This post was originally published on this site

Pedestrians wearing face masks pass the Bank of England in London on March 11.

Matt Dunham/Associated Press

The head of the Bank of England told a gathering of central bankers on Friday that quantitative easing has worked during the COVID-19 pandemic, as he said bond purchases work best when done “big and fast.”

“Measuring this effect precisely is of course hard, since we cannot easily identify what the counterfactual would have been in the absence of QE. But QE clearly acted to break a dangerous risk of transmission from severe market stress to the macroeconomy, by avoiding a sharp tightening in financial conditions and thus an increase in effective interest rates,” said Andrew Bailey, the governor of the Bank of England, at the Kansas City Federal Reserve’s Jackson Hole economic symposium.

He also explained why the Bank of England in June moved less aggressively with a new round of bond purchases.

“The pace of QE purchases may be more important during a period of market dysfunction associated with a widespread shock to liquidity demand. Indeed, when the MPC [Monetary Policy Committee] voted to expand QE further in June, in more normal market conditions, the pace of purchases was reduced,” he said, drawing on new research he co-wrote.

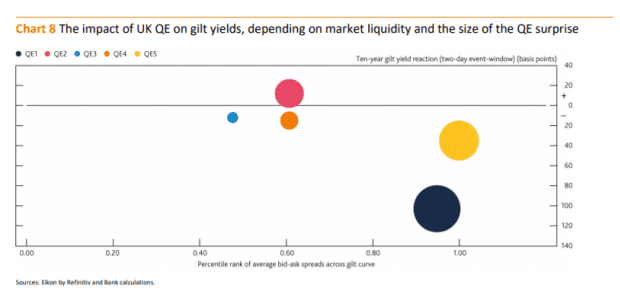

Bailey said there is some evidence that the impact of QE over the past decade has been largest at times of market dysfunction and illiquidity. “Of course the available event studies are very few in number. But, if this result proves robust, it suggests that ‘going big and fast’ with QE is particularly effective in these conditions,” he said.

The yields on all major market government bonds are at extremely low levels. The yield on the 10-year U.S. Treasury TMUBMUSD10Y, 0.726% was 0.73%, the yield on the 10-year U.K. gilt TMBMKGB-10Y, 0.316% was 0.32%, and the yield on the 10-year German bund TMBMKDE-10Y, -0.408% was -0.41%.