This post was originally published on this site

Bryan Smith/Zuma Press

Researchers at the New York Fed said the number of U.S. public companies that couldn’t generate enough cash to pay for their interest costs shot up in the first quarter of 2020.

They cast a spotlight on the weakness around big businesses that issued a record amount of debt this year in order to keep themselves afloat during the COVID-19 pandemic until earnings recovered. Their data showed that though interest expenses had fallen, the decline in cash flow more than offset that boost, expanding the ranks of businesses vulnerable to a sudden decline in revenues.

“A sizable share of U.S. corporations have interest expense greater than cash flow, raising concerns about the ability of those corporations to endure further liquidity shocks,” the researchers said in a Monday note at the New York Fed’s Liberty Street Economics blog.

To be sure, the New York Fed’s data only reflected the first-quarter disruption from the pandemic, which is expected to pale next to the second-quarter hit to corporate earnings.

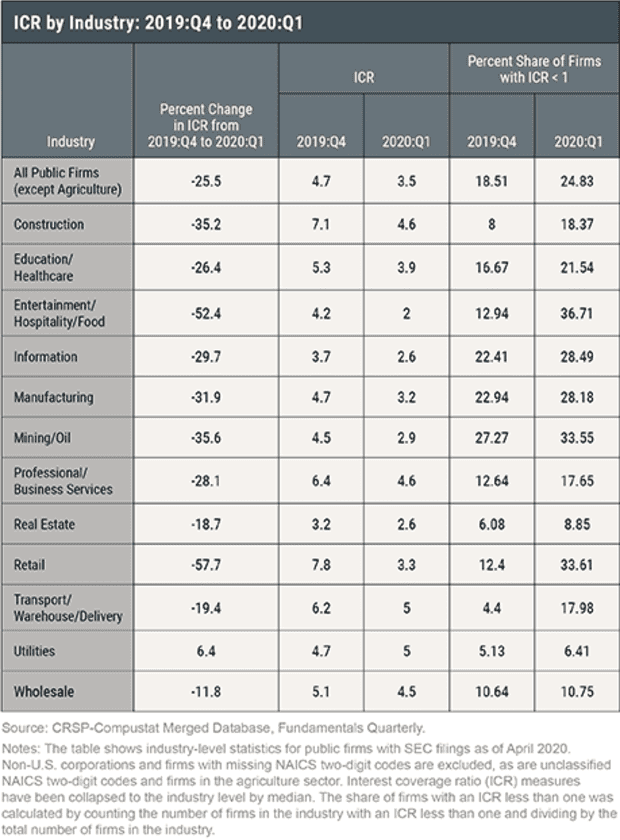

They pointed out that the rise in the number of vulnerable corporations was particularly acute in the oil and hospitality industries, which were already running high levels of debt and were struggling to generate enough cash to cover interest payments before the COVID-19 pandemic.

Around a third or more of companies in the two sectors had an interest coverage ratio of less than 1. In other words, the cost of servicing their debt exceeded their ability to bring in cash. Businesses would have to borrow funds to make up the difference.

Analysts have previously fretted over so-called zombie companies that are unable to cover their debt servicing costs with their profits.

Some have argued their swelling ranks could end up crowding out other more productive firms, and hamper economic growth.

In markets, the S&P 500 SPX, +0.27% and Dow Jones Industrial Average DJIA, +1.30% ended higher on Monday. Meanwhile, the 10- year Treasury note yield TMUBMUSD10Y, 0.582% rose a basis point to 0.57%.