This post was originally published on this site

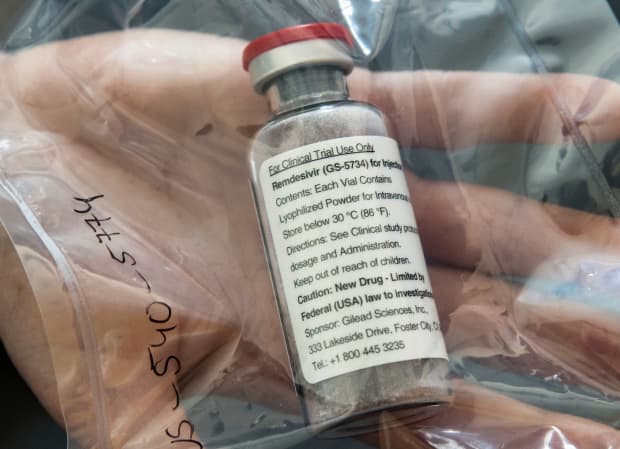

Hikma said it has started manufacturing remdesivir – Gilead’s antiviral drug approved to treat COVID-19.

REUTERS

U.K. stocks were mixed on Friday, as better-than-expected U.S. jobs data failed to inspire investors and geopolitical tensions mounted.

The FTSE 100 UKX, +0.14% was 0.1% down in early afternoon trading, while the more domestically-focused FTSE 250 MCX, +0.78% climbed 0.6% as U.K. house prices rose for the first time in five months.

Hikma Pharmaceuticals HIK, +11.54% led the way for the U.K.’s blue-chip index as the stock surged 11.5%. Hikma raised its interim dividend after increased demand for injectable products led to a 21% rise in first-half pretax profit. The company also said it has started manufacturing remdesivir – Gilead GILD, +0.24% ‘s antiviral drug approved to treat COVID-19 after reaching a non-exclusive supply agreement with the U.S. company.

U.S. nonfarm payrolls data slightly beat expectations as the economy added 1.8 million jobs in July — compared with June’s 4.8 million gain — and the unemployment rate fell to 10.2%.

Economists had expected the U.S. to add 1.7 million jobs, according to a poll by MarketWatch. The unemployment rate was expected to decline to 10.5% from 11.1% in June.

Better-than-expected jobless claims data — the first drop in claims after two weeks of increases — had boosted stocks late on Thursday as the Dow Jones Industrial Average DJIA, -0.15% rose 0.7% and the Nasdaq Composite COMP, -0.01% climbed above 11,000 to fresh record highs. Friday’s slight surprise failed to repeat the trick as U.S. stock futures were largely unmoved. However, the job numbers pushed the pound GBPUSD, -0.72% lower against the dollar.

Escalating tensions between the U.S. and China also concerned investors around the world. President Donald Trump issued executive orders late on Thursday banning “transactions” with the Chinese owners of TikTok and WeChat apps from Sept. 20. Shares in WeChat owner Tencent 700, -5.04% stock in Hong Kong sank as a result.

House prices in the U.K. rose in July for the first time in five months, according to the closely-followed Halifax house price index. It comes after Chancellor of the Exchequer Rishi Sunak cut stamp duty — a property tax on buyers — in a bid to reinvigorate the housing market. Online property website Rightmove RMV, +8.48% provided more evidence of a rebound, reporting surging demand for sales and rentals in June and July. The company’s stock rose more than 10% on Friday.

Stocks in focus

Shares in Hargreaves Lansdown HL, +2.13% rose 1.9%, after the U.K.’s biggest investment platform reported an increase in full-year earnings, driven by record levels of share trading and the addition of new clients during the pandemic.

Rolls-Royce RR, -0.39% stock fell 2.3%, on reports by the Financial Times that activist investor ValueAct has sold its entire stake in the British aircraft-engine maker. ValueAct had a 4.5% shareholding in Rolls-Royce, according to FactSet.

AstraZeneca AZN, +0.48% shares rose 0.6%, on renewed vaccine hopes after the British drugmaker struck a deal for a Chinese company to produce its experimental COVID-19 vaccine in China. Shenzhen Kangtai Biological Products will produce the vaccine, being developed by the University of Oxford, in mainland China if it is successful.