This post was originally published on this site

AFP via Getty Images

Here’s a weird twist on American exceptionalism — U.S. stocks, as measured by the benchmark S&P 500 index, are holding their own versus European rivals, even though U.S. coronavirus cases are surging again and threatening the economic recovery while European countries appear to largely have the outbreak under control.

Coronavirus update: Global cases of COVID-19 climb above 13 million as California, Hong Kong and India reimpose restrictions on movement

Oliver Jones, senior markets economist at Capital Economics, argued in a Tuesday note that there was more to the phenomenon than the valid but oft-cited outsize weighting of tech and health-care companies in the S&P 500 SPX, +1.34%.

In particular, he emphasized that the index “also contains nearly all of the world’s very largest listed firms, including several global monopolists with vast cash reserves. ”

“After accounting for sectoral patterns, big firms with strong balance sheets have been much better able to weather the storm of the coronavirus crisis than most. Some have even used it as an opportunity to secure their dominance, snapping up the assets of weakened would-be rivals,” he said, noting that the five largest companies have announced a “remarkable 18 acquisitions between them since the crisis began. ”

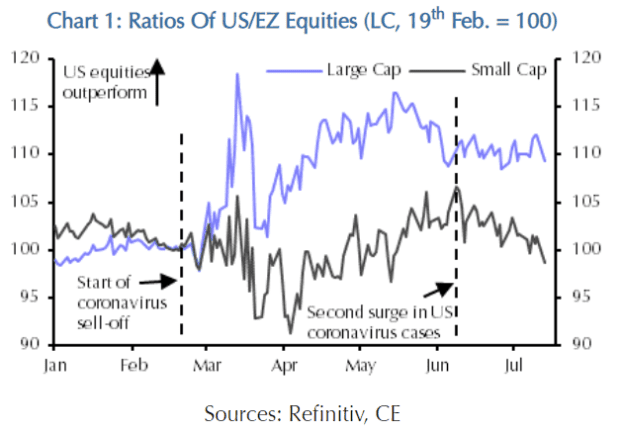

Jones noted that in contrast to the S&P 500, U.S. small-cap indexes, which also don’t share the S&P 500’s sectoral advantages and are more exposed to the domestic economy have fallen sharply since June 8, faring much worse than their European counterparts. (see chart below).

CAPITAL ECONOMICS

The number of new cases in the U.S. continues to rise, while most Western European countries have seen the number hold steady or fall over the past two weeks, according to a New York Times tracker.

Meanwhile, the S&P 500 has performed “no worse” than major European indexes despite real-time data pointing to a stall in the U.S. recovery even as European re-openings largely, proceed, Jones noted.

Jones argued that “what stands out most is that the relative performances of large-cap equity indices have had at least as much to do with global sectoral patterns as with domestic economic performance.”

But, he warned, that carries a big “counterintuitive implication” for relative performance once the U.S. does get its virus outbreak under control—“the S&P 500 might not be the biggest beneficiary.”