This post was originally published on this site

Over and out?

Mark Wilson/Getty Images

Investors left confused by the U.S. dollar’s accelerating decline, while the stock market marches close to all-time highs as the economy slowly recovers from the coronavirus pandemic, might look for an explanation to the political gridlock in Washington over another fiscal stimulus plan and President Trump’s attempt to cast doubt on the legitimacy of the upcoming election.

“The state of political disarray is clearly weighing on the buck as the failure to produce more fiscal stimulus [and] the clearly partisan skirmishing over mail-in voting that threatens to undermine the credibility of the election are all taking their toll on the dollar,” said Boris Schlossberg, managing director at BK Asset Management, in a Tuesday note.

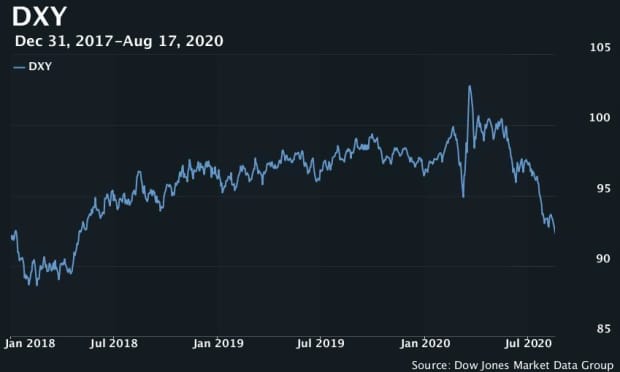

The currency tumbled 4% in July, as measured by the ICE U.S. Dollar Index DXY, -0.60%, which tracks its value versus a basket of six major rivals, for its biggest monthly fall in nearly a decade. After some consolidation earlier this month, the dollar is back under pressure, with the index sliding 0.6% Tuesday to its lowest since May 2018.

Spending stalemate

Washington remains in a stalemate over extending a fiscal aid package that lapsed at the end of July and included $600 a week in additional unemployment benefits. President Donald Trump earlier this month signed executive orders aimed at providing up to $400 a week in additional benefits, but the order faces logistical and political challenges.

Senate Republicans were planning to introduce a scaled back stimulus plan this week that would include $300 a week in additional benefits, according to news reports.

Post Office battle

House Democrats have called top U.S. Postal Service officials to testify before a panel on Aug. 24 regarding concerns over mail delays and cost-cutting measures put in place amid budget shortfalls by Postmaster General Louis DeJoy, a major Republican donor. Trump last Thursday told Fox Business Network that he had declined to approve $25 billion in emergency funding for the agency because Democrats were seeking to expand mail-in voting ahead of the Nov. 3 presidential election.

The Postal Service on Monday said it has stopped removing mailboxes and mail-sorting machines in response to an outcry from lawmakers.

The House is expected to vote on a bill Saturday that would provide $25 billion in additional funding to the Postal Service and prohibit changes at the agency. Meanwhile, the Republican-controlled Senate on Monday invited DeJoy to testify before a panel on Friday, potentially providing a friendlier platform ahead of the House hearing next week.

On Tuesday Postmaster General Louis DeJoy pledged that the mail service is ready today to handle all of the mail-in ballots it receives in November after warning last Friday it may not be able to do so in time.

Election jitters or all about the Fed?

Fears of a muddled election outcome in November alongside signs of an increasingly polarized electorate were cited by some analysts as a possible driver for the currency’s July swoon. Some dollar watchers have expressed fear the greenback could fall hard in the event of election-related turmoil.

Read: Dollar could be a ‘crash risk’ if U.S. loses ‘credibility’, analyst says

Others have argued that dollar weakness is largely a function of a lagging U.S. response to the pandemic amid signs much of the rest of the developed world had made more progress in containing the virus and moving toward reopening, though a rise in cases in Europe has more recently resulted in new rounds of restrictions.

An aggressive response by the Federal Reserve, and expectations it will move to provide additional monetary stimulus if the economic rebound stalls, particularly if politicians remain stalemated, were also seen by some analysts as the primary driver of the dollar’s decline.

“The Fed seems certain to loosen its interpretation of its inflation mandate, and is working hand-in-glove with the government to make sure that funds are available to finance fiscal spending, yet 5-year/5-year inflation swaps [a measure of future inflation expectations] are at 2%, just 0.1% above the average CPI rate of the last decade,” said Kit Juckes, global macro strategist at Société Générale, in a note.

“When I look at it like that, the very least I should expect is that the Fed manages to significantly cheapen the dollar. In real terms, it’s about 7% off its peak, but it’s still 25% above the 2011 levels,” he said.

The euro EURUSD, +0.53%, meanwhile, was up 0.5% versus the dollar, trading near $1.1952, its highest since May 2018. The euro’s strength is seen potentially pushing the European Central Bank to boost its own bond-buying program.

Weaker dollar, stronger stocks?

Stocks were mixed Tuesday, with the S&P 500 SPX, +0.29% on track for a record close if it can maintain its modest gain. That would complete a round trip that saw the U.S. large-cap benchmark plunge by 34% from a record Feb. 19 close to its March 23 low as the COVID-19 pandemic forced the near-shutdown of the U.S. and global economy. The Dow Jones Industrial Average DJIA, -0.14% was down around 60 points, or 0.2%.

A weaker dollar, in general, is viewed as a positive for equities, though investors and analysts have noted that the negative correlation between the currency and non-U.S. stocks is stronger than the negative correlation between the greenback and U.S. equities.

See: Here’s what the U.S. dollar’s fall means for the stock market

‘Favored safe haven’

And other analysts have argued that the dollar is likely to prove to be a port in the storm should equities and other assets perceived as risky take a hit in coming months.

In fact, analysts at Morgan Stanley on Tuesday argued that the dollar may be even more favored in such an event than traditional havens like the Swiss franc USDCHF, -0.40% and Japanese yen USDJPY, -0.55%.

While those currencies will continue to benefit from any flights to safety, the U.S. dollar “ is likely to become the favored safe haven as the fall in

U.S. rates this year makes it an attractive funding currency for borrowing and carry trades,” they wrote. Carry trades are a popular strategy in which a trader typically borrows in a low-yielding currency and converts it into a higher-yielding currency or uses it to buy assets denominated in the second currency.

Gold tells the tale?

Schlossberg, however, argued that a renewed rise by gold GOLD, -0.19%, which pushed back above $2,000 an ounce, is the best expression of weak dollar sentiment.

While gold’s rally to all-time highs this summer has largely been a function of a fall in real, or inflation-adjusted Treasury yields by eliminating the opportunity cost of holding a nonyielding asset like a precious metal, the rebound came despite a bounce last week in rates, he noted.

That means gold “is now acting as a store of value as the market loses faith in the leadership of the United States of America,” Schlossberg wrote. “The longer the stalemate in D.C. remains in place the greater the danger that the dollar selloff can turn into a rout.”