This post was originally published on this site

Wall Street signs in New York

Mark Lennihan/Associated Press

U.S. companies in August were supposed to take a breather after borrowing massive amounts of debt to help tide them over during the pandemic.

That didn’t happen. But why would it? After all, August vacations for Wall Street aren’t exactly what they used to be, with all the COVID-19 quarantine rules for domestic travel and Americans still pretty much barred from European travel.

More importantly, big businesses have taken up the offer of cheap debt, supplied in part by the Federal Reserve’s pandemic support that’s kept credit flowing.

Already in August, the huge investment-grade portion of the U.S. corporate market has borrowed more than $117 billion, up from an $95 billion average for the same month, when looking over the past five years, per Goldman Sach data.

That’s pushed issuance to a record $1.48 trillion already this year, more than any full-year total ever, which Goldman analysts think could easily nudge volumes above their full-year $1.7 trillion forecast.

“So far, this heavier than anticipated supply has generally been well absorbed, with only modest widening in IG spreads at the index level,” wrote Goldman analysts in a late Thursday note, adding that risks “are certainly skewed higher” for their original forecast.

The closely watched ICE BofA US Corporate Index yield now sits slightly below 2%, after hovering near 4% for much of the past decade and slipping to a record low of 1.87% eariler this month.

On Thursday, Johnson & Johnson JNJ leveraged its top AAA credit ratings to borrow $7.5 billion worth of cheap funding for its buyout of Momenta Pharmaceuticals, Inc MNTA.

Its longest 40-year slug of bonds priced to yield about 2.5%.

That’s a better borrowing rate than the average 30-year fixed-rate home loan, which touched to a record monthly low of 3.02% in July, according to Freddie Mac data.

Ultralow rates haven’t been limited to qualifying homeowners or investment-grade corporate darlings. They’ve also stoked a borrowing spree among the much smaller segment of speculative, or “junk-rated” companies, even as analysts at BofA Global point out “the weakest names continue to be flushed out,” in a Friday note.

The week saw energy companies Valaris PLC CHAPQ, +3.03% and Chaparral Energy Inc. CHAPQ, +3.03% file for bankruptcy protection, bringing speculative-grade corporate bond defaults so far in August to $10.2 billion, per BofA data.

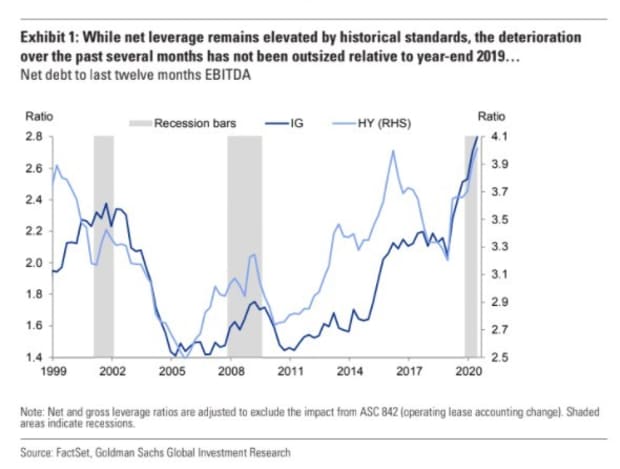

What’s more, this chart shows how U.S. corporate leverage also resides at fresh highs.

Goldman analysts think it could be worst, saying that “somewhat surprisingly” corporate balance sheets only have “modestly deteriorated” during the pandemic’s economic shocks, relative to levels at the end of 2019.

For example, not all of the debt being borrowed by companies ends up working against their balance sheets, particuarly since a sizeable portion of the debt raised since March, via the issuance of bonds, was earmarked to refinance or pay down existing debt, per Goldman data.

The major U.S. stock market indexes have been swept up in records too, with the S&P 500 SPX, +0.34% index this week eclipsing its prior all-time high from February, booking its fastest turnound from bear-market territory ever.

Still, some investors view the latest corporate borrowing blitz as a “double-edged sword” and hope that when the pandemic crisis subsides that businesses will bring back down their leverage levels.

There has been a further rush of junk-rated companies issuing bonds in recent weeks that’s pushed this year’s supply to $278 billion — or above the full-year volumes of 2015 to 2019, per Goldman data.

“At this rate,” the Goldman analyst wrote, supply is “surely to exceed our previous full-year forecast of $300 billion,” which is why the team revised its 2020 forecast to $350 billion.