This post was originally published on this site

https://d1-invdn-com.akamaized.net/content/pic3c150f3a8575baf39704a97442e7c897.jpg

Those with the rosier outlook point to Biden’s mostly pro-business inner circle, his significant campaign contributions from the financial industry and his longtime support of credit card companies located in his home state of Delaware. Plus, a Biden victory would likely be driven by U.S. voters seeking change because they believe the country is a mess. Wall Street thinks it has a strong argument to make that reining in lenders would be a fatal mistake when unemployment is sky-high and the economy remains ravaged by the coronavirus pandemic.

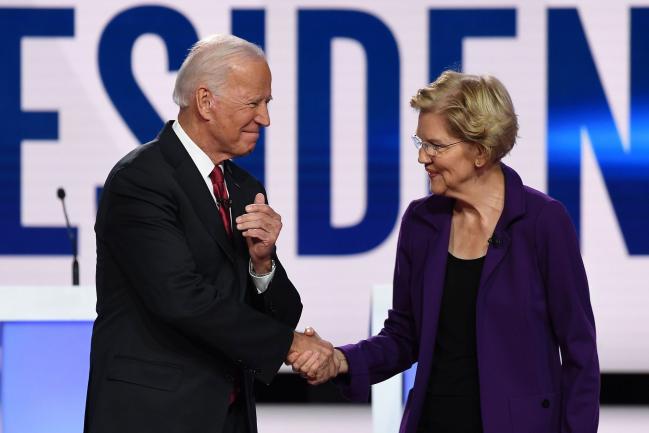

The enthusiasm, however, is tempered by fears over how much sway Biden will give progressives and their firebrand leaders, including Senators Elizabeth Warren and Bernie Sanders. That’s especially true when it comes to picking appointees to run the powerful agencies that police banks and securities firms, jobs that the activists are mobilizing to fill with industry critics. At a minimum, progressives want to ensure that the days are long over when Democrats appointed officials like Robert Rubin, Timothy Geithner and Lawrence Summers, who is a key Biden adviser.

The stakes for Wall Street couldn’t be higher. Centrist regulators would be less likely to overturn rule rollbacks approved under Trump that have saved financial firms tens of billions of dollars. Progressive (NYSE:PGR) agency heads, on the other hand, could pursue what the C-suite calls the “shame and investigation agenda.” Policies like taxes on trading, curbs on executive pay and even breaking up behemoth banks would be back on the table.

Serious Threat

That’s a threat that the industry should take seriously, especially if wealth inequality and Covid-fueled job losses “force a new Democratic tone,” said Karen Shaw Petrou, a managing partner at Washington research firm Federal Financial Analytics. “While Biden as president would surely be less ornery than Warren, it’s more than premature to say he won’t be considerably more progressive than many on the Street expect.”

The looming battle over key positions at agencies such as the Treasury Department, Federal Reserve and Securities and Exchange Commission was described in interviews with more than a dozen people including progressives, financial executives, banking lobbyists and ex-regulators. Most requested anonymity so they could discuss specific names and strategies without endangering access to the Biden campaign.

“All these jobs matter,” said Jeff Hauser, who runs the Revolving Door Project, a Washington-based group that has led campaigns to keep corporate executives out of government.

The debate threatens to put Biden in a bind as he seeks to balance the competing interests of Wall Street donors and the activists he’s counting on to help generate enthusiasm among Democratic voters. Thus far, the former vice president has mainly stayed mum on potential nominees.

Read More: Biden Woos Left Flank Along With Wall Street to Avoid 2016 Rerun

The Biden campaign, according to people who have been in touch with it, has also been vague in private. Some attribute that to disorganization, while others say his aides want to avoid a divisive topic, especially at a time when the focus is on beating Trump in November.

The Biden campaign declined to comment.

Bankers’ Candidates

In compiling its wish list of potential nominees, Wall Street is pushing for what some executives call “adults” who understand markets and have been regulators in the past, such as Fed Governor Lael Brainard, ex-Deputy Treasury Secretary Sarah Bloom Raskin, and Atlanta Fed President Raphael Bostic and TIAA Chief Executive Officer Roger Ferguson, both of whom are African American.

Other favorites include several women with closer Wall Street ties: Sallie Krawcheck, the former chief financial officer of Citigroup Inc (NYSE:C). who now runs a digital investment platform for women; Alphabet (NASDAQ:GOOGL) Inc. CFO Ruth Porat, who held the same job at Morgan Stanley (NYSE:MS); and Mellody Hobson, co-CEO of Ariel Investments and a board member of JPMorgan Chase (NYSE:JPM) & Co.

A Biden fundraiser last month put together by alumni of Barack Obama’s Treasury Department also showcased a number of people thought to be vying for regulatory jobs. The top donors, who each paid $25,000, included ex-Treasury counselor Antonio Weiss, Mary Miller, who recently ran unsuccessfully for mayor of Baltimore, and Seth Carpenter, the chief economist at UBS Securities.

Overall, Biden has raised more than $42.4 million from the securities and investment industry, according to the Center for Responsive Politics.

Progressives’ Strategy

Progressives say they are working on a two-pronged plan, offering names to the Biden campaign but also developing opposition research against potential Wall Street nominees. Among their biggest targets, people familiar with their effort said, is blocking anyone from BlackRock Inc (NYSE:BLK). Activists argue the world’s biggest money manager is dangerously inter-connected and holds too much sway in Washington.

The progressive effort is being led by several groups such as the Revolving Door Project, Demand Progress, Americans for Financial Reform and Data for Progress. They are counting on massive email lists, social media and alliances with other liberal organizations, including the environmental movement, to help them press their case.

Their candidates include Obama Commodity Futures Trading Commission chief Gary Gensler, ex-SEC Commissioner Kara Stein, Amanda Fischer, who recently served as Representative Katie Porter’s chief of staff, ex-Warren aide Bharat Ramamurti and Graham (NYSE:GHM) Steele, a former San Francisco Fed staff member. They also would support Democratic SEC Commissioner Allison Lee becoming chairwoman.

Pro-Business Aides

A point Wall Street says it has in its favor is that Biden’s closest advisers are mainly centrists and seasoned Washington hands who would resist progressives’ most extreme ideas. They include Steve Ricchetti, a former corporate lobbyist, attorney Ron Klain, general counsel at venture capital firm Revolution, and longtime Democratic strategists Bruce Reed and Mike Donilon. Another Biden supporter is Donilon’s brother, Tom, a BlackRock executive who was Obama’s national security advisor.

Read More: Biden’s Wall Street Pals Think They Have His Ear Despite Snubs

But the liberal activists believe they also have allies in several staff who are working on domestic policy issues, as well as in Ted Kaufman, who is leading Biden’s transition team. After being appointed as a placeholder for Biden’s Senate seat in 2009, Kaufman called for capping the size of banks and ripped the Justice Department for failing to send Wall Street executives to prison after the 2008 financial crisis.

As both sides game out their strategy, there are plenty of unknowns. Perhaps the biggest factor will be which party ends up controlling the Senate, where most senior appointees must be approved. If Republicans continue to hold a majority, it could be tough for those with long track records of bashing banks to win confirmation.

Trump’s Squatters

Also adding to the uncertainty is that Biden wouldn’t immediately be able to replace all of Trump’s regulators because several don’t have to leave their jobs with a change in administration.

They include Fed Vice Chairman for Supervision Randal Quarles, who has more than a year left in his term and has given no indication that he will step down. He’s led the charge in quietly relaxing post-crisis constraints, such as a June revamp of derivative rules that could free up an estimated $40 billion that Wall Street banks had been forced to set aside for protecting swaps trades.

Read More: Banks Get Easier Volcker Rule and $40 Billion Break on Swaps

Warren’s status, too, is up in the air. Biden has said she is under consideration for the vice president slot, and she has also been talked about for a cabinet position. But if she remains in the Senate, Warren could lead the drive for progressive regulators.

Thwarting Nominees

While progressives say they don’t expect to win all their battles under a moderate Biden administration, they do have some experience defeating nominees during the Obama years. That includes helping thwart the likely nomination of Summers, who serves as a paid contributor to Bloomberg Television, to run the Fed. That campaign led to the confirmation of Janet Yellen, the first woman to head the central bank.

Read More: Biden Feels Heat From Left to Drop Larry Summers as an Adviser

“The basic issue vis-a-vis Wall Street is that we want to make clear that Biden World should ask itself a question,” said Hauser, of the Revolving Door Project. “Is this person worth the hassle?”

©2020 Bloomberg L.P.