This post was originally published on this site

“ My 19 year-old niece is asking me what stocks [she] should invest in…Everybody’s a genius in a bull market and everybody’s making money now because you have the Fed put. ”

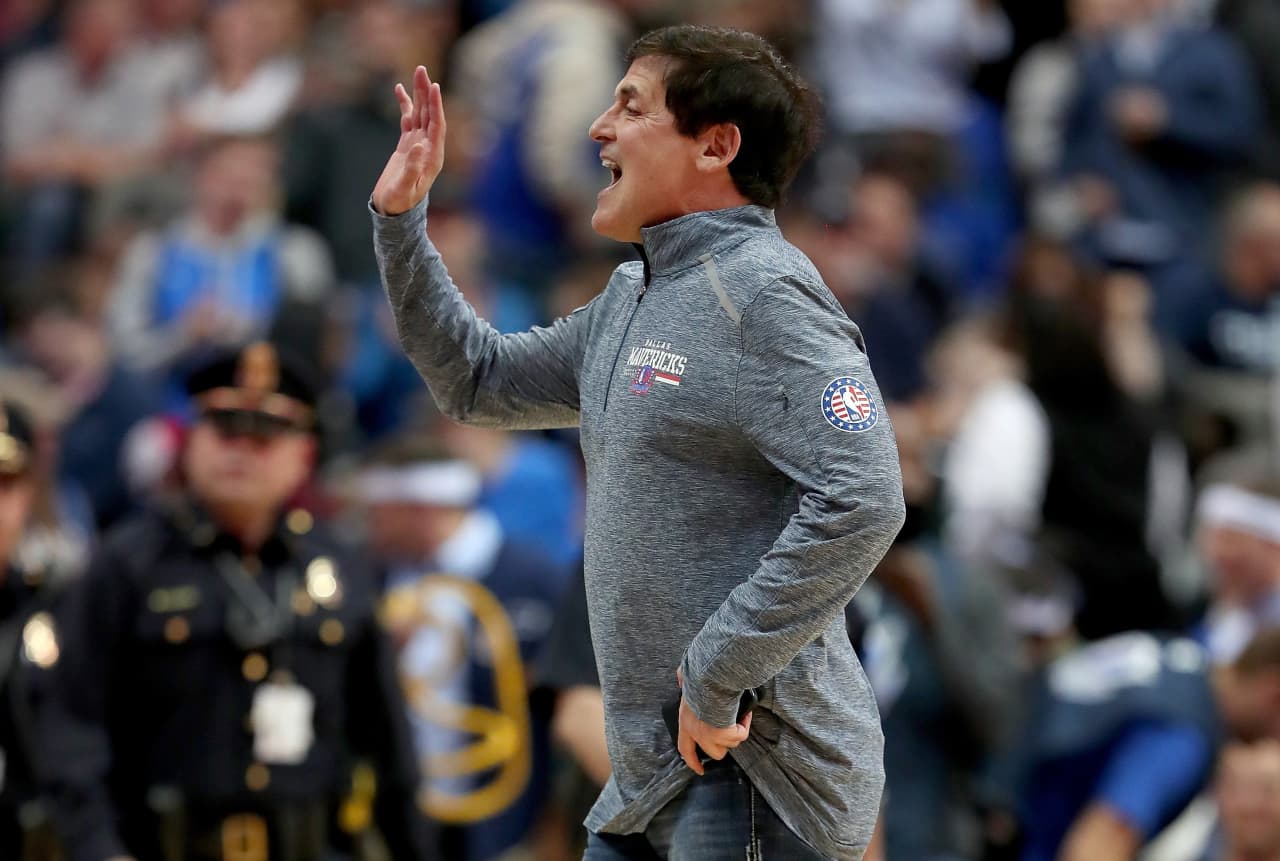

Outspoken billionaire and Dallas Mavericks owner Mark Cuban says that the stock market’s recent technology-driven run-up from coronavirus lows has many of the hallmarks of the bubble that rocked markets in the late 1990s and early 2000s. One big difference: This time the Federal Reserve is amplifying liquidity in the pandemic-battered economy, which has helped to support risk appetite on Wall Street, emboldening newly minted individual investors to make risky bets on highflying stocks.

“ In some respects, it’s different because of the Fed and liquidity. On a bigger picture, it’s so similar. ”

During a Monday morning interview with CNBC, the entrepreneur, who boasts a net worth of $4.2 billion, according to Forbes, said that he has to remind himself that it can take a long time for periods that are considered bubblicious to ultimately burst.

“I have to keep reminding myself that the internet bubble lasted for years.…and so it’s difficult to have patience and recognize that there’s still a lot of money” that can be made, the “Shark Tank” star said.

Former Fed Chairman Alan Greenspan uttered his famous “irrational exuberance” warning in a December 1996 speech, inspired by comments from Professor Robert Shiller. However, the internet and tech-related bubble didn’t burst until nearly three years later when from March 2000 to October 2002, the Nasdaq Composite Index COMP, +1.41% fell by nearly 80% and languished their for years.

Most recently, the technology-heavy Nasdaq has enjoyed a near parabolic ascent from its March low of this year, as investors have fretted about the outlook for the economy amid the pandemic and placed bets that some of the biggest technology and e-commerce companies will fare better in a post-COVID-19 world.

The Nasdaq has rallied nearly 55% since hitting a recent March 23 low, outpacing gains of about 45% for the S&P 500 SPX, +0.29% and the Dow Jones Industrial Average DJIA, -0.29%, 43%, over the same period.