This post was originally published on this site

The best start to an August for the U.S. stock market in years might get even better, as soon as next week, if the forecast from Thomas Lee, founder of Fundstrat Global Advisors, is accurate.

Lee makes the argument that the stock market’s underloved sectors are on the verge of a breakout that could come as his research team sees COVID-19 cases peaking, setting the stage for what he describes as a almost textbook rebound for parts of the stock market that had been pummeled so utterly near the start of 2020.

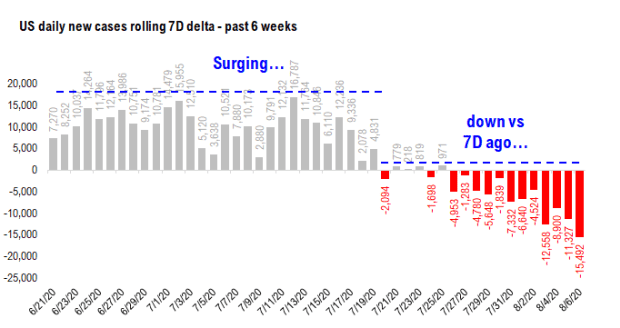

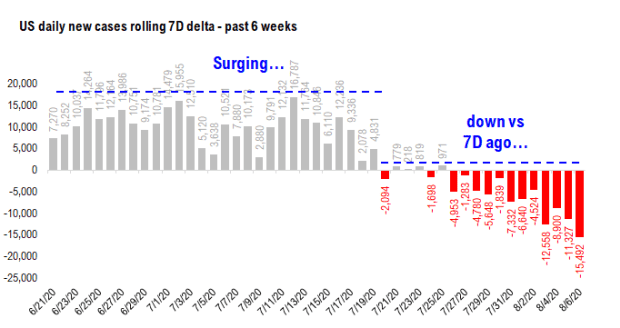

Fundstrat says coronavirus cases, which have topped 19 million globally and are 4.9 million in the U.S., as of Friday, are declining on a seven-day rolling basis to a decrease of 15,492 (see attached chart):

Based on research from the Fundstrat team, the stock market will start to drive higher on Aug. 14, with the possibility of a 30% rally in store for equity markets over the course of the ensuing two weeks.

That is if history is any analog, after the indexes have already enjoyed a brisk pace of gains but a fairly narrow breadth. The Dow Jones Industrial Average and Nasdaq Composite notched their best starts to an August (the first five trading sessions) since 1996, while the S&P 500 index had its best August start since 2009, according to Dow Jones Market Data .

So why is Lee and company so assured in their forecast?

Well, they’re not but based on prior periods in which they have determined that the national rise in COVID-19 cases have peaked, 20 days later, the market has staged a brisk run-up.

“But as we discuss below, when cases peaked in late April, it took 20 days before the epicenter stocks started their massive 3,000bp [or 30%] outperformance rally (over 10 days). If cases peaked July 24th (which looks definitive), the 20th day is August 14th,” Fundstrat wrote.

“So if history is an analog, next week is the week we could see a monstrous rally in epicenter stocks.”

More broadly, the gains for stocks have come after the Dow DJIA, +0.17%, the S&P 500 SPX, +0.06% and the Nasdaq Composite COMP, -0.87% all fell by at least 30% from their recent peaks in February.

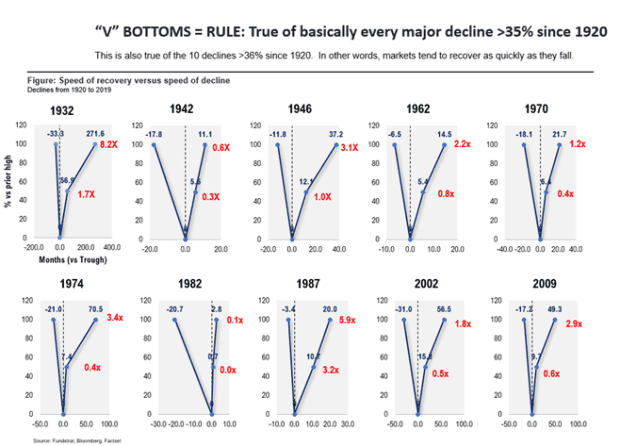

Lee says that it is characteristic for such declines to be followed by powerful rebounds that far outstrip the initial slumps.

“Since 1920, every stock market decline >35% saw a symmetric price recovery. In other words, the faster the markets fall, the faster the markets recover, and the ratio is 2.5X. Given the speed of the 2020, this implied making new highs before the end of the Summer,” his team writes (see chart):

Lee defines “epicenter” stocks as those worst hit from the social-distancing protocols put in place to mitigate the spread of the disease derived from the novel strain of coronavirus. These include a host of companies, including airlines, apparel retail, hotels and household appliances.

Fundstrat says this epicenter group makes up about 25% of the overall market in terms of market capitalization, compared with the roughly 75% of market value of the megacap tech-related companies, including Facebook FB, +1.19%, Netflix NFLX, -2.81% and Google parent Alphabet GOOGL, -0.43% GOOG, -0.37%. Some include Amazon.com Inc. AMZN, -1.78%, Apple AAPL, -2.27%, Microsoft Corp MSFT, -1.78%. and even Tesla TSLA, -2.47% among the companies that have surged during the pandemic, gaining in market value, at the expense of other broad-market names.

Many have made the call that a rotation out of tech and into other areas of the market, such as industrials, consumer discretionary, financials, and energy, would soon take place. However getting the timing right has been the challenge.

That said, some signs that such a rotation may be at hand were present in Friday’s trade with the small-capitalization Russell 2000 index RUT, +1.35%, a group of stocks more sensitive to the vagaries of the economy, rising 0.8% on Friday, boasting a weekly gain of more than 5%.

Meanwhile, the Dow Jones Transportation Average DJT, +2.37% — which tracks the performance of 20 large U.S. airlines, truckers, railroads and shipper–was also up more than 5% for the week.

The Industrial Select Sector SPDR ETF XLI, +1.71% was up 4.3% for the week and the energy sector XLE, +0.13% equivalent was 2.5% higher on the week. The technology-laden Nasdaq Composite, meanwhile, was up a more pedestrian 2% on the week.