Workday Inc.’s stock rallied Friday to set new records after nearly three-fourths of analysts hiked their price targets on the human-resources cloud-software company following a strong earnings report and outlook.

Workday WDAY, +12.57% shares surged to close up nearly 13% at a record $243.88, after touching an intraday record of $248.75 earlier in the session. The last time the stock closed at a record was July 12 at $222.17.

Late Thursday, Workday topped Wall Street estimates for the quarter and raised its subscription revenue guidance for the year.

Of the 33 analysts who cover Workday, 17 have buy or overweight ratings, 13 have hold ratings, and three have sell ratings. Of those analysts, 24 hiked their price targets on the stock following earnings for an average target price of $242.55, according to FactSet data.

Stifel analyst Brad Reback, who has a hold rating and raised his price target to $227 from $190, called Workday’s performance a “strong execution during difficult times.”

“That said, given the complexity and time consuming nature of financial system upgrades we do not envision a near-term inflection in WDAY’s growth rate in this segment of the market but rather forecast incremental gains, especially in its core verticals,” Reback said.

Cowen analyst J. Derrick Wood, who has a market perform rating and raised his price target to $250 from $190, said Workday’s results and outlook were encouraging despite “ambiguous” spending from customers.

“Fears stemming from WDAY’s reliance on large ticket purchases for back-office systems seem to be overblown,” Wood said. “But deals are lumpy and we’d like to see more evidence of this in 2H before underwritinga bigger multiple. “

Jefferies analyst Brent Thill, who has a hold rating and raised his price target to $250 from $195, said he was encouraged by Workday raising its margin guidance to levels not seen in three years.

“Although some of this leverage is due to canceled events, we believe this shows WDAY’s ability to deliver more profitability in the future,” Thill said.

Earlier in the week, cloud-based customer relationship-management software company Salesforce.com Inc. CRM, -1.88% posted record revenue as more businesses picked up the pace of their digital transformations because of COVID-19. Also on Thursday, cloud-based identity-management services company Okta Inc. OKTA, -4.78% topped Wall Street expectations.

Workday shares are up 48% for the year, while the First Trust Cloud Computing ETF SKYY, +1.39% is up 38% and the iShares Expanded Tech-Software Sector ETF IGV, +0.94% is up 39%. Meanwhile the S&P 500 index SPX, +0.67% is up nearly 9%, and the tech-heavy Nasdaq Composite Index COMP, +0.60% is up 30%.