This post was originally published on this site

https://i-invdn-com.akamaized.net/news/LYNXNPEB760N5_M.jpg

Investing.com – U.S. stocks are set to weaken at the open Thursday, consolidating after gains in the previous session, with investors wary amid few signs of progress over the next virus relief bill and ahead of the latest employment data.

At 7 AM ET (1100 GMT), US 500 Futures traded 8 points, or 0.3%, lower, Nasdaq 100 Futures down 29 points, or 0,3%. The Dow Futures contract fell 70 points, or 0.3%.

On Wednesday, the Dow Jones Industrial Average gained 1.4% to hit a new 1-month high. The S&P 500 index gained 0.6%, and the NASDAQ Composite index climbed 0.5%, just shy of 11,000, to post its 31st closing high this year.

The focus remains on Washington amid political stalemate over the shape and size of the next U.S. fiscal recovery package, prompting U.S. President Donald Trump to float the idea of extending unemployment benefits and eviction protection by executive order.

“Stocks are really struggling to find direction until we know the outcome of those negotiations,” said Hugh Gimber, global markets strategist at J.P. Morgan Asset Management, reported by Reuters. “The clock is ticking for U.S. policymakers to get something done.”

The politicians were also given a nudge by Cleveland Fed President Loretta Mester Wednesday, when she called for more fiscal help from Congress as “downside risks” to the economy were on the rise.

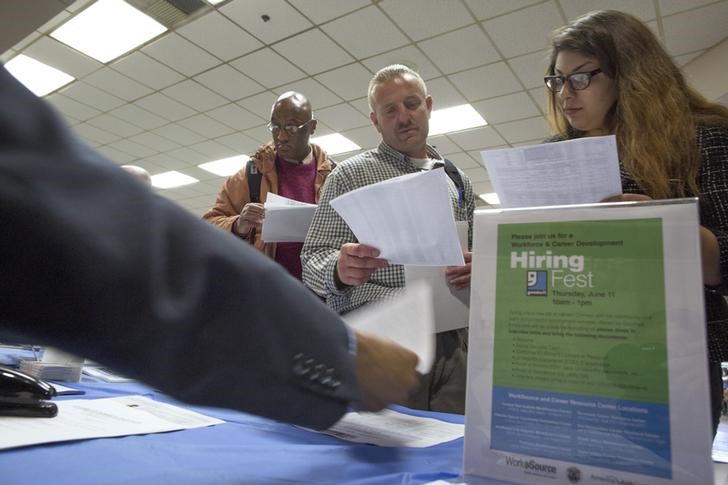

Evidence of those risks came in the form of the ADP employment data Wednesday, which showed that payroll gains at U.S. companies slowed sharply in July, suggesting the pickup in coronavirus cases is putting a brake on the job market.

More jobs numbers are due later Thursday, in the form of the weekly initial claims release. Friday sees the release of the monthly official employment report.

Meanwhile, the earnings season continues, but the airlines sector looks likely to be in the spotlight after President Trump expressed support for a proposal for another $25 billion in federal aid to support the industry in keeping people employed.

Oil prices edged lower Thursday, consolidating after hitting five-month highs the previous session on the back of lower-than-expected U.S. crude stocks.

The Energy Information Administration reported a much bigger than expected drop in U.S. crude stockpiles late Wednesday – a 7.37 million-barrel draw in crude oil inventories, more than double the 3 million-barrel draw forecast.

U.S. Crude futures traded 1.1% lower at $41.73 a barrel, while the international benchmark Brent fell 0.5% to $44.95.

Elsewhere, gold futures rose 0.6% to $2,050.20, posting new all-time highs, while EUR/USD traded at 1.1837, down 0.2%.